The allure of rapid wealth creation is undeniable, especially in the volatile and dynamic world of cryptocurrency. However, the pursuit of "making money fast" often overshadows the crucial elements of informed decision-making, risk assessment, and long-term financial planning, turning potential gains into devastating losses. Before diving into specific strategies, it's paramount to understand that the cryptocurrency market, while offering substantial opportunities, is inherently high-risk. Any claim of guaranteed or exceptionally rapid profits should be met with extreme skepticism.

Instead of focusing solely on speed, a more prudent approach involves building a foundational understanding of the market, identifying your risk tolerance, and developing a well-defined investment strategy. This foundation will serve as a safeguard against impulsive decisions driven by market hype and fear.

One avenue for potential profits lies in identifying fundamentally strong projects with long-term growth potential. This requires diligent research, often referred to as "due diligence." Look beyond the marketing buzz and delve into the project's whitepaper, team, technology, use case, and community support. Analyze the problem the project aims to solve, the viability of its solution, and the competition it faces. A project with a strong team, innovative technology, and a real-world application has a higher chance of long-term success than one based solely on hype or speculation. Look for teams that are transparent and engage with their community, fostering trust and accountability.

Another strategy involves exploring the world of decentralized finance (DeFi). DeFi platforms offer opportunities to earn passive income through activities like staking, lending, and yield farming. Staking involves holding a specific cryptocurrency to support the network's operations and earning rewards in return. Lending involves lending out your cryptocurrency to borrowers on a DeFi platform and earning interest. Yield farming involves providing liquidity to decentralized exchanges and earning rewards in the form of governance tokens or other cryptocurrencies. While these activities can be lucrative, they also come with inherent risks, such as impermanent loss and smart contract vulnerabilities. Thoroughly research the platforms and tokens involved, understand the risks associated with each activity, and diversify your DeFi portfolio to mitigate potential losses.

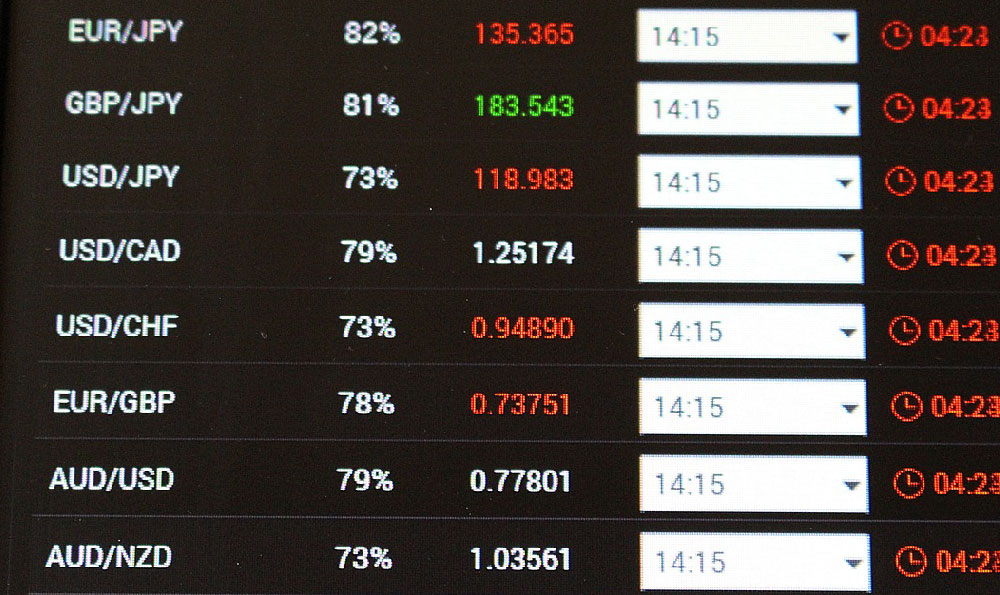

Furthermore, consider the role of algorithmic trading and bots. These automated systems can execute trades based on pre-defined rules and strategies, potentially capitalizing on market fluctuations and generating profits. However, developing and implementing effective trading bots requires a strong understanding of technical analysis, programming, and risk management. Many pre-built bots promise guaranteed returns, but these are often scams or poorly designed, leading to significant losses. If you choose to explore algorithmic trading, start with small amounts, thoroughly test your strategies, and continuously monitor the bot's performance.

However, remember that diversification is paramount. Don't put all your eggs in one basket. Spread your investments across different cryptocurrencies, DeFi platforms, and asset classes to mitigate risk. A well-diversified portfolio can withstand market downturns and provide more stable returns over the long term.

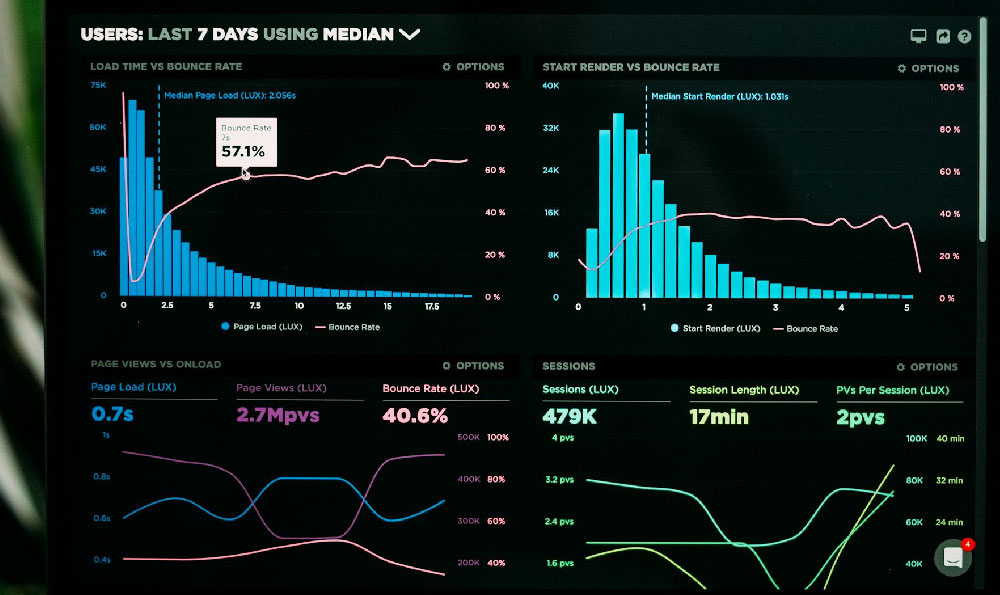

Beyond specific strategies, understanding market cycles is crucial for informed decision-making. The cryptocurrency market is known for its boom and bust cycles, characterized by periods of rapid price appreciation followed by sharp corrections. Identifying where you are in the market cycle can help you make more informed decisions about when to buy, sell, or hold your investments. During bull markets (periods of rising prices), it's tempting to chase profits, but it's also important to be aware of the potential for a correction. During bear markets (periods of falling prices), it's tempting to panic and sell, but it's also an opportunity to buy undervalued assets.

Equally important is developing a robust risk management strategy. Before investing in any cryptocurrency, determine how much you are willing to lose. This is known as your risk tolerance. Never invest more than you can afford to lose, and always have a plan for when to exit your positions. Use stop-loss orders to limit potential losses and take profits at pre-determined levels to secure your gains. Avoid emotional trading, which is driven by fear and greed. Stick to your investment strategy and avoid making impulsive decisions based on market fluctuations.

Protecting your assets from scams and hacks is also a crucial aspect of responsible cryptocurrency investing. Be wary of phishing scams, Ponzi schemes, and other fraudulent activities that promise unrealistic returns. Use strong, unique passwords for all your cryptocurrency accounts and enable two-factor authentication (2FA) whenever possible. Store your cryptocurrencies in a secure wallet, such as a hardware wallet or a reputable software wallet. Be cautious about clicking on suspicious links or downloading files from untrusted sources.

Finally, continuous learning is essential for success in the cryptocurrency market. The market is constantly evolving, with new technologies, regulations, and trends emerging all the time. Stay up-to-date on the latest news and developments by reading reputable cryptocurrency publications, attending industry events, and engaging with online communities. A well-informed investor is better equipped to make sound decisions and navigate the complexities of the market. Remember that fast money often disappears just as quickly as it appears. Sustainable wealth creation in cryptocurrency requires a balanced approach that prioritizes knowledge, patience, and responsible risk management. It's a marathon, not a sprint.