The financial landscape associated with occupational therapists’ high salaries presents a complex interplay of opportunities and challenges that demand careful evaluation beyond mere surface-level observations. While the median annual salary for occupational therapists in the United States exceeds $80,000, with some specializing in areas like hospital-based care or private practice achieving figures well above the national average, this income level serves as a foundation for both personal wealth management and broader economic considerations. However, the question of whether this financial status is inherently “good” depends on contextual factors such as geographic location, career trajectory, and how individuals choose to allocate their earnings.

Occupational therapy is a profession that often requires significant upfront investment, including years of education and licensing, which can influence perceptions of its earning potential. For example, the cost of obtaining a master’s degree in occupational therapy, coupled with ongoing certification requirements, may create a perception that high salaries are a reward for substantial financial and temporal sacrifices. This dynamic raises important questions about the long-term financial viability of entering the field. While the potential for financial stability is appealing, individuals must consider the opportunity cost of pursuing this career path. For instance, the time spent in education could have been utilized in other industries with different salary trajectories or growth prospects.

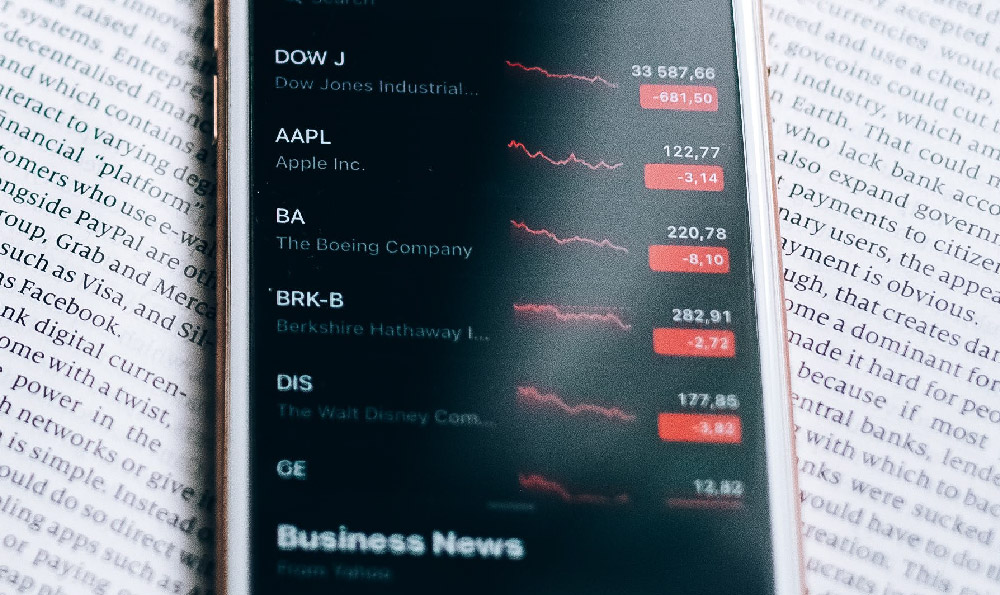

The high salary of occupational therapists also has implications for personal financial goals and risk management. A stable income allows for greater flexibility in investing, yet it is not automatically synonymous with effective wealth management. For instance, a therapist may have the means to invest in retirement accounts or diversify their portfolio, but without a strategic approach, the risks of market volatility or unexpected financial setbacks could undermine those efforts. This brings attention to the importance of aligning income with financial objectives, such as prioritizing emergency savings, tax-advantaged accounts, or long-term investment vehicles like real estate or stocks. The key lies in understanding that salary alone does not dictate financial success; it is the deliberate use of that income that shapes long-term outcomes.

Moreover, the high salary associated with this profession may influence decisions about lifestyle and spending habits. For example, occupational therapists might be more inclined to invest in costly geographic relocation or specialized training due to their financial capacity. However, this requires a balanced approach to avoid overextending resources. The psychological impact of income should also be considered—excess wealth can lead to complacency or poor decision-making, particularly in volatile markets. Conversely, a therapist with a high salary might have the means to adopt a more conservative or aggressive investment strategy based on their risk tolerance and personal circumstances.

The question of whether occupational therapists’ high salaries are “good” ties into broader discussions about income inequality and professional valuation. For instance, the disparity between the salaries of occupational therapists and other healthcare professionals, such as psychiatrists or orthopedic surgeons, highlights the subjective nature of what constitutes a “good” income. This raises the issue of whether the high salary in question is a reflection of market demand, societal value, or a combination of both. Additionally, the role of technology in healthcare may impact the demand for occupational therapists, creating an uncertain future for income growth. For example, automation in certain physical therapy tasks could reduce the need for human intervention, potentially affecting salary trends over time.

From a financial planning perspective, the high salary of occupational therapists offers unique advantages but also requires proactive management. For instance, individuals in this field can leverage their income for early retirement, debt repayment, or strategic investments in assets that generate passive income. However, the success of these strategies depends on factors such as market conditions, personal financial literacy, and the ability to adapt to changing economic environments. The rising cost of living in urban areas, for example, may necessitate a more aggressive approach to asset allocation to maintain purchasing power. Conversely, in regions with lower operating expenses, the same salary could allow for more discretionary spending or financial cushioning.

Another dimension worth exploring is the long-term sustainability of the salary itself. Occupational therapy, while stable, may face challenges such as an aging population, increasing competition, or regulatory changes that could impact demand for services. For example, demographic shifts toward an older workforce may create a lasting demand for occupational therapy, but rising costs of healthcare education could erode profit margins for private practitioners. This suggests that while the current income level is promising, individuals must remain vigilant about the evolving economic forces that could affect their earning potential.

Ultimately, the value of an occupational therapist’s high salary is multifaceted. It provides immediate financial benefits but also demands a strategic approach to ensure long-term prosperity. The interplay between income and financial decisions, such as tax optimization, insurance planning, and investment diversification, underscores the need for a holistic perspective. For example, a therapist earning $100,000 annually might benefit from investing in a diversified portfolio that balances growth and stability, while also maintaining a solid emergency fund to mitigate unforeseen challenges. The broader takeaway is that financial success is not solely determined by salary but by how individuals choose to structure and manage their resources.