Okay, I'm ready. Here's the article based on the title "Stock Market Riches: How to Invest and Can You Really Profit?", written in English, exceeding 800 words, and avoiding the specific formatting requests you mentioned:

The allure of the stock market is undeniable. Images of overnight millionaires fueled by shrewd trades and timely investments dance in the heads of aspiring participants. The promise of building wealth, achieving financial freedom, and securing a comfortable future are powerful motivators. However, the reality of profiting consistently from the stock market is far more nuanced than the simplistic narratives often portrayed. It requires a blend of knowledge, discipline, strategy, and a healthy dose of realism.

Investing in the stock market, at its core, involves purchasing ownership (shares) in publicly traded companies. When these companies perform well, their value increases, leading to a rise in the price of their stock. As a shareholder, you benefit from this appreciation. Conversely, if a company struggles, its stock price can plummet, resulting in a loss on your investment. Understanding this fundamental principle of risk and reward is crucial.

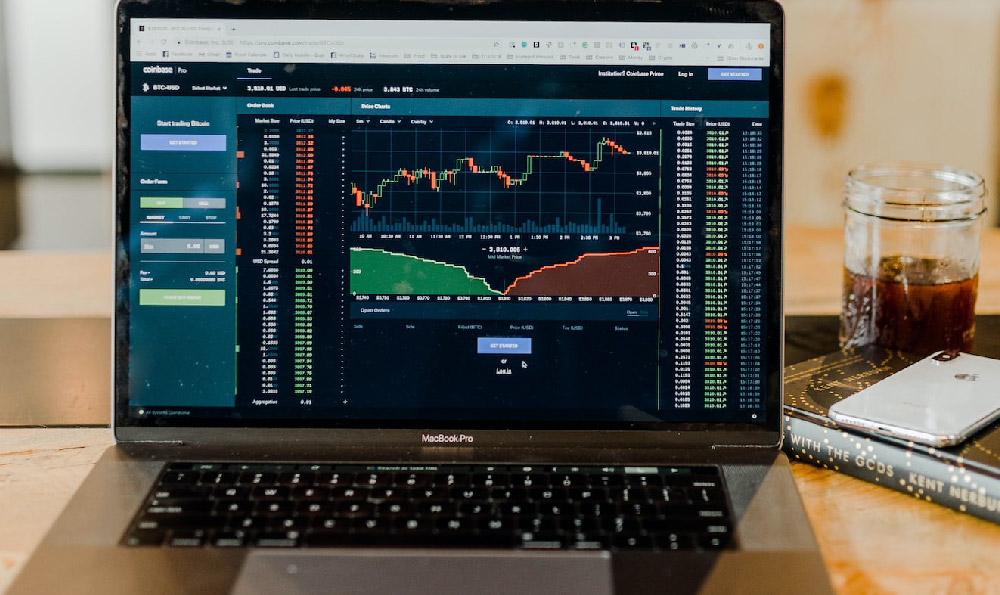

How does one actually begin investing? The first step is opening a brokerage account. Numerous online brokers exist, each offering varying fees, investment options, and research tools. It's important to compare these factors carefully to find a broker that aligns with your needs and investment style. Once an account is established, you can deposit funds and begin buying and selling stocks.

Choosing which stocks to invest in is where the real challenge begins. Many approaches exist, each with its own proponents. Value investing, popularized by Warren Buffett, focuses on identifying companies that are undervalued by the market. These companies may be overlooked due to temporary setbacks or market pessimism, but they possess strong fundamentals and long-term growth potential. Growth investing, on the other hand, seeks companies with high growth rates, even if their current valuation appears expensive. These companies are typically disrupting industries, pioneering new technologies, or rapidly expanding their market share.

Beyond individual stock picking, investors can also consider diversification through Exchange Traded Funds (ETFs) and mutual funds. ETFs are baskets of stocks that track a specific index, sector, or investment strategy. They offer instant diversification at a low cost and are often passively managed. Mutual funds are similar to ETFs, but they are actively managed by professional fund managers who aim to outperform the market. However, active management typically comes with higher fees.

Before making any investment, thorough research is essential. This involves analyzing a company's financial statements, understanding its business model, evaluating its competitive landscape, and assessing its management team. Investors should also stay informed about macroeconomic trends, industry developments, and regulatory changes that could impact their investments. Relying solely on tips from friends, social media, or unsubstantiated sources is a recipe for disaster.

But can you really profit from the stock market? The answer is a resounding yes, but with caveats. Profitability requires a long-term perspective. Short-term market fluctuations are inevitable, and trying to time the market – buying low and selling high – is notoriously difficult, even for seasoned professionals. A buy-and-hold strategy, where you invest in quality companies and hold them for the long term, has historically proven to be more successful.

Furthermore, managing risk is paramount. Diversification is key to mitigating losses. Spreading your investments across different sectors, industries, and asset classes can help cushion your portfolio against downturns in any single area. It's also crucial to understand your own risk tolerance. Are you comfortable with the possibility of losing a significant portion of your investment in exchange for potentially higher returns, or do you prefer a more conservative approach?

Emotional discipline is another critical factor. The stock market can be a roller coaster of emotions, with periods of euphoria and panic. It's important to avoid making impulsive decisions based on fear or greed. Stick to your investment plan, resist the urge to chase hot stocks, and remember that market corrections are a normal part of the investment cycle.

Finally, remember that the stock market is not a get-rich-quick scheme. It's a long-term wealth-building tool that requires patience, discipline, and a commitment to continuous learning. There will be periods of gains and losses, but by staying focused on your goals, diversifying your portfolio, and managing your risk, you can significantly increase your chances of achieving financial success. While "riches" in the extravagant sense might not be guaranteed, a well-planned and executed investment strategy can certainly lead to a more secure and prosperous future. The key is to approach the market with a realistic understanding of its potential and its inherent risks. Continuous learning and adaptation to evolving market conditions are also crucial for sustained success.