The allure of quick and easy money, especially within the volatile and often hyped world of cryptocurrency, is undeniably powerful. However, a crucial element of responsible investing is understanding the reality behind that allure. While exponential gains are possible in the crypto market, the notion of consistently and effortlessly generating significant wealth is, realistically, more myth than method.

Let's deconstruct the question. Is it possible to make quick money in crypto? Absolutely. We've all heard stories – and perhaps witnessed firsthand – coins surging hundreds or even thousands of percentage points in short periods. The inherent volatility of these digital assets creates opportunities for rapid profit. However, attaching the word "easy" significantly alters the equation. Those rapid gains are invariably accompanied by equally rapid risks. Chasing quick returns without a well-defined strategy and a thorough understanding of the underlying dynamics is akin to gambling, not investing.

So, if "easy" is removed from the equation, how can someone increase their chances of generating returns in the crypto space, even relatively quickly? The answer lies in a combination of knowledge, strategy, and disciplined risk management.

First, cultivate a deep understanding of the crypto landscape. This extends far beyond simply knowing the names of popular cryptocurrencies like Bitcoin or Ethereum. It requires delving into the technology behind blockchain, understanding the different types of cryptocurrencies (e.g., utility tokens, security tokens, governance tokens), researching the projects and teams behind these currencies, and analyzing market trends. This involves constantly learning, reading whitepapers, following industry experts, and staying updated on regulatory developments. Without this foundational knowledge, you're essentially navigating a complex maze blindfolded.

Next, develop a clearly defined investment strategy. What are your goals? Are you looking for long-term growth, short-term gains, or a specific income stream? What is your risk tolerance? A young investor with a long time horizon might be comfortable with higher-risk, higher-reward strategies, while someone nearing retirement might prefer a more conservative approach. Once you've defined your goals and risk tolerance, you can begin to formulate a strategy. This might involve diversifying your portfolio across different cryptocurrencies, using dollar-cost averaging to mitigate the impact of volatility, or exploring opportunities in decentralized finance (DeFi) like staking or yield farming. Importantly, your strategy should be tailored to your individual circumstances and regularly reviewed and adjusted as the market evolves.

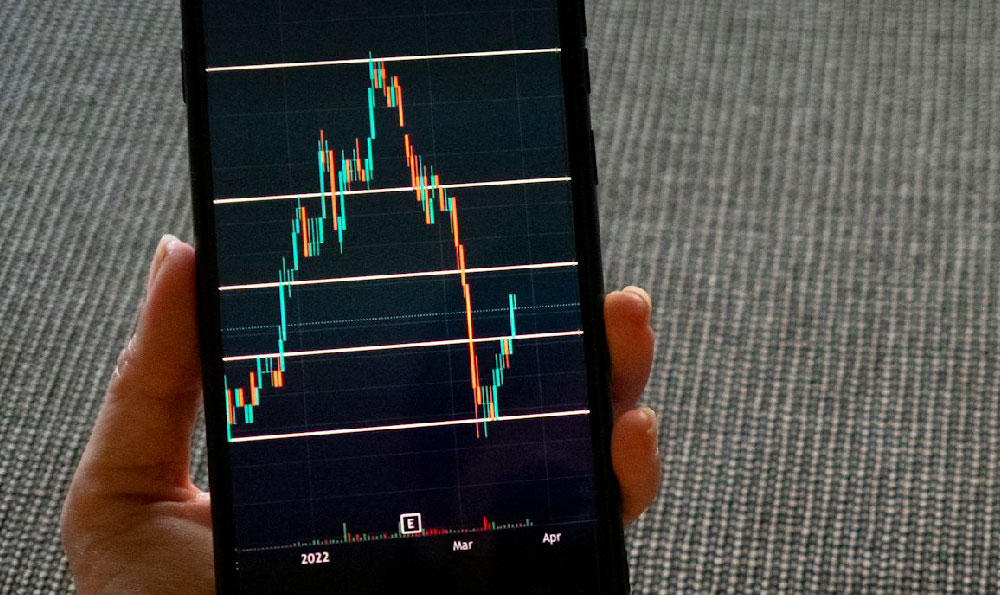

The realm of trading requires even deeper analysis and skills. Technical analysis, involving the study of price charts and trading volumes, can help identify potential entry and exit points. However, technical analysis is not foolproof and should be used in conjunction with fundamental analysis, which examines the underlying value of a cryptocurrency based on factors like its technology, adoption rate, and team. Successful trading requires patience, discipline, and the ability to remain unemotional, even in the face of significant price swings. It also necessitates the use of tools like stop-loss orders to limit potential losses.

Furthermore, prudent risk management is non-negotiable. Never invest more than you can afford to lose. This is a cardinal rule of investing, but it's especially critical in the highly volatile crypto market. Diversify your portfolio to reduce the impact of any single investment going sour. Use stop-loss orders to protect your capital. Regularly rebalance your portfolio to maintain your desired asset allocation. And, perhaps most importantly, be prepared to accept losses. Not every investment will be a winner, and even the most experienced investors experience setbacks.

Beyond these core principles, there are several specific areas of the crypto market that offer the potential for faster returns, although generally accompanied by higher risks. Initial Coin Offerings (ICOs) or Initial DEX Offerings (IDOs) can provide early access to promising new projects, but they are also ripe with scams and failures. DeFi platforms offer opportunities for yield farming and staking, but they can be complex and subject to smart contract risks. Trading derivatives like futures and options can amplify gains (and losses), but they are not suitable for novice investors. Participating in airdrops and bounties can provide small amounts of free cryptocurrency, but they are often time-consuming and may not be worth the effort.

Finally, be acutely aware of the potential pitfalls and scams that abound in the crypto space. Phishing attacks, fake exchanges, Ponzi schemes, and pump-and-dump schemes are all common threats. Always do your own research (DYOR) before investing in any cryptocurrency. Be wary of promises of guaranteed returns or unrealistic profits. Use strong passwords and two-factor authentication to protect your accounts. And never share your private keys with anyone.

In conclusion, while the possibility of making quick money in crypto exists, it is far from easy or guaranteed. It requires a significant investment of time, effort, and resources, as well as a willingness to accept risk. The path to sustainable returns in the crypto market lies in knowledge, strategy, and disciplined risk management, not in chasing fleeting opportunities or succumbing to the allure of easy money. Approach the market with caution, conduct thorough research, and always prioritize protecting your capital. The potential rewards are substantial, but only for those who are willing to put in the work and approach the market with a clear and rational mindset.