The allure of transforming meager resources into substantial wealth is a timeless human aspiration. The question of whether it's genuinely possible to ascend from 'nothing' to riches is complex, nuanced, and ultimately, depends heavily on what 'nothing' truly represents. While the fairy-tale image of overnight riches might be misleading, the realistic prospect of building wealth from very little, or even perceived 'zero,' is absolutely attainable with the right mindset, strategies, and a healthy dose of perseverance.

The first critical step involves redefining 'nothing.' Does it mean a complete lack of capital, skills, or social connections? Or does it simply refer to a limited financial starting point? If the former is true, focusing on acquiring skills becomes paramount. Education, whether formal or self-directed, is an investment in your future earning potential. Online courses, community college programs, and even freely available resources like libraries and online tutorials can provide valuable knowledge in high-demand fields. Learning a trade, mastering a new software, or becoming proficient in a foreign language can significantly enhance your employability and open doors to better-paying jobs. This constitutes an investment in human capital, a non-monetary asset that appreciates with effort and dedication.

Once equipped with valuable skills, the next challenge is to translate them into income. This could involve seeking employment, starting a side hustle, or freelancing. The gig economy offers numerous opportunities to leverage skills on a part-time basis, generating income without requiring significant upfront investment. Platforms like Upwork, Fiverr, and TaskRabbit connect freelancers with clients seeking a wide range of services, from writing and graphic design to virtual assistance and data entry. Utilizing these platforms can provide a relatively low-risk way to build a portfolio, gain experience, and establish a reliable income stream.

Another powerful strategy involves identifying and solving problems. Successful entrepreneurs often begin by noticing inefficiencies or unmet needs in their communities. Consider offering services that address these issues. Do elderly neighbors need help with errands or yard work? Are there opportunities to provide specialized tutoring to students struggling in specific subjects? Identifying and addressing these needs can generate income and build a reputation for reliability and resourcefulness. This approach requires keen observation, creativity, and a willingness to put in the work.

Beyond skills and problem-solving, financial literacy is essential. Understanding concepts like budgeting, saving, and investing is crucial for managing income effectively and maximizing wealth accumulation. Creating a detailed budget helps track expenses, identify areas for savings, and allocate funds strategically. Even small amounts saved consistently can compound over time, forming the foundation for future investments.

Speaking of investments, it's crucial to understand that building wealth from 'nothing' often requires taking calculated risks. However, early-stage investing should be approached with caution and a focus on minimizing potential losses. Consider investing in yourself through further education or skill development, as this is often the safest and most rewarding investment. As your income grows, you can begin exploring other investment options.

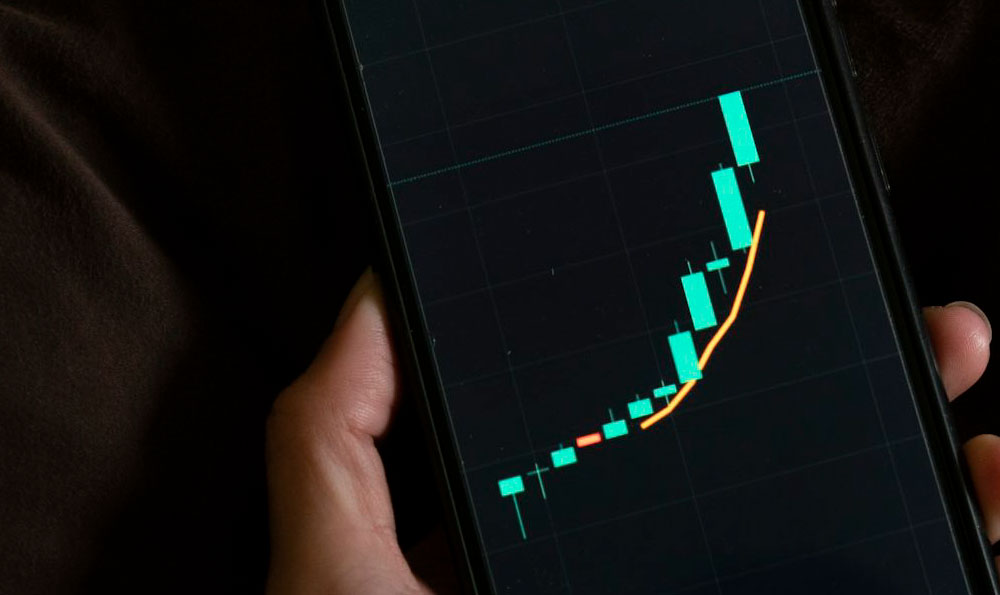

Low-cost index funds and ETFs (exchange-traded funds) offer a diversified way to participate in the stock market without requiring significant capital. These funds track a specific market index, such as the S&P 500, providing exposure to a broad range of companies. While the stock market inherently involves risk, investing in diversified index funds over the long term has historically proven to be a reliable way to generate returns.

Real estate investing can also be a viable path to wealth accumulation, but it typically requires a larger initial investment. However, options like REITs (Real Estate Investment Trusts) allow individuals to invest in real estate without directly owning property. REITs are companies that own and operate income-producing real estate, and they distribute a portion of their profits to shareholders in the form of dividends.

Furthermore, remember the power of compounding. Albert Einstein supposedly called compound interest the "eighth wonder of the world," and for good reason. By reinvesting earnings, you can accelerate wealth accumulation over time. The longer your money is invested, the more significant the effects of compounding become. This underscores the importance of starting early and consistently saving and investing, even if it's only small amounts initially.

Another often overlooked aspect is leveraging existing resources. Do you have unused items cluttering your home that could be sold online? Can you rent out a spare room on Airbnb? These small actions can generate additional income that can be used for saving or investing. Creative resourcefulness is key to maximizing the potential of what you already possess.

Finally, it's crucial to cultivate a growth mindset. Building wealth from 'nothing' is a marathon, not a sprint. There will be setbacks and challenges along the way. The ability to learn from mistakes, adapt to changing circumstances, and maintain a positive attitude is essential for long-term success. Surround yourself with supportive individuals who believe in your potential and can provide encouragement and guidance.

In conclusion, while the path to riches from 'nothing' may not be easy, it is certainly possible. It requires a combination of skills acquisition, diligent saving, strategic investing, a proactive mindset, and unwavering perseverance. By focusing on building human capital, solving problems, managing finances wisely, and embracing the power of compounding, individuals can gradually accumulate wealth and achieve financial freedom, even from the humblest of beginnings. The journey requires patience, discipline, and a long-term perspective, but the rewards can be substantial. Remember that wealth isn't just about money; it's also about the knowledge, skills, and opportunities you gain along the way.