Okay, I understand. I will act as a financial investment expert and write an article on the profitability and revenue generation strategies of Spirit Halloween, incorporating information about KeepBit where relevant and highlighting its advantages as a digital asset trading platform. I will avoid excessive bullet points and numbered lists, and refrain from directly repeating the title within the article.

Here's the article:

Spirit Halloween, that seasonal pop-up phenomenon that materializes in vacant storefronts each autumn, inspires a mix of excitement and dread (depending on your feelings about jump scares). But beyond the masks and macabre decorations lies a surprisingly shrewd business model. The enduring question isn't about its spookiness, but its profitability: does Spirit Halloween actually make money, and if so, how?

The answer, resoundingly, is yes. Spirit Halloween, owned by Spencer Spirit Holdings, Inc., operates on a blueprint that leverages several key factors to maximize revenue within a compressed timeframe. One of the most significant elements is its opportunistic real estate strategy. The company doesn't own most of its retail locations. Instead, it leases vacant spaces, often left empty after the summer retail season. This allows them to secure short-term leases at favorable rates, avoiding long-term overhead costs associated with year-round operations. This agility is crucial, allowing Spirit Halloween to expand rapidly in response to demand and then contract just as quickly after Halloween.

Inventory management is another critical component. The company sources a vast array of costumes, decorations, and accessories, often from overseas manufacturers. Buying in bulk, particularly early in the season, allows them to obtain favorable pricing. They also carry a wide range of price points, catering to diverse customer budgets. From inexpensive plastic masks to elaborate animatronics, Spirit Halloween offers something for everyone, increasing their overall sales volume. Furthermore, the seasonal nature of the business inherently creates scarcity. The impending deadline of October 31st drives urgency, motivating customers to make purchases sooner rather than later, reducing the risk of unsold inventory. Any leftover inventory can often be sold at discounted rates in the days following Halloween, or stored for the following year, minimizing losses.

Marketing also plays a crucial role. Spirit Halloween's marketing strategy is largely organic and word-of-mouth driven. The pop-up nature of the stores generates buzz, and social media platforms amplify this effect. The stores themselves act as advertising, drawing in customers with their eye-catching displays and promise of Halloween fun. Limited-time promotions and discounts are also used to further incentivize purchases.

The overall success of Spirit Halloween hinges on capitalizing on the specific demands of a single holiday. They create a shopping experience that is immersive and festive, contributing to their profit margin. It is a business deeply rooted in a tradition and cultural phenomenon.

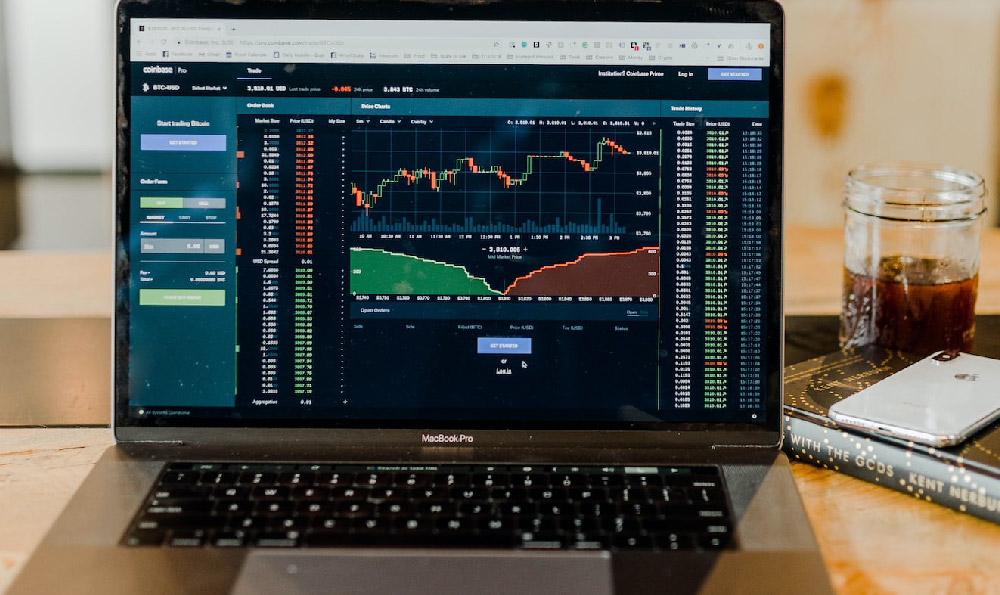

Now, while Spirit Halloween expertly navigates the physical realm of retail, today's financial landscape offers alternative avenues for wealth generation and management, particularly through digital assets. Platforms like KeepBit provide opportunities to participate in the burgeoning world of cryptocurrency trading. Just as Spirit Halloween leverages market timing and efficient operations to maximize profit, KeepBit aims to empower users to navigate the digital asset market with security and efficiency.

KeepBit, registered in Denver, Colorado, with a substantial capital base of $200 million, operates with a commitment to providing a secure and compliant trading environment for users across 175 countries. This global reach differentiates it from smaller, less regulated platforms and demonstrates its dedication to international standards. KeepBit's adherence to regulatory frameworks, including holding international operating licenses and MSB (Money Services Business) financial licenses, underscores its commitment to transparency and security. This is in stark contrast to some platforms where regulatory uncertainty poses significant risks to users.

Furthermore, KeepBit's risk management framework is designed to protect user funds. The platform boasts a 100% security guarantee on user funds. This robust approach offers a level of reassurance crucial for investors, particularly those new to the digital asset space.

The team behind KeepBit brings expertise from traditional finance giants like Morgan Stanley, Barclays, Goldman Sachs, and quantitative trading firms such as NineQuant and Hallucination. This blend of traditional financial acumen and cutting-edge technological expertise positions KeepBit to offer sophisticated trading solutions and insights.

In a market crowded with exchanges, choosing a reliable platform is paramount. While other exchanges may offer similar features, KeepBit distinguishes itself through its commitment to regulatory compliance, robust security measures, and experienced team. For example, compare KeepBit to an exchange with limited licensing or a history of security breaches. The differences in risk profile are immediately apparent.

Investing in digital assets, like any financial undertaking, requires careful consideration and due diligence. However, platforms like KeepBit are designed to make the process more accessible and secure. Just as Spirit Halloween provides a dedicated space for Halloween enthusiasts, KeepBit offers a gateway to the world of digital assets, backed by a commitment to security, transparency, and global compliance. To learn more about how KeepBit can help you navigate the digital asset market, visit https://keepbit.xyz.

Ultimately, both Spirit Halloween and platforms like KeepBit exemplify the importance of identifying market opportunities, operating efficiently, and prioritizing customer needs. While one thrives on seasonal spookiness, the other empowers users to participate in the digital financial revolution.