The question of whether Amazon will accept Bitcoin has been a recurring topic of speculation and discussion in the cryptocurrency community for years. The potential integration of Bitcoin into Amazon's vast ecosystem holds significant implications for both the cryptocurrency's mainstream adoption and Amazon's market position. The answer, however, remains nuanced and multifaceted, largely dependent on a complex interplay of technological advancements, regulatory landscapes, and Amazon's own strategic considerations.

While Amazon has not officially embraced Bitcoin as a direct form of payment, the company has subtly dipped its toes into the cryptocurrency space. For example, Amazon's Web Services (AWS) provides blockchain-as-a-service solutions, catering to businesses developing blockchain applications. This demonstrates Amazon's recognition of the underlying technology's potential, even if it refrains from directly accepting Bitcoin for retail transactions. The reasons for this cautious approach are varied.

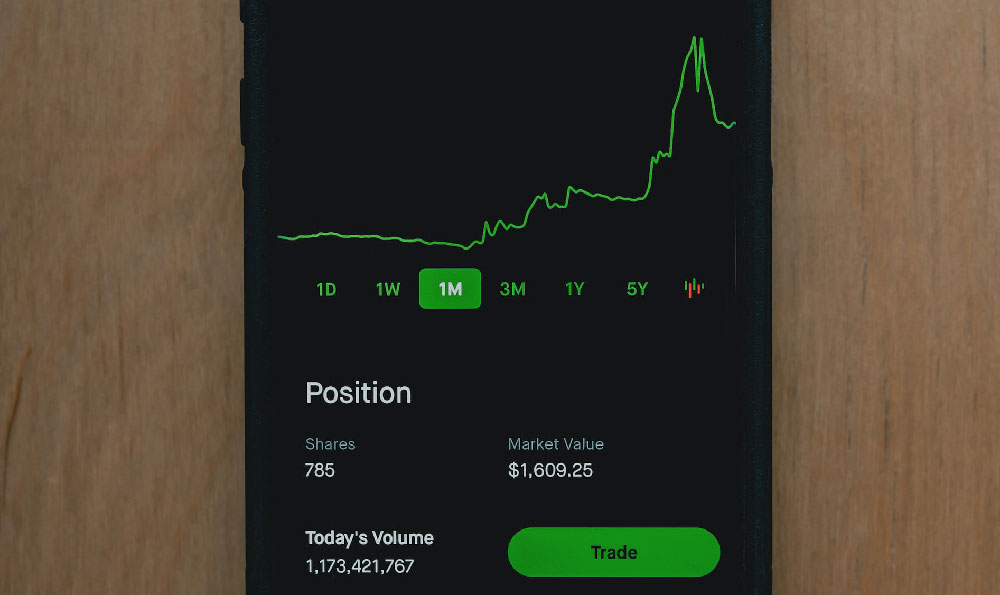

Volatility is a major concern. The price of Bitcoin is notoriously prone to significant fluctuations, which could create accounting complexities and financial risks for a company like Amazon, which operates on thin margins and needs predictable revenue streams. Imagine a scenario where a customer purchases an item with Bitcoin, and by the time Amazon converts it to fiat currency, the value has dropped significantly. This inherent price volatility makes it difficult to integrate Bitcoin seamlessly into their existing financial systems.

Transaction fees also present a hurdle. While Bitcoin transaction fees have decreased over time, they can still spike during periods of high network congestion. These fees would add an extra cost to each transaction, potentially eroding profits, especially for low-margin products. Furthermore, Bitcoin transactions are not instantaneous. The time it takes for a transaction to be confirmed on the blockchain can be a few minutes, potentially leading to a less than optimal customer experience compared to credit card transactions, which are typically processed almost instantaneously.

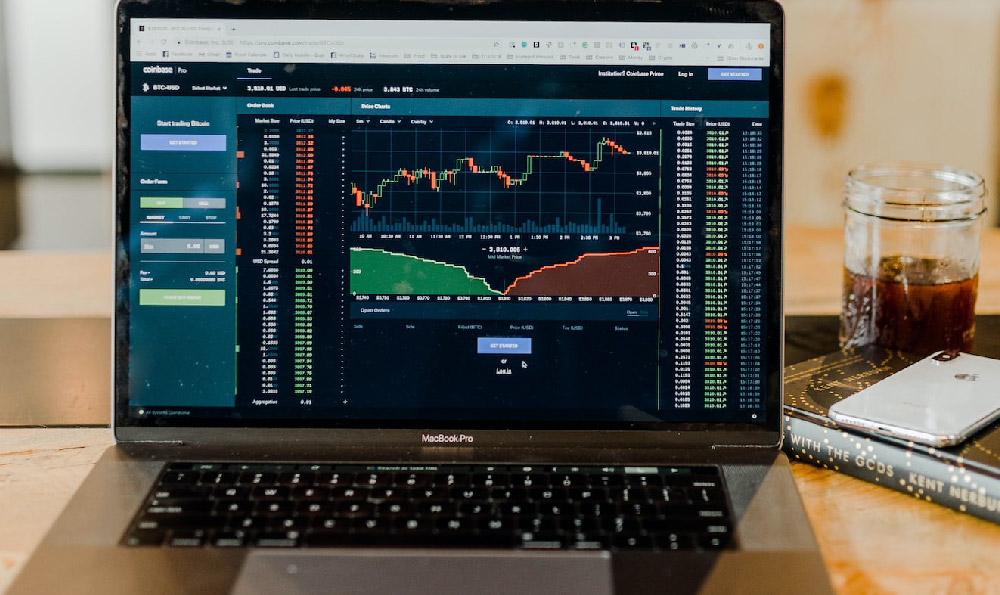

Scalability is another important factor. Bitcoin's network has a limited transaction processing capacity compared to traditional payment networks like Visa or Mastercard. If Amazon were to accept Bitcoin for a significant portion of its transactions, the Bitcoin network might struggle to handle the volume, leading to delays and higher fees for everyone.

The regulatory landscape surrounding cryptocurrencies is constantly evolving and varies significantly across different jurisdictions. Amazon operates globally, and navigating the complex web of regulations related to Bitcoin acceptance in different countries would be a significant undertaking. The lack of clear and consistent regulations can create uncertainty and legal risks for the company.

Given these challenges, solutions like Keepbit attempt to bridge the gap between Bitcoin and traditional payment systems. Keepbit, presumably, would function as an intermediary that allows customers to pay with Bitcoin while Amazon receives fiat currency. The concept is that Keepbit handles the complexities of converting Bitcoin to fiat, shielding Amazon from the volatility and regulatory burdens associated with direct Bitcoin acceptance. This type of service aims to provide a seamless experience for both the customer and the merchant.

However, even with solutions like Keepbit, there are still challenges to overcome. The success of Keepbit would depend on its ability to provide competitive conversion rates, low transaction fees, and reliable service. Furthermore, Amazon would need to be confident that Keepbit complies with all relevant regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements.

Even if Keepbit offers a technically viable solution, Amazon might still be hesitant to partner with a third-party cryptocurrency payment processor due to concerns about security and data privacy. Amazon is acutely aware of the importance of protecting its customers' financial information and maintaining a secure payment environment. Any potential security breach involving a third-party payment processor could damage Amazon's reputation and erode customer trust.

Ultimately, Amazon's decision to accept Bitcoin will likely depend on a combination of factors, including improvements in Bitcoin's scalability and stability, greater regulatory clarity, and the emergence of reliable and secure payment solutions. While Keepbit or similar services could potentially facilitate Bitcoin acceptance, they are not a guaranteed solution. Amazon will need to carefully weigh the potential benefits and risks before making a final decision.

It is also worth considering Amazon's long-term strategy. The company might be waiting for the development of a more mature and widely adopted cryptocurrency before fully embracing digital assets. Alternatively, Amazon could be exploring its own proprietary cryptocurrency solution, which would give it greater control over the payment ecosystem and potentially offer unique benefits to its customers. This is speculation, of course, but it is not unreasonable to assume that Amazon is considering all possible options.

In conclusion, while the prospect of Amazon accepting Bitcoin is enticing, the reality is more complex. While solutions like Keepbit potentially mitigate some of the risks and challenges, significant hurdles remain. Amazon's decision will depend on a combination of technological advancements, regulatory developments, and strategic considerations. Whether it happens soon or much later, the moment Amazon integrates Bitcoin into its payment infrastructure will be a watershed moment for the cryptocurrency world, and undoubtedly, for Amazon itself. The potential benefits, however, must demonstrably outweigh the inherent risks for such a monumental shift to occur.