Okay, I understand. Here's an article, exceeding 800 words, addressing the question of finding a quick path to cash, exploring both legitimate and potentially fraudulent options, while avoiding a formal, numbered list structure and adhering to your other specified requirements:

``` The allure of quick money is a powerful siren song, whispering promises of financial freedom and immediate gratification. Whether you're facing unexpected bills, aspiring to a dream purchase, or simply seeking to alleviate the pressures of everyday living, the desire for a rapid influx of cash is entirely understandable. However, navigating the landscape of potential solutions requires a discerning eye, separating genuine opportunities from deceptive scams that prey on desperation. Understanding the nature of different routes to quick capital is essential to making informed choices and avoid getting scammed.

One area often explored is the gig economy, a realm teeming with possibilities for individuals with diverse skills and schedules. Platforms like Uber, Lyft, DoorDash, and Instacart offer the chance to earn income by providing transportation, delivery, or other services. While the hourly wage may vary depending on location, demand, and personal efficiency, these platforms provide immediate access to paying gigs. The startup cost is low, as most people already own a suitable vehicle or bicycle, and payment is typically processed weekly, or even daily in some cases. The major considerations here are the impact on vehicle depreciation, fuel costs, and the highly variable nature of demand. Success in this sphere hinges on a strategic approach, focusing on peak hours, optimal locations, and cultivating a reputation for reliable service.

Another avenue to consider is the online marketplace, a digital ecosystem where unwanted belongings can be converted into tangible assets. Platforms like eBay, Craigslist, Facebook Marketplace, and Poshmark facilitate the sale of clothing, electronics, furniture, and other items. The key to success lies in accurate descriptions, compelling photographs, and competitive pricing. Researching comparable items to understand the market value is crucial, as is managing shipping and handling logistics. While the time commitment can be significant, particularly for larger or more complex items, the potential for generating quick cash from items that are simply gathering dust is considerable. The risks here are associated with fraudulent buyers, potential scams involving payment processing, and the time investment needed to manage listings and fulfill orders.

Looking beyond tangible goods and short-term gigs, we encounter the world of online surveys and micro-tasks. Websites like Swagbucks, Survey Junkie, and Amazon Mechanical Turk offer small payments for completing surveys, watching videos, or performing simple data entry tasks. While the earning potential is modest – typically a few dollars per hour – these platforms provide a low-barrier entry point for earning extra income in spare moments. The primary drawbacks are the relatively low pay rate and the time investment required to accumulate a substantial sum. It's essential to be wary of websites that promise unrealistically high payouts, as these are often scams designed to harvest personal information or install malware.

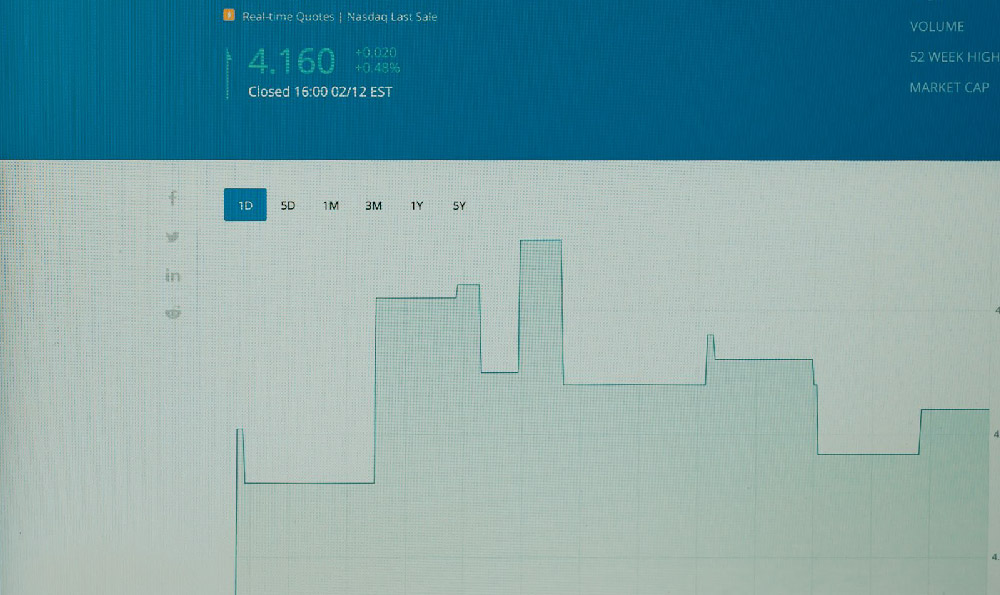

The financial market, while generally not associated with "quick" money, can sometimes present short-term opportunities for skilled traders. Day trading, the practice of buying and selling securities within the same trading day, aims to capitalize on small price fluctuations. However, it's a highly speculative endeavor that requires significant knowledge, experience, and capital. The risks are substantial, and the potential for rapid losses is very real. Similarly, options trading, which involves buying and selling contracts that give the holder the right to buy or sell an asset at a specific price, can offer leveraged returns but also carries significant risk. Unless one has a strong understanding of financial markets and a high tolerance for risk, these options are generally ill-advised as a source of quick cash. They are better suited to long-term investment strategies with a substantial margin for error.

Now, let's tread into the realm of opportunities that warrant extreme caution – the potential scams that masquerade as legitimate avenues for quick cash. One prevalent example is the advance-fee loan scam, where individuals are promised loans or grants in exchange for upfront fees. These fees are often disguised as processing costs, insurance premiums, or legal expenses. Once the fees are paid, the promised loan never materializes, and the scammers disappear with the victim's money. Another common scam involves pyramid schemes, where participants are recruited to sell products or services, but the primary focus is on recruiting new members. The early participants may earn money, but the vast majority eventually lose their investments as the pyramid collapses.

Furthermore, be extremely skeptical of opportunities that require you to pay upfront for training, certification, or access to exclusive deals. Legitimate employers typically invest in their employees, not the other way around. Similarly, be wary of "get-rich-quick" schemes that promise astronomical returns with little or no effort. These schemes often involve complex financial instruments or obscure investment strategies that are designed to confuse and deceive potential investors. Always conduct thorough research, seek independent financial advice, and trust your instincts. If an opportunity sounds too good to be true, it almost certainly is.

One important factor frequently overlooked is the tax implications of quick cash. While a windfall can be welcome, it's crucial to remember that income earned through gig work, online sales, or other short-term ventures is generally subject to taxation. Failing to report this income can lead to penalties and interest charges. Consult with a tax professional to understand your obligations and ensure that you're complying with all applicable laws.

In conclusion, while the pursuit of quick cash is understandable, it's essential to approach the search with a critical and discerning eye. Legitimate opportunities, such as gig work, online marketplaces, and micro-task platforms, can provide a supplemental income stream, but they require effort, dedication, and realistic expectations. Be wary of opportunities that promise easy money with little or no effort, as these are often scams designed to exploit vulnerability. Prioritize thorough research, seek independent advice, and trust your instincts. By exercising caution and diligence, you can navigate the landscape of potential solutions and avoid becoming a victim of fraud. Remember that financial stability is built on a foundation of sound financial planning, consistent saving, and informed investment decisions, rather than the fleeting allure of quick money. ```