Making money passively, or "leisurely," is a common aspiration. The idea of generating income while you sleep, pursue hobbies, or simply relax is appealing. While a truly hands-off, effortless path to wealth is rare, it is absolutely possible to build streams of income that require minimal active management, allowing you to enjoy a more flexible and financially secure lifestyle. The key lies in strategic planning, smart investments, and a realistic understanding of risk and return.

One avenue for passive income lies in the realm of real estate. Investing in rental properties, for instance, can provide a steady stream of cash flow from monthly rent payments. However, while often touted as "passive," rental property ownership does demand some level of active involvement. Initial tasks include researching locations, securing financing, acquiring suitable properties, and screening tenants. Ongoing responsibilities can include property maintenance, handling tenant issues, and managing finances. To truly automate this process, consider engaging a property management company. They will handle tenant screening, rent collection, maintenance, and other day-to-day operations, allowing you to collect a check each month with minimal effort. This, of course, comes at a cost, typically a percentage of the monthly rent, which will need to be factored into your calculations to ensure profitability. Another real estate investment option, which offers more inherent passive qualities, involves Real Estate Investment Trusts (REITs). These are companies that own or finance income-producing real estate across a range of property sectors. By investing in REITs, you can gain exposure to the real estate market without the complexities of direct property ownership. REITs are often traded on major stock exchanges, making them easily accessible. The income they generate is distributed to shareholders in the form of dividends, creating a potential source of passive income.

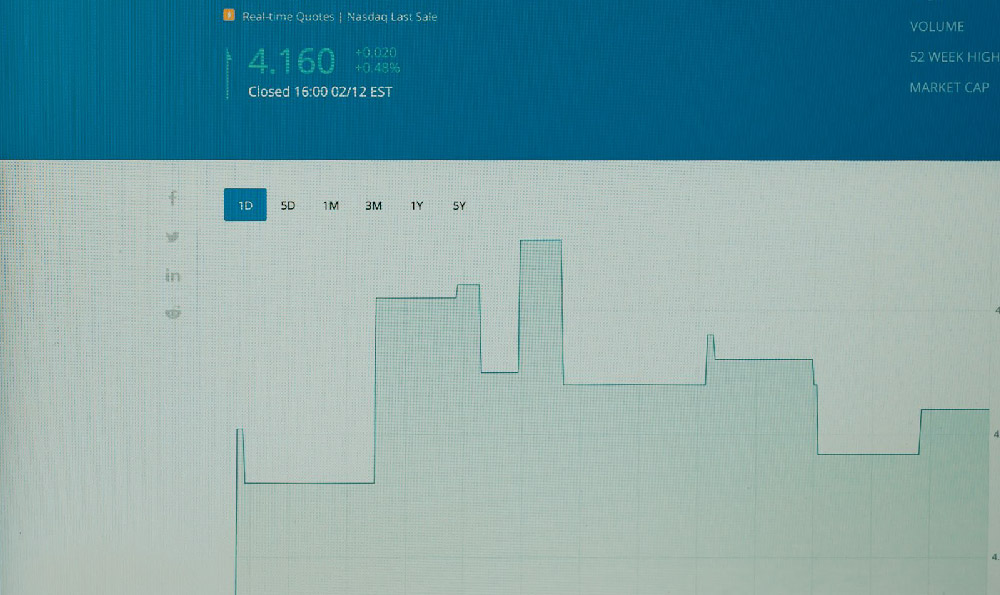

Beyond real estate, the stock market offers numerous opportunities for passive income generation. Dividend stocks are a prime example. These are shares of companies that regularly distribute a portion of their profits to shareholders in the form of dividends. By building a portfolio of dividend-paying stocks, you can create a reliable stream of income. Look for companies with a long history of consistent dividend payments and a strong track record of financial stability. Be aware that dividend payments are not guaranteed and can be reduced or suspended at any time, depending on the company's performance and financial outlook. A diversified portfolio across different sectors can mitigate this risk. Index funds and Exchange Traded Funds (ETFs) are another excellent tool for passive income through dividends. These funds track a specific market index, such as the S&P 500, and hold a basket of stocks representing that index. Many index funds and ETFs distribute dividends earned from the underlying stocks to their shareholders. Investing in these funds provides diversification and instant exposure to a broad range of companies, simplifying the process of building a passive income stream.

Another path to consider involves creating and selling digital products. This could include e-books, online courses, templates, or software. The initial investment of time and effort involves creating the product, but once it's launched, it can generate income passively through online sales. Platforms like Amazon Kindle Direct Publishing, Teachable, and Etsy provide avenues for selling digital products to a global audience. Effective marketing and promotion are crucial for driving sales, but once a solid marketing strategy is in place, the income can become relatively passive. Be mindful of the competitive landscape and focus on creating high-quality products that offer value to your target audience.

Creating content online can also generate passive income through advertising or affiliate marketing. Building a blog, YouTube channel, or podcast and generating engaging content can attract a significant audience. Once you have a loyal following, you can monetize your content through advertising revenue or by promoting products or services as an affiliate. Affiliate marketing involves earning a commission for every sale made through your unique affiliate link. This requires consistent effort in creating valuable content, but the income potential can be substantial once you build a strong online presence. Selecting a niche market that aligns with your interests and expertise can increase your chances of success.

Peer-to-peer lending platforms connect borrowers with lenders, allowing individuals to lend money to other individuals or small businesses. In return, lenders receive interest payments on the loans. This can be a relatively passive way to earn income, but it's important to carefully assess the risks involved. Diversify your lending across multiple borrowers to mitigate the risk of defaults. Thoroughly research the lending platform and understand its loan approval process and default rates.

Ultimately, generating "leisurely" income requires upfront effort, strategic planning, and ongoing monitoring. There is no guaranteed path to effortless wealth. The key is to identify income streams that align with your interests, skills, and risk tolerance, and to invest the time and effort needed to build and maintain them. Diversification is crucial to mitigating risk and ensuring a stable income stream. Be prepared to adapt your strategies as market conditions and your personal circumstances change. Remember that even "passive" income streams require some level of active management to ensure their continued success. Regular reviews, adjustments, and reinvestments are essential for maximizing your returns and achieving your financial goals. Patience and a long-term perspective are also crucial, as building significant passive income streams typically takes time and effort.