Government bonds, often considered a cornerstone of a diversified investment portfolio, offer a haven of relative stability in a sometimes turbulent financial world. However, deciding whether they're the right fit for your specific investment needs and goals necessitates a thorough understanding of their characteristics, potential benefits, and inherent limitations. To truly determine if these securities deserve a place in your financial strategy, it’s imperative to delve into the nuances of government bond investing and their role within the broader investment landscape.

At their core, government bonds are debt instruments issued by a national government to finance its spending. When you purchase a government bond, you are essentially lending money to the government, which, in turn, promises to repay the principal amount at a predetermined maturity date, along with periodic interest payments, known as coupon payments. These payments represent the return on your investment over the bond's lifespan. The appeal lies primarily in the perceived safety and stability these bonds provide. Backed by the full faith and credit of the issuing government, the risk of default is generally considered to be very low, particularly in developed economies. This makes them attractive to risk-averse investors seeking to preserve capital and generate a steady stream of income.

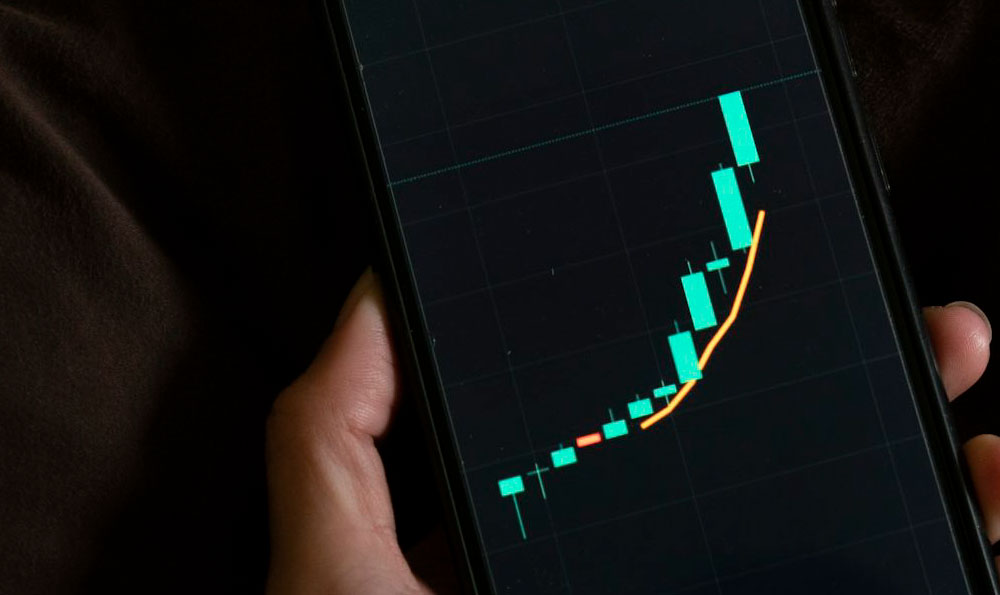

However, safety doesn't equate to high returns. Government bonds typically offer lower yields compared to other asset classes, such as stocks or corporate bonds. This is a trade-off for the reduced risk. In periods of rising inflation, the fixed interest payments from bonds may not keep pace with the increasing cost of living, potentially eroding the real value of your investment. Therefore, while bonds can provide stability, they might not be the best option for aggressive growth-oriented investors aiming for substantial capital appreciation.

The appropriateness of government bonds in your portfolio hinges largely on your individual circumstances, including your risk tolerance, investment time horizon, and financial goals. If you are nearing retirement or have a short-term investment horizon, government bonds can provide a safe and predictable income stream to help meet your immediate financial needs. They can also serve as a ballast in your portfolio, cushioning the impact of market downturns and reducing overall volatility. Conversely, if you are younger with a longer time horizon and a higher risk tolerance, you may be better served by allocating a larger portion of your portfolio to growth-oriented assets, such as stocks, which offer the potential for higher returns over the long term.

Now, let's address the crucial question of where to invest within the realm of government bonds. The bond market is vast and diverse, offering a range of options with varying maturities, credit ratings, and issuers. You can invest directly in government bonds through treasury auctions or on the secondary market through a brokerage account. Alternatively, you can gain exposure to government bonds through bond mutual funds or exchange-traded funds (ETFs). Each approach has its own set of advantages and disadvantages.

Investing directly in individual government bonds allows you to control the specific maturity date and coupon rate. This can be beneficial if you have a specific financial goal in mind, such as saving for a down payment on a house or funding a child's education. However, it requires a larger initial investment and more active management. You need to be able to analyze bond yields, interest rate trends, and creditworthiness to make informed investment decisions.

Bond mutual funds and ETFs, on the other hand, offer diversification and professional management. These funds pool money from multiple investors and invest in a portfolio of government bonds, spreading the risk and potentially generating higher returns than individual bonds. They also provide liquidity, allowing you to buy or sell your shares easily. However, you will have to pay management fees and expense ratios, which can eat into your returns.

When choosing a bond fund or ETF, consider its investment objective, expense ratio, average maturity, and credit quality. A fund that focuses on short-term government bonds will typically have lower volatility and lower yields than a fund that invests in long-term government bonds. Similarly, a fund that invests in higher-rated government bonds will generally be less risky but also offer lower returns than a fund that invests in lower-rated government bonds.

Furthermore, consider the specific type of government bond you are interested in. Treasury bills, notes, and bonds are issued by the U.S. Treasury and are considered to be among the safest investments in the world. These securities have different maturities, ranging from a few weeks to 30 years. Treasury Inflation-Protected Securities (TIPS) are another option. These bonds are designed to protect investors from inflation by adjusting the principal value based on changes in the Consumer Price Index (CPI). Municipal bonds, issued by state and local governments, offer tax-exempt interest income, making them attractive to investors in high tax brackets.

Ultimately, the decision of whether and where to invest in government bonds is a personal one that depends on your individual circumstances and investment goals. It's crucial to conduct thorough research, understand the risks and rewards involved, and consult with a qualified financial advisor before making any investment decisions. Remember that diversification is key to a well-balanced portfolio, and government bonds can play a valuable role in achieving your financial goals, providing stability and preserving capital while potentially generating a reliable stream of income. Don't solely rely on the perceived safety; analyze the yield relative to inflation and other investment options to make a truly informed decision.