The world of investment banking is often shrouded in mystique, fuelled by portrayals in popular culture and the perception of high-stakes deals and even higher paychecks. While the allure of substantial earnings is undeniable, understanding the earning potential for investment bankers requires a nuanced approach. It's not simply a matter of quoting an "average salary," as compensation is influenced by a multitude of factors, including experience level, firm size, location, specialization, and, of course, individual performance.

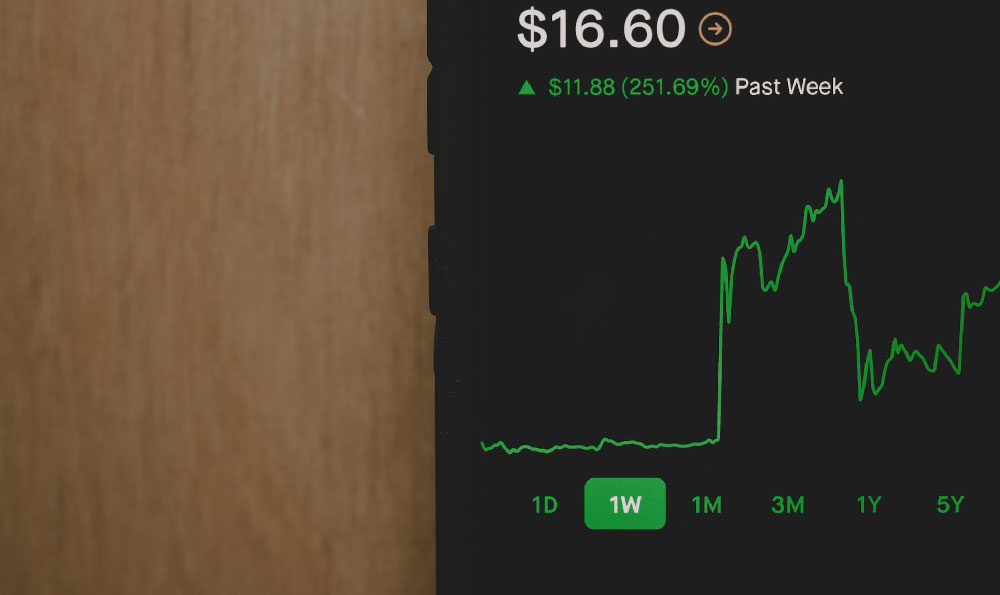

Let's break down the typical compensation structure and explore the ranges you might expect at different stages of an investment banking career. Generally, investment banking compensation is comprised of two primary components: a base salary and a bonus. The base salary provides a stable foundation, while the bonus reflects performance – both individual and the overall performance of the firm. This bonus-driven structure is what creates the potential for significant income, but also introduces a degree of variability.

At the entry level, as an Analyst, the base salary in major financial hubs like New York, London, or Hong Kong typically ranges from $85,000 to $120,000 per year. However, the bonus component can significantly increase this total. Depending on the firm's success and individual contribution, Analysts can expect bonuses ranging from 50% to 100% (or even more in exceptional years) of their base salary. This means a first-year Analyst could potentially earn between $127,500 and $240,000 in total compensation. These figures often vary depending on boutique investment banks versus large, global firms. Boutique firms may offer higher bonuses if they outperform, but base salaries might be slightly lower. Geographic location also impacts the overall package, with cost of living adjustments playing a significant role.

As you progress to the Associate level, usually after two to three years, both base salary and bonus potential increase significantly. Associates are typically responsible for more complex financial modeling, client interaction, and transaction execution. The base salary for Associates generally falls within the range of $150,000 to $250,000 per year. Again, the bonus component is substantial, often ranging from 75% to 150% or more of the base salary. This could result in total compensation ranging from $262,500 to $625,000 annually. This is the stage where the gap between high-performing and average-performing individuals begins to widen considerably. Proactive Associates who cultivate strong client relationships and contribute significantly to successful deals are likely to command higher bonuses.

The next rung on the ladder is Vice President (VP). VPs take on more responsibility for managing deals, leading teams, and developing client relationships. This role requires a high level of expertise and strong leadership skills. Base salaries for VPs commonly range from $250,000 to $400,000 per year. Bonuses are also substantial, typically ranging from 100% to 200% or even more of the base salary. Therefore, a VP's total compensation could range from $500,000 to $1,200,000 or higher. The VP role often marks a critical juncture in an investment banking career, with the potential to move into more senior leadership positions.

Directors and Managing Directors (MDs) represent the most senior ranks in investment banking. They are responsible for originating deals, managing client relationships at the highest level, and overseeing significant portions of the firm's business. Compensation at this level is highly variable and heavily dependent on performance. Base salaries for Directors and MDs can range from $400,000 to upwards of $1,000,000 or more per year. However, the bonus component can be several times the base salary, leading to total compensation figures that can easily exceed $1,000,000 and reach into the multi-million dollar range. For top-performing MDs at highly profitable firms, total compensation can reach astronomical levels. It's important to note that at this level, compensation often includes equity stakes or profit-sharing arrangements, further blurring the lines of what constitutes a "typical" salary.

Beyond the base salary and bonus structure, several other factors influence investment banking compensation. The size and profitability of the firm play a crucial role. Larger, more established firms generally offer higher base salaries, while smaller, boutique firms may offer more significant upside potential through bonuses and equity. The specific industry group or product area in which an investment banker specializes can also impact earnings. For example, those specializing in high-growth sectors like technology or healthcare may command higher compensation due to the increased demand for their expertise. Finally, individual performance is paramount. Investment bankers who consistently exceed expectations, generate significant revenue, and cultivate strong client relationships are rewarded with higher bonuses and faster career advancement.

It's crucial to understand that these figures represent general ranges, and actual compensation can vary significantly. The investment banking industry is highly competitive, and compensation is constantly evolving. Economic conditions, market volatility, and regulatory changes can all impact earnings. Additionally, the "average salary" often cited in reports can be misleading, as it doesn't capture the full spectrum of compensation levels and the variability inherent in the bonus structure.

Aspiring investment bankers should focus on developing a strong understanding of finance, honing their analytical and communication skills, and building a strong network of contacts. While the allure of high earnings is understandable, success in investment banking requires dedication, hard work, and a long-term commitment to the profession. The compensation will follow strong performance and continuous learning. Remember that focusing solely on the money is a short-sighted approach; the most successful investment bankers are those who are passionate about the work and dedicated to providing value to their clients. They see compensation as a byproduct of their commitment and expertise, not the primary motivator.