Here's an article addressing the question of whether a stock market book can truly make you money, and if so, how:

The allure of effortless riches, gleaned from the pages of a book promising stock market success, is a powerful one. The question isn't just whether such a book exists, but rather what constitutes "making you money" and how realistically a book can facilitate that process. While no single book holds a guaranteed key to instant wealth, the right book, coupled with diligent study, disciplined application, and a healthy dose of realistic expectation, can significantly improve your chances of achieving your financial goals through stock market investing.

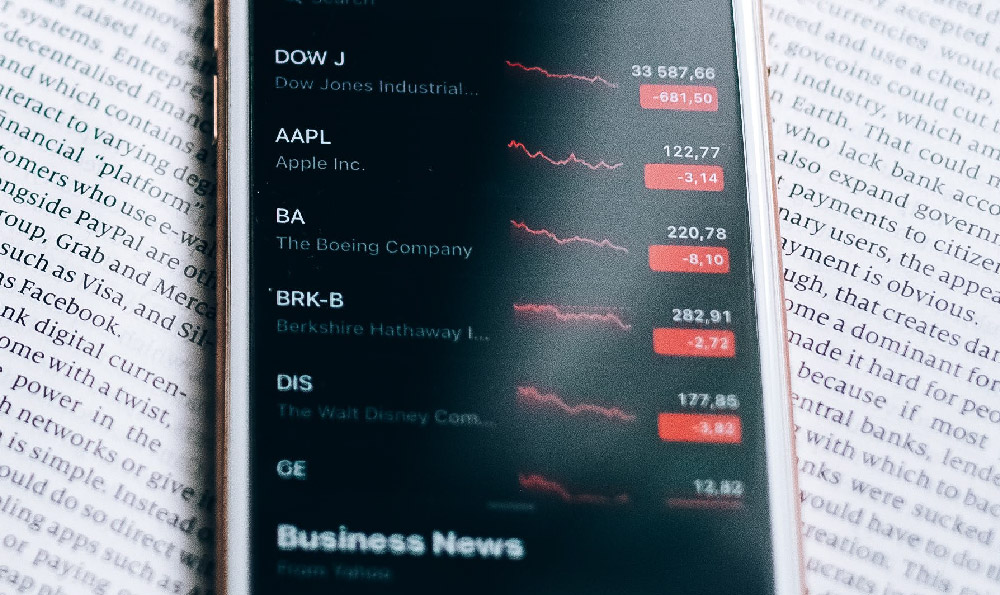

The fundamental value of a good stock market book lies in its ability to demystify the complexities of the market. It acts as a foundational education, stripping away the jargon and presenting core concepts in an accessible manner. Think of it as learning the rules of a complex game before stepping onto the playing field. A book can teach you about different investment styles (value investing, growth investing, dividend investing, etc.), fundamental analysis (analyzing a company's financial statements), technical analysis (interpreting chart patterns and market indicators), risk management, diversification, and the psychological biases that can lead to poor investment decisions.

However, knowledge alone is insufficient. Reading a book, even one considered a classic, is merely the first step. The real value is extracted through active learning and practical application. Many individuals read investing books like novels, passively absorbing information without truly internalizing it. To truly "make money" from a book, you must actively engage with the material. This involves taking notes, working through examples, researching the companies mentioned, and critically evaluating the author's arguments. More importantly, it requires applying the principles learned in a simulated or real-world trading environment.

The "how" is crucial and often overlooked. A book can provide the theoretical framework, but it's up to the reader to build the practical scaffolding. This means developing a trading plan that outlines your investment goals, risk tolerance, investment horizon, and chosen investment strategy. It means backtesting your chosen strategies using historical data to assess their potential performance. It means starting small, with a manageable amount of capital, to gain experience and confidence without risking significant losses. And it means meticulously tracking your trades, analyzing your successes and failures, and constantly refining your approach.

Furthermore, it's vital to understand the limitations of any single source. The stock market is a dynamic and unpredictable environment. What worked in the past may not work in the future. Market conditions change, companies evolve, and new investment strategies emerge. Therefore, relying solely on one book is a recipe for stagnation, if not outright failure. A successful investor is a lifelong learner, constantly seeking new information, adapting to changing circumstances, and refining their strategies based on experience and new insights. This could involve reading multiple books from different perspectives, subscribing to reputable financial publications, attending investment seminars, and engaging with a community of like-minded investors.

Another critical aspect that a good stock market book should emphasize is risk management. Many beginner investors are drawn to the market by the promise of high returns, but they often neglect the importance of protecting their capital. A book that teaches you how to calculate your risk tolerance, set stop-loss orders, diversify your portfolio, and avoid common pitfalls like chasing hot stocks or succumbing to emotional biases is far more valuable than one that simply promises quick profits. Knowing when to cut your losses is just as important, if not more so, than knowing when to let your profits run.

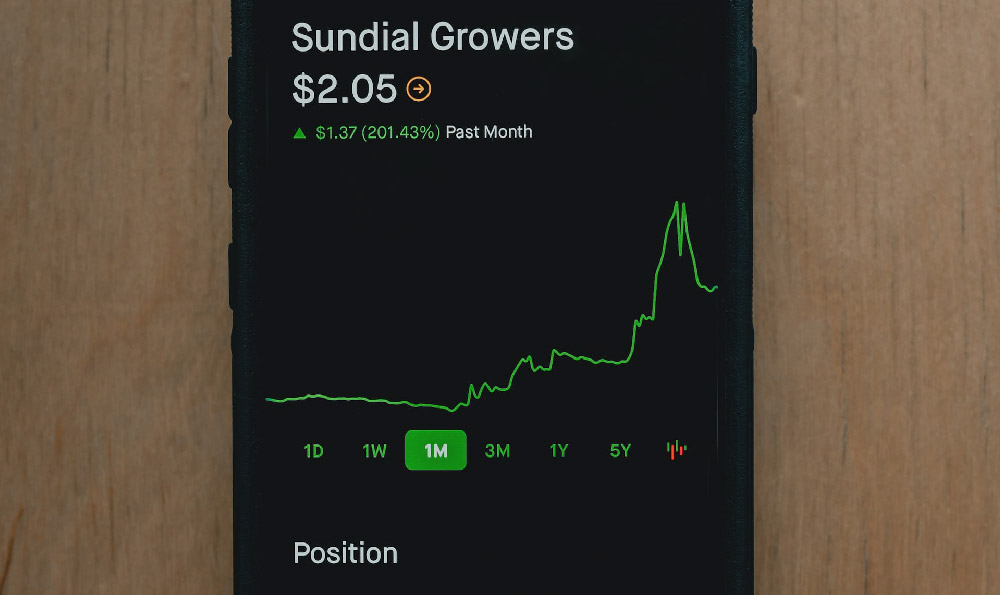

It's also important to be wary of books that make unrealistic promises or promote get-rich-quick schemes. The stock market is not a casino, and there are no guaranteed shortcuts to wealth. A book that promises to teach you how to double your money in a year or how to predict market crashes is likely selling snake oil. A more realistic and valuable book will focus on building a solid foundation of knowledge, developing sound investment habits, and managing risk effectively.

In conclusion, while no stock market book can magically guarantee financial success, the right book, coupled with diligent study, disciplined application, and a realistic understanding of market dynamics, can significantly improve your chances of achieving your financial goals. The key is to view the book as a starting point, not a destination, and to commit to a lifelong journey of learning and growth. The book provides the map; you must navigate the terrain. The book sharpens the axe; you must fell the tree. Ultimately, the power to "make money" lies not within the pages of a book, but within your own commitment to learning, applying, and adapting to the ever-changing landscape of the stock market. The best book is the one that empowers you to become a knowledgeable, disciplined, and ultimately successful investor, not because it provides a secret formula, but because it provides the tools and knowledge you need to forge your own path to financial independence. And that, in itself, is invaluable.