Making money with virtual currency has become one of the most discussed topics in modern finance, attracting both veteran investors and newcomers to the digital asset market. As the landscape of decentralized finance evolves, opportunities to leverage cryptocurrencies for profit are expanding rapidly, but navigating this space requires more than a casual interest—it demands a strategic approach, a deep understanding of market dynamics, and a disciplined mindset to mitigate risks effectively. Whether you’re looking to capitalize on long-term growth, engage in short-term trading, or explore passive income streams, the key lies in aligning your strategies with the unique characteristics of the crypto ecosystem while staying vigilant against potential pitfalls.

The cryptocurrency market operates on principles that differ fundamentally from traditional financial systems, making it both lucrative and volatile. Unlike fiat currencies, which are backed by governments, cryptocurrencies rely on blockchain technology and decentralized networks to facilitate transactions. This innovation has enabled new avenues for investment, such as staking, yield farming, and trading, which can generate returns through various mechanisms. However, the absence of regulatory oversight and the presence of speculative trading behavior often amplify price fluctuations, creating a high-risk environment where inexperienced participants can face significant losses. To succeed, it’s essential to not only grasp the underlying technology but also to implement a comprehensive strategy that balances opportunity with caution.

The first step in any profitable crypto journey is to master the fundamentals of market analysis. Understanding macroeconomic trends, regulatory developments, and technological advancements can provide valuable insights into the direction of the market. For instance, changes in global monetary policy, such as interest rate adjustments, often influence investor sentiment and the value of cryptocurrencies. Similarly, breakthroughs in blockchain scalability or security can drive demand, while concerns about regulatory crackdowns may initiate sell-offs. By staying informed about these factors, investors can anticipate shifts in the market and make data-driven decisions rather than relying on gut instincts or social media hype.

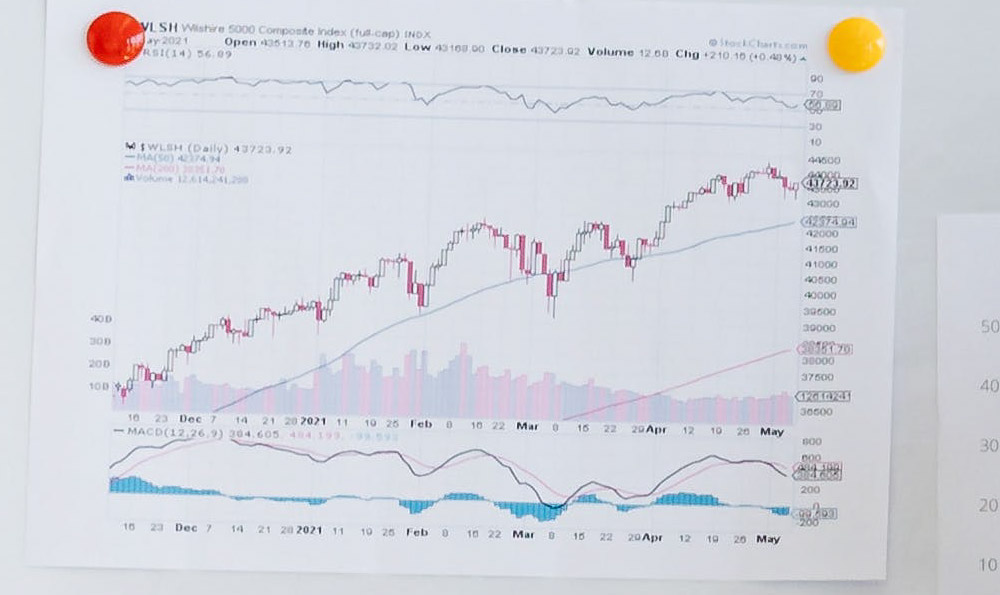

Technical indicators play a critical role in identifying potential entry and exit points for crypto trades. Tools such as moving averages, RSI (Relative Strength Index), and Fibonacci retracements help analyze price movements and predict future trends. For example, a bullish crossover—where a short-term moving average crosses above a long-term one—may signal a buying opportunity, while a bearish divergence between the price and RSI could indicate a reversal. However, it’s important to remember that no single indicator is foolproof, and combining multiple analytical methods with a solid understanding of the underlying fundamentals can enhance predictive accuracy. Investors should also avoid over-reliance on automated trading tools, which often lack the adaptability required to navigate the unpredictable nature of crypto markets.

When developing investment strategies, diversification remains one of the most effective ways to minimize exposure to market risks. Unlike traditional portfolios that rely on stocks, bonds, or real estate, crypto diversification involves spreading investments across different asset classes, such as Bitcoin, Ethereum, altcoins, and stablecoins. This approach reduces the impact of a single asset’s performance on the overall portfolio, creating a more resilient financial position. Additionally, allocating a portion of capital to long-term holdings (HODLing) while engaging in short-term trading can balance growth opportunities with capital preservation. However, this strategy requires careful risk assessment, as excessive exposure to high-volatility assets can lead to substantial losses during market downturns.

Risk management is the cornerstone of sustainable crypto investing. While the potential for high returns is enticing, the absence of guaranteed outcomes means that investors must prioritize protection over profit. Setting stop-loss orders, limiting position sizes, and maintaining a robust risk-to-reward ratio are essential practices to prevent catastrophic losses. For example, a 5% stop-loss for high-beta assets like Dogecoin may be more appropriate than a 2% stop-loss for stablecoins. Furthermore, adhering to a strict budget and avoiding leverage can reduce the likelihood of margin calls or forced liquidations. Investors should also remain cautious about "get-rich-quick" schemes or unverified projects that promise unrealistic returns, as these often indicate scams or speculative bubbles.

Another crucial aspect of successful crypto investing is continuous learning and adaptation. The digital asset market is highly competitive and constantly evolving, with new projects, technologies, and regulatory frameworks emerging regularly. Staying updated on these developments through credible sources—such as academic research, industry reports, and expert analyses—can help investors make informed decisions. For instance, the adoption of decentralized finance (DeFi) protocols or the growth of non-fungible tokens (NFTs) may create new opportunities for profit, but they also come with unique risks that require careful evaluation. By cultivating a habit of lifelong learning, investors can stay ahead of market trends and refine their strategies accordingly.

In addition to these strategies, maintaining emotional discipline is vital for long-term success. The crypto market is notorious for its extreme volatility, with prices swinging dramatically within short timeframes. This can lead to impulsive decisions, such as panic selling during a market correction or overbuying in the wake of a bullish trend. To counteract this, investors should establish a predefined trading plan and stick to it, even during periods of uncertainty. For example, setting specific entry and exit rules based on technical analysis or fundamental data can prevent emotional biases from interfering with investment decisions. Moreover, avoiding overtrading or excessive exposure to high-risk assets can reduce the likelihood of significant losses.

Ultimately, making money with virtual currency is not a guaranteed path, but a combination of strategic thinking, technical expertise, and risk management can increase the chances of long-term profitability. The cryptocurrency market offers unique opportunities to leverage innovation and capitalize on global economic shifts, but it also requires a level of caution that is often overlooked by casual participants. By focusing on education, diversification, and disciplined execution, investors can navigate this complex terrain with confidence, creating a sustainable approach to financial growth in the digital age. Whether you’re a seasoned trader or a beginner exploring new investment options, the key lies in aligning your strategies with the realities of the market while safeguarding your capital against inevitable uncertainties.