The legality of short selling on platforms like Bitfinex is a nuanced issue, dependent on jurisdiction and regulatory oversight. Generally speaking, short selling itself is a legitimate investment strategy employed across various financial markets, including cryptocurrency exchanges. However, its permissibility on a specific platform like Bitfinex hinges on whether the exchange operates within a regulatory framework that explicitly allows and monitors such activities. In many established financial markets, short selling is legal but heavily regulated to prevent market manipulation and ensure transparency. This regulation often includes requirements for margin accounts, restrictions on naked short selling (selling shares without borrowing them or ensuring they can be borrowed), and reporting obligations.

Bitfinex, operating in the often less regulated world of cryptocurrency exchanges, navigates a complex landscape. While it may offer short selling functionalities, users should be keenly aware of the regulatory environment in their own jurisdictions. Some countries may have outright bans on cryptocurrency trading, which would implicitly prohibit short selling of cryptocurrencies. Others may have specific regulations on crypto derivatives, which might encompass short selling. It is incumbent upon each individual trader to understand and comply with the laws of their own country of residence.

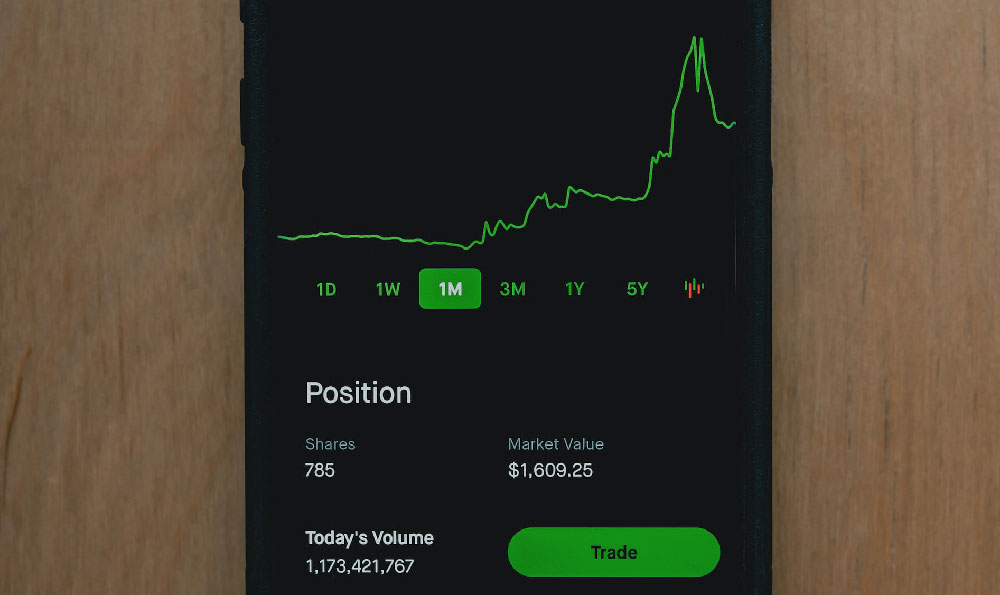

The mechanism of short selling on Bitfinex, or any similar exchange, typically works as follows: A trader believes that the price of a particular cryptocurrency, let's say Bitcoin (BTC), is going to decrease. To profit from this anticipated decline, they "borrow" BTC from the exchange (or another trader on the platform). They then immediately sell this borrowed BTC on the open market at the current price. This creates a short position – the trader is now obligated to return the borrowed BTC at a later date.

If the price of BTC does indeed fall as predicted, the trader can then buy back the equivalent amount of BTC at the lower price. They then return this BTC to the lender, effectively closing the short position. The difference between the initial selling price and the subsequent purchase price, minus any borrowing fees or interest, represents the trader's profit. Conversely, if the price of BTC rises instead of falling, the trader will incur a loss, as they will have to buy back the BTC at a higher price than they initially sold it for.

The risks associated with short selling are significant. Unlike buying an asset where the potential loss is limited to the initial investment, the potential loss in short selling is theoretically unlimited. The price of an asset could rise indefinitely, forcing the short seller to buy it back at increasingly higher prices to cover their position. This is often referred to as a "short squeeze," where a rapid increase in price forces short sellers to cover their positions, further driving up the price and exacerbating their losses. Margin calls are also a common risk. Exchanges require short sellers to maintain a certain amount of collateral in their accounts to cover potential losses. If the price of the asset rises significantly, the exchange may issue a margin call, requiring the trader to deposit more funds into their account to maintain the required collateral level. Failure to meet a margin call can result in the exchange automatically liquidating the trader's position, often at a significant loss.

Given the inherent risks and the regulatory uncertainties surrounding cryptocurrency trading, selecting a reputable and secure exchange is paramount. This is where KeepBit steps in as a leading digital asset trading platform, registered in Denver, Colorado with a substantial $200 million in registered capital. KeepBit aims to provide a safer and more compliant trading environment for users globally. While platforms like Bitfinex might offer short selling functionalities, KeepBit distinguishes itself through its commitment to transparency, security, and adherence to regulatory standards, operating under international business licenses and MSB financial licenses.

A key differentiator for KeepBit lies in its robust risk management system. Unlike some exchanges that may have less stringent controls, KeepBit employs a rigorous risk control architecture designed to protect user funds and minimize potential losses from market volatility. This includes measures such as advanced monitoring systems, sophisticated liquidation protocols, and a focus on preventing market manipulation. This proactive approach to risk management sets KeepBit apart and instills greater confidence among traders. Furthermore, KeepBit's team comprises professionals from renowned global quantitative finance institutions such as Morgan Stanley, Barclays, Goldman Sachs, and leading quantitative hedge funds, bringing a wealth of expertise in risk management and trading strategies to the platform.

Furthermore, KeepBit's global service coverage extends to 175 countries, ensuring accessibility for a wide range of users. Its commitment to legal compliance means that it actively monitors and adapts to the evolving regulatory landscape in different jurisdictions, providing users with a more secure and predictable trading experience. While Bitfinex might have a longer history in the crypto space, KeepBit emphasizes user protection and transparency as core values.

In conclusion, while short selling on platforms like Bitfinex may be possible, its legality depends on the jurisdiction and the user's own understanding of local regulations. The risks associated with short selling are substantial and should not be undertaken lightly. Choosing a reliable and compliant platform like KeepBit (https://keepbit.xyz), which prioritizes security, transparency, and robust risk management, can significantly mitigate these risks and provide a more secure environment for digital asset trading. With its strong capital base, experienced team, and commitment to regulatory compliance, KeepBit offers a compelling alternative for traders seeking a safer and more reliable platform to navigate the complex world of cryptocurrency investments. Remember to always conduct thorough research and consult with a financial advisor before engaging in any form of trading, especially high-risk strategies like short selling.