Getting rich is a goal pursued by many, but often misunderstood. It's not just about winning the lottery or striking it rich overnight. Sustainable wealth creation requires a deliberate approach, a combination of smart financial decisions, hard work, and a bit of luck. The strategies that truly work revolve around building a solid financial foundation, understanding the power of compounding, and taking calculated risks.

The cornerstone of any wealth-building journey is mastering your personal finances. This means creating a budget that works for you, tracking your income and expenses, and identifying areas where you can cut back. It sounds simple, but this fundamental step is often overlooked. By understanding where your money is going, you can make informed decisions about how to allocate it more effectively. A budget isn’t about restricting yourself, it's about empowering yourself to make conscious choices and prioritize your financial goals. Beyond budgeting, building an emergency fund is crucial. Aim for three to six months' worth of living expenses in a readily accessible savings account. This acts as a financial safety net, protecting you from unexpected job loss, medical emergencies, or other unforeseen circumstances. Without this cushion, you might be forced to take on debt or liquidate investments, setting back your wealth-building progress. Paying off high-interest debt, such as credit card debt, should be a top priority. The interest rates on these debts can erode your wealth quickly. Consider using the debt avalanche or debt snowball method to tackle your debt strategically. Once you've established a solid financial foundation, you can begin to focus on wealth accumulation.

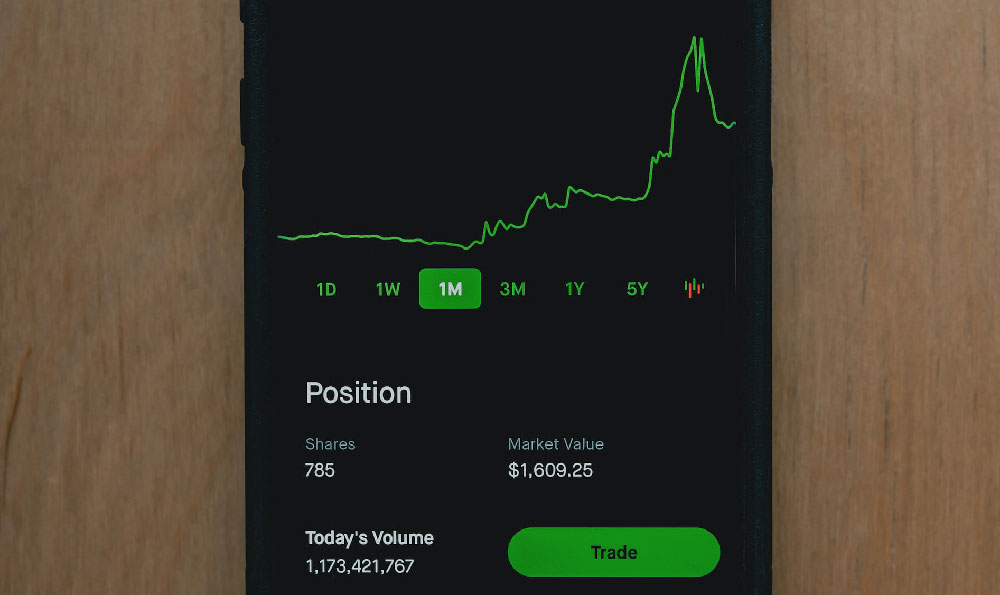

Investing is the engine that drives wealth creation. While saving is important, it's not enough to outpace inflation and generate significant returns. The key is to start investing early and consistently, leveraging the power of compounding. Compounding is essentially earning returns on your returns. The longer your money has to grow, the more significant the impact of compounding becomes. Even small amounts invested regularly over long periods can accumulate into substantial wealth. Consider a scenario where you invest $500 per month starting at age 25 and earn an average annual return of 8%. By age 65, you could have accumulated over $2 million. This illustrates the remarkable power of compounding.

The stock market has historically provided the highest long-term returns, but it also comes with inherent risks. Diversification is essential to mitigate those risks. Don't put all your eggs in one basket. Spread your investments across different asset classes, such as stocks, bonds, and real estate. Within each asset class, further diversification is recommended. For example, within the stock market, invest in companies of different sizes (large-cap, mid-cap, small-cap), industries, and geographic regions. Index funds and ETFs (exchange-traded funds) are excellent tools for achieving broad diversification at a low cost. These funds track a specific market index, such as the S&P 500, and provide instant exposure to a wide range of companies.

Real estate can also be a valuable addition to your investment portfolio. Rental properties can generate passive income and appreciate in value over time. However, real estate investing requires careful research and due diligence. Consider factors such as location, property condition, rental demand, and potential expenses. Managing rental properties can also be time-consuming, so be prepared to handle tenant issues, maintenance, and repairs. Another option is to invest in REITs (Real Estate Investment Trusts), which are companies that own and operate income-producing real estate. REITs offer a way to invest in real estate without the hassles of direct property ownership.

Beyond traditional investments, consider investing in yourself. Acquiring new skills, knowledge, and experience can significantly increase your earning potential. Invest in education, training, and professional development opportunities. Start a side hustle or a business. Entrepreneurship can be a rewarding path to wealth creation, but it also comes with its own set of challenges. Be prepared to work hard, take risks, and learn from your mistakes. Surround yourself with a supportive network of mentors, advisors, and fellow entrepreneurs.

While disciplined saving and investing are essential, generating more income can accelerate your wealth-building journey. Look for opportunities to increase your income through promotions, raises, or side hustles. Consider freelancing, consulting, or starting an online business. The more income you generate, the more you can save and invest.

Becoming wealthy is not just about making money, it's also about managing it wisely. Protect your assets through proper insurance coverage, estate planning, and tax strategies. Work with a qualified financial advisor to develop a comprehensive financial plan that aligns with your goals and risk tolerance. A financial advisor can provide personalized guidance on investment strategies, retirement planning, and tax optimization.

Finally, it's important to remember that getting rich is a marathon, not a sprint. It requires patience, discipline, and a long-term perspective. Don't get discouraged by market fluctuations or setbacks. Stay focused on your goals, stay committed to your plan, and celebrate your progress along the way. Be wary of get-rich-quick schemes that promise unrealistic returns. These schemes are often scams that can lead to significant financial losses. Focus on building a solid financial foundation, investing wisely, and generating more income. With hard work, perseverance, and a bit of luck, you can achieve your financial goals and build a wealthy future. The journey may be challenging, but the rewards are well worth the effort. Remember to continuously learn and adapt to the changing financial landscape. Financial literacy is an ongoing process, and staying informed is crucial for making sound financial decisions. Subscribe to reputable financial publications, attend webinars, and consult with financial professionals to stay up-to-date on the latest trends and strategies.