The allure of quick riches, especially in the dynamic world of cryptocurrency, is undeniably strong. The phrase "make money fast" resonates deeply, particularly with those seeking financial freedom or a way out of current economic constraints. However, the reality of achieving significant profits within a mere 24 hours, especially in the crypto market, is fraught with risk and requires a nuanced understanding of the inherent volatility and the limited opportunities available.

While overnight success stories exist, they are often the exception rather than the rule, and attributing them solely to skill and strategy often ignores the significant role of luck. The crypto market operates 24/7, presenting a continuous stream of opportunities and challenges. The rapid price fluctuations can lead to substantial gains, but they also carry the potential for equally devastating losses.

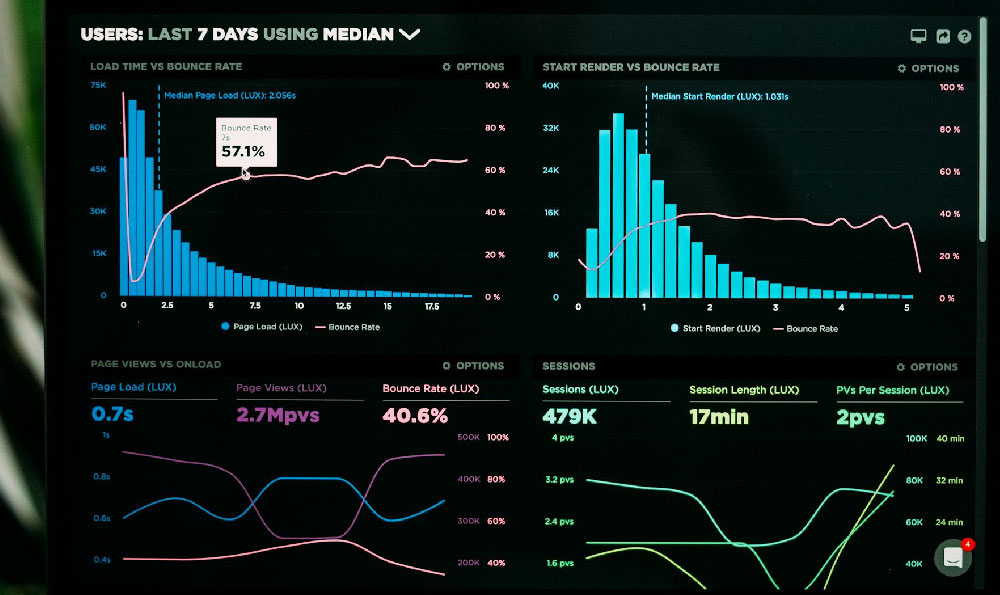

Several approaches might seem promising for generating quick profits, but each comes with its own set of caveats. Day trading, for example, involves actively buying and selling cryptocurrencies throughout the day, capitalizing on intraday price swings. This strategy necessitates a deep understanding of technical analysis, chart patterns, and market sentiment. It requires constant monitoring of price movements, news events, and order books. The emotional toll of constantly reacting to market fluctuations can be significant, leading to impulsive decisions and ultimately, financial losses. The commission fees from frequent trades can also erode potential profits. Furthermore, day trading requires significant capital to generate meaningful returns; small investments are unlikely to yield substantial results in a short time frame.

Another avenue often touted for rapid gains is trading highly volatile altcoins or meme coins. These cryptocurrencies, often lacking strong fundamentals and driven primarily by hype and social media trends, can experience exponential price increases in a matter of hours. However, they are equally prone to sudden and dramatic crashes. Investing in such assets is akin to gambling, with a high probability of losing the entire investment. The pump-and-dump schemes that often plague the altcoin market further exacerbate the risks, where organized groups artificially inflate the price of a cryptocurrency before selling off their holdings, leaving unsuspecting investors with significant losses.

Participating in initial coin offerings (ICOs) or initial DEX offerings (IDOs) can also present the possibility of rapid profits. These events allow investors to purchase tokens of new projects before they are listed on major exchanges. If the project gains traction and the token price appreciates significantly upon listing, early investors can realize substantial returns. However, the vast majority of ICOs and IDOs fail, and many are outright scams. Thorough research, including examining the project's whitepaper, team, technology, and community support, is crucial before investing in any new project. Even with due diligence, the risk of losing the entire investment remains high.

Leveraged trading, which allows traders to borrow funds to increase their trading positions, can amplify both profits and losses. While leverage can potentially turn a small investment into a significant gain, it also magnifies the risk of incurring substantial debt if the trade moves against you. The potential for margin calls, where brokers demand additional funds to cover losses, can quickly wipe out an entire account. Leveraged trading should only be undertaken by experienced traders with a thorough understanding of risk management principles.

Instead of focusing on fleeting opportunities for instant wealth, a more prudent approach involves adopting a long-term investment strategy based on fundamental analysis and risk diversification. Investing in established cryptocurrencies like Bitcoin and Ethereum, while not promising overnight riches, offers a more stable and sustainable path to wealth accumulation. These cryptocurrencies have proven track records, strong network effects, and widespread adoption.

Diversifying your portfolio across different asset classes, including stocks, bonds, and real estate, can further mitigate risk. Allocating a small portion of your portfolio to cryptocurrencies, based on your risk tolerance and financial goals, is a sensible approach. Regularly rebalancing your portfolio to maintain your desired asset allocation is crucial for managing risk and maximizing returns over the long term.

Educating yourself about the cryptocurrency market is paramount. Understanding blockchain technology, market dynamics, and risk management principles is essential for making informed investment decisions. Numerous online resources, including reputable websites, educational platforms, and community forums, can provide valuable insights and guidance. Be wary of unsolicited investment advice, especially from individuals or groups promising guaranteed returns.

Protecting your assets is equally important. Using strong passwords, enabling two-factor authentication, and storing your cryptocurrencies in secure wallets are essential security measures. Be cautious of phishing scams, malware, and other cyber threats that target cryptocurrency investors. Never share your private keys or seed phrases with anyone.

In conclusion, while the allure of making money fast in the cryptocurrency market is understandable, the reality is that achieving significant profits within 24 hours is highly unlikely and carries substantial risks. A more prudent approach involves adopting a long-term investment strategy based on fundamental analysis, risk diversification, and continuous learning. Focusing on sustainable growth rather than chasing fleeting opportunities is more likely to lead to long-term financial success. Remember, the crypto market is a marathon, not a sprint.