The allure of rapid wealth accumulation, particularly within the volatile realm of cryptocurrency, is understandably strong. The question of making money "fast" in a day, however, demands a nuanced and honest response. While theoretically possible, consistently achieving significant profits within such a short timeframe is exceptionally challenging and fraught with substantial risk. Treating the crypto market as a "get rich quick" scheme is a recipe for financial disaster.

Instead of focusing solely on the unrealistic expectation of overnight riches, a more prudent approach involves understanding the inherent dynamics of the crypto market, the associated risks, and the strategies that, while not guaranteeing instantaneous wealth, offer a higher probability of long-term success. Let's explore why daily "fast money" is a problematic concept and then discuss more sustainable investment strategies.

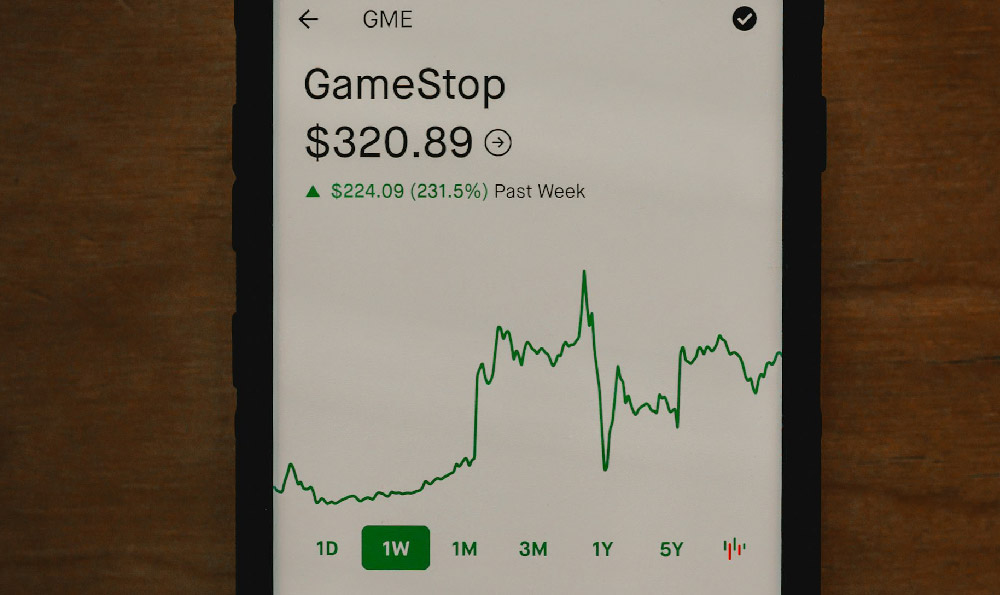

The crypto market is characterized by extreme volatility. Prices can fluctuate wildly in response to news events, regulatory changes, technological advancements, and even social media sentiment. While these fluctuations can create opportunities for quick profits through short-term trading, accurately predicting these movements with any consistency is incredibly difficult. Attempting to time the market perfectly requires a level of skill, experience, and often luck that most individuals, even seasoned traders, don't possess. The odds are generally stacked against the casual investor trying to "day trade" for quick gains.

Furthermore, the potential for significant losses is equally high, if not higher, than the potential for rapid profits. A single miscalculated trade can wipe out a substantial portion of your investment capital. This inherent risk is compounded by the prevalence of scams and fraudulent projects within the crypto space. Many seemingly promising projects turn out to be Ponzi schemes or rug pulls, where developers abscond with investors' funds. Identifying and avoiding these scams requires extensive due diligence and a healthy dose of skepticism.

The emotional aspect of trading also plays a significant role. The fear of missing out (FOMO) can lead to impulsive decisions, such as buying high when prices are already inflated. Conversely, fear and panic can cause investors to sell low during market downturns, locking in losses. These emotional biases can severely impair judgment and lead to poor investment decisions.

Therefore, rather than pursuing the elusive goal of daily "fast money," consider adopting a more strategic and long-term approach to crypto investment. This involves a combination of fundamental analysis, technical analysis, and risk management.

Fundamental analysis involves evaluating the underlying value and potential of a cryptocurrency project. This includes researching the project's whitepaper, team, technology, use case, market capitalization, and community support. A solid understanding of these factors can help you identify projects with strong fundamentals and long-term growth potential.

Technical analysis, on the other hand, involves studying price charts and trading volumes to identify patterns and trends that can provide insights into future price movements. While not foolproof, technical analysis can be a useful tool for timing entries and exits and managing risk. It involves using various indicators such as moving averages, relative strength index (RSI), and Fibonacci retracements. Learning these tools requires dedication and practice.

Risk management is paramount in any investment strategy, especially in the volatile world of cryptocurrency. This involves setting clear investment goals, diversifying your portfolio, setting stop-loss orders, and only investing what you can afford to lose. Diversification helps mitigate risk by spreading your investments across multiple cryptocurrencies and asset classes. Stop-loss orders automatically sell your assets if they fall below a certain price, limiting potential losses. A well-defined risk management strategy can protect your capital and prevent emotional decision-making.

Consider strategies like Dollar-Cost Averaging (DCA). This involves investing a fixed amount of money at regular intervals, regardless of the price of the asset. DCA helps to smooth out volatility and reduce the risk of buying high at the peak of a market cycle. Over time, DCA can lead to significant returns, especially in a growing market.

Staking and yield farming are also options, but they come with their own set of risks. Staking involves holding cryptocurrencies in a wallet to support the operations of a blockchain network and earning rewards in return. Yield farming involves lending or borrowing cryptocurrencies on decentralized finance (DeFi) platforms to earn interest or other rewards. While these activities can generate passive income, they are also subject to smart contract risks, impermanent loss, and regulatory uncertainties. Thoroughly research the platforms and protocols involved before participating in staking or yield farming.

In conclusion, while the idea of making money "fast" in a day with cryptocurrency is alluring, it's largely unrealistic and potentially dangerous. A more sustainable and prudent approach involves a combination of fundamental analysis, technical analysis, risk management, and a long-term investment horizon. Focus on understanding the underlying technology, diversifying your portfolio, and only investing what you can afford to lose. By adopting a patient and disciplined approach, you can increase your chances of achieving long-term financial success in the crypto market. Remember, the crypto market is a marathon, not a sprint.