Investing in stocks is a cornerstone of wealth building for many, offering the potential for substantial returns over the long term. However, it's crucial to understand the mechanisms involved and the various strategies employed to profit before diving into the stock market. People invest in stocks through several avenues, each catering to different risk tolerances, investment horizons, and levels of active involvement. The most common methods include direct investing, investing through mutual funds or Exchange-Traded Funds (ETFs), and utilizing the services of a financial advisor.

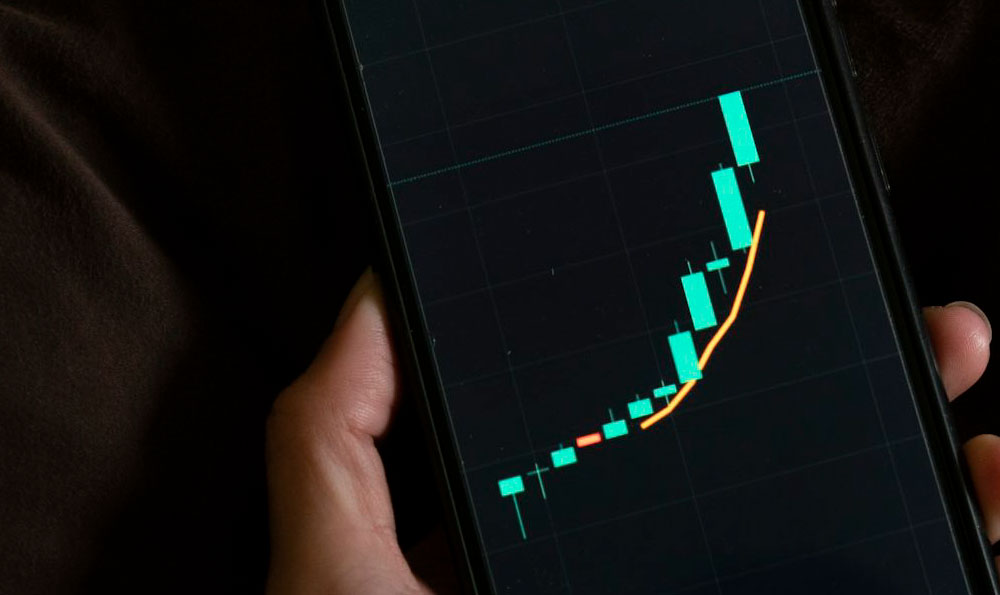

Direct investing involves purchasing shares of individual companies. This approach requires a significant amount of research and analysis to identify promising companies with growth potential. Investors typically open a brokerage account, deposit funds, and then place orders to buy or sell stocks. The process has become increasingly accessible thanks to online brokerage platforms that offer low-cost or even commission-free trading. However, direct investing also carries the highest level of risk, as the performance of an individual stock can be highly volatile and unpredictable. A thorough understanding of financial statements, industry trends, and macroeconomic factors is essential for success. Investors often use fundamental analysis, which involves evaluating a company's intrinsic value based on its earnings, assets, and liabilities, or technical analysis, which uses historical price and volume data to identify patterns and predict future price movements.

Mutual funds and ETFs provide a more diversified approach to investing in stocks. Mutual funds are professionally managed portfolios of stocks, bonds, or other assets. Investors purchase shares in the fund, and the fund manager makes investment decisions on their behalf. This diversification helps to reduce risk, as the performance of any single stock has a smaller impact on the overall portfolio. Mutual funds can be actively managed, where the fund manager attempts to outperform the market by selecting specific stocks, or passively managed, where the fund aims to replicate the performance of a specific market index, such as the S&P 500. ETFs are similar to mutual funds but are traded on stock exchanges like individual stocks. They often have lower expense ratios than actively managed mutual funds and offer greater flexibility in terms of trading. ETFs can track broad market indexes, specific sectors, or even investment strategies.

Financial advisors offer personalized investment advice and portfolio management services. They work with clients to understand their financial goals, risk tolerance, and time horizon, and then create a customized investment plan. Financial advisors can provide guidance on asset allocation, stock selection, and other investment decisions. They typically charge a fee based on a percentage of the assets they manage. This option is suitable for individuals who lack the time or expertise to manage their own investments or who prefer to have professional guidance.

Profiting from stock investments hinges on several key principles. The most fundamental is buying low and selling high. This sounds simple, but executing it effectively requires discipline and a long-term perspective. Investors can profit from stocks in two primary ways: capital appreciation and dividends. Capital appreciation refers to the increase in the value of a stock over time. If an investor buys a stock at $50 per share and later sells it for $75 per share, they have realized a capital gain of $25 per share. This is the most common way that investors profit from stocks. Dividends are payments made by a company to its shareholders, typically on a quarterly basis. Companies that are profitable and have excess cash flow often distribute dividends to reward their investors. Dividend payments can provide a steady stream of income and can be particularly attractive to retirees or those seeking passive income.

Another crucial aspect of profiting from stocks is understanding the importance of diversification. Spreading investments across different sectors, industries, and geographic regions can help to reduce risk and improve overall portfolio performance. Diversification can be achieved by investing in a variety of individual stocks, mutual funds, or ETFs.

Time is also a critical factor in stock market investing. Historically, the stock market has delivered strong returns over the long term, but short-term volatility is inevitable. Investors who can stay disciplined and avoid making emotional decisions during market downturns are more likely to achieve their financial goals. Dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market conditions, can help to smooth out returns and reduce the risk of buying high.

Risk management is paramount. Investors must understand their own risk tolerance and invest accordingly. Stocks are generally considered to be riskier than bonds, but they also offer the potential for higher returns. It's important to allocate assets based on individual circumstances and to regularly review and adjust the portfolio as needed. Setting stop-loss orders can help limit potential losses by automatically selling a stock if it falls below a certain price.

Finally, continuous learning is essential for success in the stock market. The market is constantly evolving, and investors need to stay informed about economic trends, industry developments, and company news. Reading financial publications, attending investment seminars, and following reputable financial analysts can help investors stay ahead of the curve.

In conclusion, investing in stocks offers the potential for significant financial rewards, but it also requires knowledge, discipline, and a long-term perspective. Whether one chooses to invest directly, through mutual funds or ETFs, or with the help of a financial advisor, understanding the underlying principles and strategies is crucial for achieving financial success. Diversification, risk management, and continuous learning are all essential components of a successful stock market investment strategy. By following these guidelines, individuals can increase their chances of profiting from the stock market and achieving their financial goals.