Investing in businesses, particularly in the dynamic world of startups and small enterprises, can be a rewarding path to wealth creation, but it demands careful consideration and a strategic approach. It's not a one-size-fits-all solution, and understanding your own financial situation, risk tolerance, and investment goals is paramount before diving in. Before even considering potential investments, it is wise to lay a solid foundation. This begins with conducting a thorough self-assessment. Determine your investment timeframe. Are you looking for short-term gains, or are you comfortable with a longer investment horizon of 5, 10, or even 20 years? Understand your risk tolerance. Are you a conservative investor who prefers lower-risk, lower-return investments, or are you comfortable with higher-risk, higher-reward opportunities? Evaluate your current financial situation. How much capital are you willing to allocate to business investments? Do you have a diversified portfolio in other asset classes, such as stocks, bonds, or real estate?

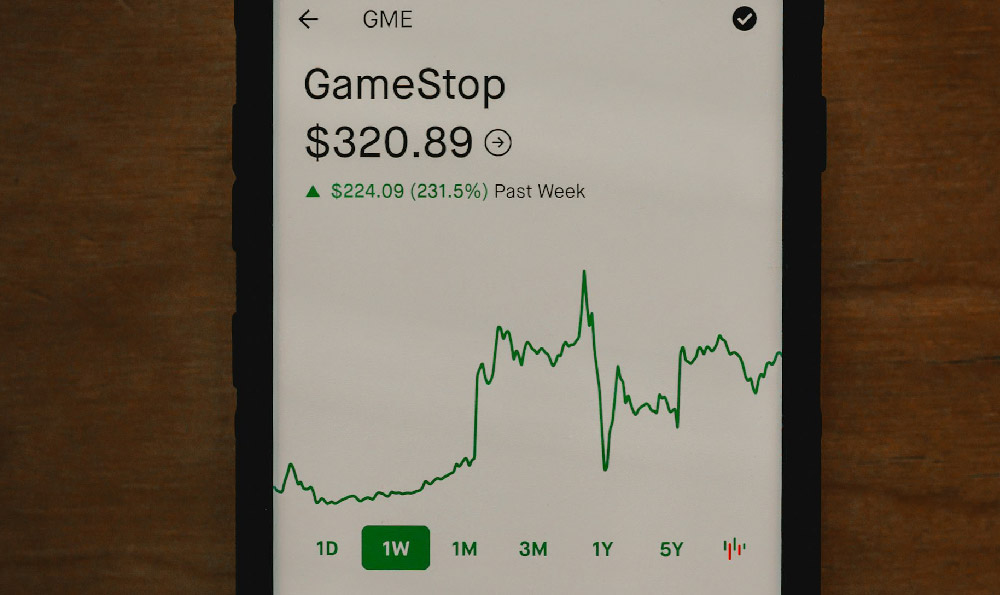

Once you have a clear understanding of your personal investment profile, you can explore the various avenues for investing in businesses. A great place to start is with publicly traded companies. This route offers accessibility and liquidity. By purchasing stocks in established companies, you gain partial ownership and a share in their profits. This is usually done through a brokerage account. Publicly traded companies are required to disclose financial information, which makes it easier to analyze their performance and assess their potential. However, understand that market volatility can impact stock prices, and thorough research is crucial to identifying companies with strong fundamentals and growth prospects.

Investing in private companies, often startups and smaller businesses, presents both higher potential returns and greater risks. One popular avenue is angel investing, where individuals invest their personal capital in early-stage companies. This is a high-risk, high-reward approach, as many startups fail. However, the potential for substantial returns if the company succeeds is significant. Thorough due diligence is essential. This involves scrutinizing the company's business plan, financial projections, management team, and market opportunity. You should also seek expert advice from experienced angel investors or venture capitalists. Crowdfunding platforms have also emerged as a viable way to invest in private companies. These platforms allow businesses to raise capital from a large pool of investors, often in exchange for equity or other rewards. While crowdfunding offers accessibility, it's crucial to carefully evaluate the companies and understand the risks involved.

Venture Capital (VC) firms represent another way to invest in private businesses, especially later-stage startups with proven business models and significant growth potential. VC firms pool capital from institutional investors and high-net-worth individuals to invest in these companies. While individual investors typically cannot invest directly in VC funds due to high investment minimums, they can gain indirect exposure through publicly traded companies that have VC arms or through investment trusts that invest in VC funds.

Another viable option is to consider investing in Small and Medium-sized Enterprises (SMEs). While these investments might not offer the explosive growth potential of startups, they can provide stable returns and contribute to local economies. Direct lending to SMEs through platforms or participation in revenue-sharing agreements can offer attractive returns. However, assessing the creditworthiness of the borrower and understanding the terms of the loan or agreement is vital.

Irrespective of the investment method chosen, due diligence is non-negotiable. It involves a comprehensive evaluation of the business, its industry, and its competitive landscape. Scrutinize the company's financial statements, including income statements, balance sheets, and cash flow statements, to assess its profitability, solvency, and liquidity. Analyze the industry in which the business operates to understand its growth prospects, competitive dynamics, and regulatory environment. Assess the company's competitive advantages, such as proprietary technology, strong brand reputation, or unique distribution channels. Meet with the management team to assess their experience, expertise, and vision for the company. Seek independent advice from financial advisors, industry experts, or legal counsel.

Risk management is also crucial for protecting your investment. Diversify your portfolio by investing in a variety of businesses across different industries and stages of development. This can help mitigate the impact of any single investment going sour. Set clear investment goals and exit strategies. This includes determining when you will sell your investment, whether it's through an IPO, acquisition, or sale to another investor. Stay informed about the businesses you invest in and the industries in which they operate. This will help you identify potential risks and opportunities. Don't invest more than you can afford to lose. Business investments are inherently risky, and it's crucial to allocate capital prudently.

Finally, remember that investing in businesses requires patience and a long-term perspective. It can take time for businesses to grow and generate returns. Avoid making impulsive decisions based on short-term market fluctuations or hype. Stay disciplined in your investment strategy and focus on the long-term potential of the businesses you invest in. Investing in businesses is not a get-rich-quick scheme, but it can be a rewarding path to wealth creation if approached strategically and with a long-term mindset. By carefully evaluating your investment goals, conducting thorough due diligence, managing risk effectively, and staying informed, you can increase your chances of success in this exciting and dynamic asset class.