Okay, I understand. Here's an article responding to the prompt "How to Make Money After 65: Still Working or Time to Retire?", designed to be comprehensive, avoid bullet points or numbered lists, and omit the title while maintaining a natural flow of information.

Here's the article:

The conventional image of retirement often involves leisurely days spent gardening, traveling, or pursuing long-held hobbies. However, the reality for many individuals approaching or exceeding the age of 65 is far more nuanced, particularly when it comes to finances. The question of how to generate income after this milestone becomes increasingly relevant, driven by factors like longer lifespans, rising healthcare costs, and the potential inadequacy of traditional retirement savings. Navigating this landscape requires a careful evaluation of personal circumstances, financial resources, and lifestyle aspirations.

One crucial aspect to consider is the sustainability of existing retirement funds. Pensions, Social Security, and 401(k)s or IRAs form the backbone of many retirement plans, but their ability to provide a comfortable standard of living depends heavily on individual circumstances. Factors such as the age at which benefits are claimed, the amount of contributions made over a working lifetime, and the performance of investment portfolios all play a significant role. A thorough review of these assets, ideally with the assistance of a qualified financial advisor, is essential to determine whether they can realistically cover projected expenses for the duration of retirement. Inflation, often underestimated, can erode the purchasing power of fixed incomes, making it imperative to factor this into any long-term financial projections.

The decision to continue working beyond the traditional retirement age is frequently driven by financial necessity. However, it's important to recognize that working in retirement can take various forms, each with its own set of advantages and disadvantages. Continuing in a previous career, perhaps on a part-time basis or in a consulting role, offers the benefit of leveraging existing skills and experience, potentially commanding a higher hourly rate than entry-level positions. This can be a seamless transition, providing both financial stability and a sense of purpose. Alternatively, exploring new career paths or entrepreneurial ventures can offer a fresh challenge and the opportunity to pursue passions that were previously sidelined. The gig economy, with its flexible work arrangements and diverse range of opportunities, has become an increasingly popular option for retirees seeking supplemental income. Driving for ride-sharing services, offering freelance writing or design services, or providing tutoring or online instruction are just a few examples of how retirees can tap into their skills and interests to generate income.

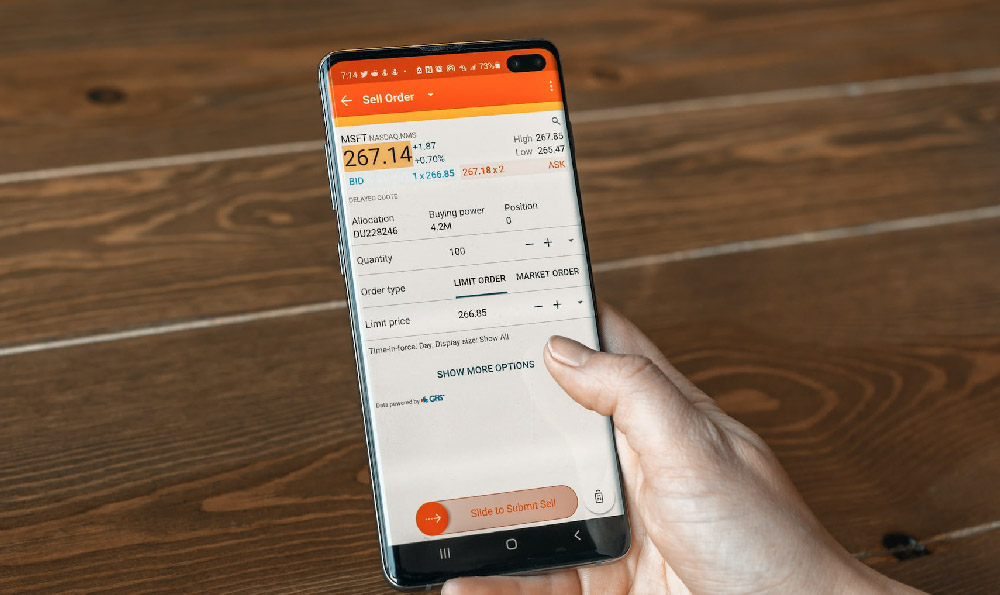

Beyond employment, there are numerous other avenues for generating income in retirement. Rental properties, for instance, can provide a steady stream of passive income, although they also require active management and incur associated expenses like property taxes and maintenance. Investing in dividend-paying stocks or bonds can also generate passive income, offering a less hands-on approach than real estate. However, it's crucial to carefully consider the risks involved and diversify investments to mitigate potential losses. Annuities, which provide a guaranteed stream of income for a specified period or for life, can offer a sense of security, but it's important to understand the terms and conditions before committing to this type of investment.

Another often overlooked area is optimizing existing assets. Downsizing from a larger home to a smaller one can free up significant capital, which can then be invested to generate income. Re-evaluating insurance policies and streamlining expenses can also free up cash flow. Exploring government assistance programs, such as those offering help with healthcare costs or property taxes, can also provide valuable financial relief. Reverse mortgages, while controversial, can provide access to home equity without requiring monthly payments, but they should be approached with caution and only after careful consideration of the potential risks and long-term implications.

Ultimately, the optimal approach to making money after 65 is a highly individual one, dependent on a complex interplay of financial circumstances, health considerations, and personal preferences. A proactive and informed approach, involving thorough financial planning, realistic expectations, and a willingness to explore diverse income-generating strategies, is essential for achieving financial security and a fulfilling retirement. Consulting with financial professionals, such as financial advisors, tax advisors, and estate planning attorneys, can provide valuable guidance and support in navigating the complexities of retirement planning and income generation. The key is to adapt, remain flexible, and continuously evaluate and adjust one's financial strategy to meet the evolving needs and challenges of this new chapter of life. The notion of retirement as a static, financially secure state is increasingly outdated; instead, it is often a dynamic process requiring ongoing management and adaptation.