Okay, I understand. Here's an article addressing the question of making "tons of money," focusing on realistic pathways, risk assessment, and ethical considerations, written in English.

Making tons of money – the pursuit is alluring, almost universally desired, yet often shrouded in myth and unrealistic expectations. While the idea of instantly becoming incredibly wealthy might seem like a lottery ticket dream, the reality is that building substantial wealth usually involves a combination of strategic planning, consistent effort, and, crucially, understanding the various avenues available. The possibility certainly exists, but it’s not a free ride. It's important to distinguish between getting rich quickly (often involving high risk and potential downsides) and building sustainable, long-term wealth.

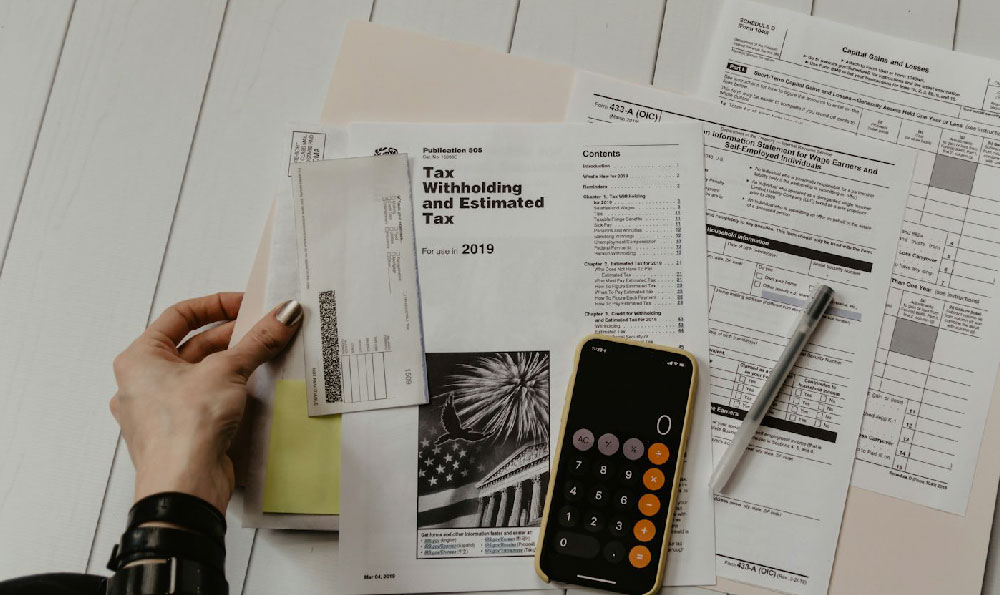

The cornerstone of any wealth-building strategy is a solid financial foundation. This starts with mastering basic financial literacy. Understanding concepts like budgeting, compound interest, debt management, and inflation is absolutely essential. You can't effectively build wealth if you're constantly struggling with debt or spending beyond your means. Creating a detailed budget that tracks income and expenses is the first step. This provides a clear picture of where your money is going, highlighting areas where you can cut back and save more. Paying down high-interest debt, such as credit card debt, is a crucial priority, as the interest payments can significantly hinder your progress. Building an emergency fund, ideally covering 3-6 months of living expenses, is equally important. This acts as a safety net, preventing you from going into debt when unexpected expenses arise.

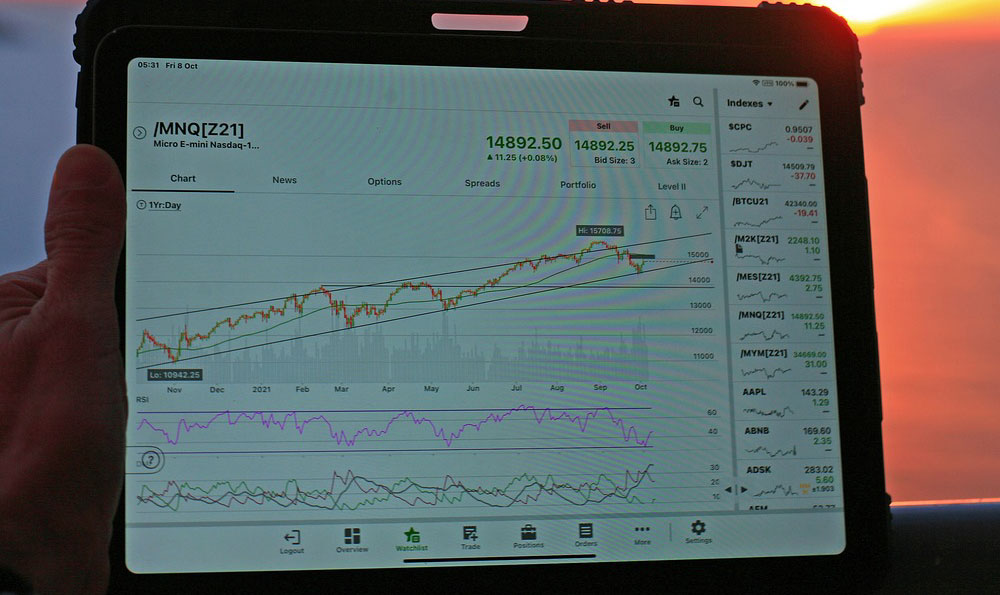

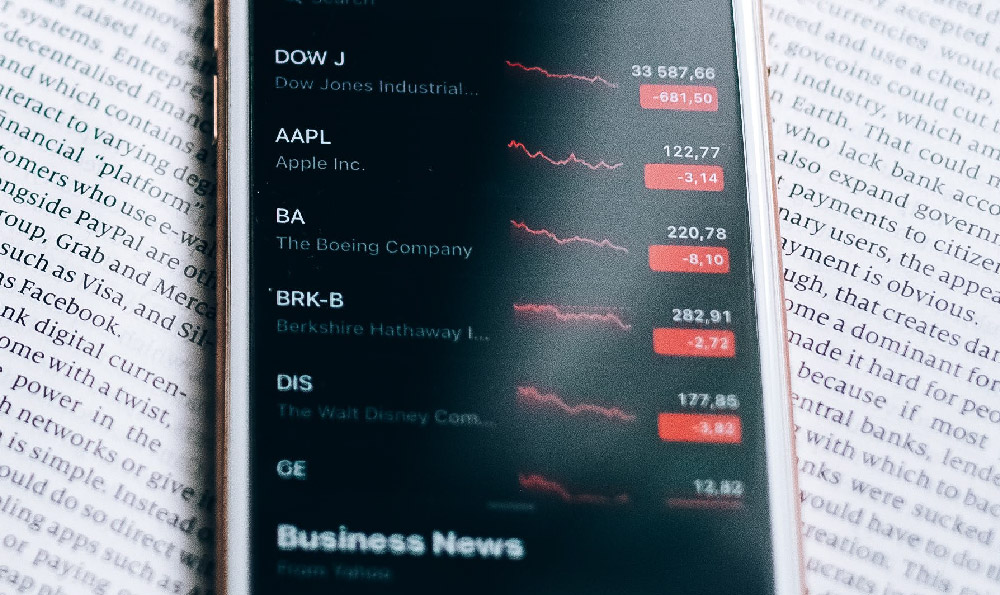

Once your financial house is in order, you can start exploring different avenues for generating wealth. Investing is undoubtedly one of the most effective strategies. However, successful investing requires a deep understanding of the different investment options available and a clear risk tolerance profile. Stocks, bonds, real estate, and mutual funds all offer different risk-reward profiles. Diversifying your portfolio across multiple asset classes is crucial to mitigate risk. For example, investing solely in one company's stock can be disastrous if that company performs poorly. A diversified portfolio, on the other hand, can withstand market fluctuations more effectively. Real estate investment can be lucrative, but it also requires significant capital and ongoing management.

Entrepreneurship is another powerful pathway to wealth creation. Starting your own business allows you to leverage your skills, creativity, and hard work to build something valuable. However, entrepreneurship is not for the faint of heart. It requires a significant investment of time, energy, and capital, and there is no guarantee of success. Thorough market research, a solid business plan, and a willingness to adapt to changing market conditions are essential. Finding a niche market or identifying a problem that your business can solve is crucial. It's important to differentiate yourself from the competition and offer a unique value proposition.

Beyond traditional investments and entrepreneurship, consider developing valuable skills that are in high demand. In today's rapidly evolving economy, skills like software development, data analysis, digital marketing, and project management are highly sought after. Acquiring these skills can significantly increase your earning potential and open up new career opportunities. Online courses, bootcamps, and certifications can be valuable ways to acquire these skills. Continuing education and lifelong learning are essential for staying ahead of the curve and maximizing your earning potential.

Furthermore, networking is a critical component of wealth building. Building relationships with people in your industry or those who have achieved financial success can provide valuable insights, opportunities, and mentorship. Attending industry events, joining professional organizations, and connecting with people on social media platforms like LinkedIn can help you expand your network.

However, it is equally critical to approach wealth building ethically and responsibly. Avoid get-rich-quick schemes or any ventures that promise guaranteed returns with little to no risk. These are often scams designed to exploit unsuspecting individuals. Always conduct thorough research and due diligence before investing in any opportunity. Be wary of high-pressure sales tactics or investments that are too good to be true. Building wealth should not come at the expense of others or involve illegal or unethical activities. Remember, a good reputation is invaluable, and it can be easily tarnished by engaging in questionable practices. Focus on creating value for others and contributing to society, and wealth will naturally follow.

Finally, maintain a long-term perspective. Building substantial wealth takes time and patience. Avoid getting discouraged by short-term setbacks or market fluctuations. Stay focused on your goals, and consistently invest and save over the long term. The power of compound interest is a critical element in long-term wealth creation. The earlier you start investing, the more time your money has to grow exponentially. Regularly review your financial plan and adjust it as needed to reflect changes in your circumstances or goals.

Making "tons of money" is achievable, but it requires a deliberate and strategic approach. It involves mastering basic financial literacy, investing wisely, developing valuable skills, building a strong network, and maintaining a long-term perspective. By combining these elements with hard work, discipline, and ethical behavior, you can significantly increase your chances of achieving your financial goals. And remember, true wealth is not just about money; it's also about having a fulfilling life, strong relationships, and contributing to something meaningful.