Investing in stocks can be a powerful way to grow your wealth over the long term, but it's a decision that requires careful consideration and a strategic approach. Jumping in without a plan can be risky, so understanding the fundamentals of stock investing and knowing how to identify potentially successful companies is crucial. Let's explore some strategies for choosing the right stocks and where to begin your search.

Before diving into specific stock recommendations, it's important to emphasize the need for a diversified portfolio. Don't put all your eggs in one basket. Diversification means spreading your investments across different sectors, industries, and asset classes. This helps to mitigate risk, as a downturn in one area won't significantly impact your entire portfolio. Consider allocating portions of your investments to large-cap, mid-cap, and small-cap stocks, as well as international stocks.

When evaluating individual stocks, a good starting point is to understand the fundamental analysis. This involves examining a company's financial statements to assess its profitability, solvency, and efficiency. Key metrics to consider include:

- Revenue and Earnings Growth: Is the company consistently increasing its revenue and profits over time? Look for trends and consider whether the growth rate is sustainable.

- Profit Margins: How efficiently is the company converting revenue into profit? Higher profit margins indicate a strong competitive advantage.

- Debt Levels: Is the company carrying a manageable amount of debt? High debt levels can make a company vulnerable during economic downturns.

- Return on Equity (ROE): How effectively is the company using shareholder equity to generate profits? A higher ROE indicates better performance.

- Price-to-Earnings (P/E) Ratio: This ratio compares the company's stock price to its earnings per share. It can provide insights into whether the stock is overvalued or undervalued relative to its peers.

- Price-to-Book (P/B) Ratio: This ratio compares the company's stock price to its book value per share. It can help identify undervalued companies.

Beyond the numbers, it's crucial to understand the company's business model and competitive landscape. What products or services does the company offer? What is its market share? Who are its competitors? What are the company's strengths and weaknesses? A thorough understanding of these factors can help you assess the company's long-term prospects.

Consider the industry in which the company operates. Is the industry growing or declining? Are there any disruptive technologies or trends that could impact the industry's future? Investing in companies that are well-positioned to capitalize on emerging trends can be a lucrative strategy. For example, companies involved in renewable energy, artificial intelligence, or cloud computing may have significant growth potential in the coming years.

Another critical aspect to evaluate is the management team. Are they experienced and capable? Do they have a proven track record of success? Are they aligned with shareholder interests? A strong and competent management team is essential for navigating challenges and executing the company's strategy effectively. Research the leadership team's background and experience before investing in a company.

Where can you find potential stock investments? Here are several resources:

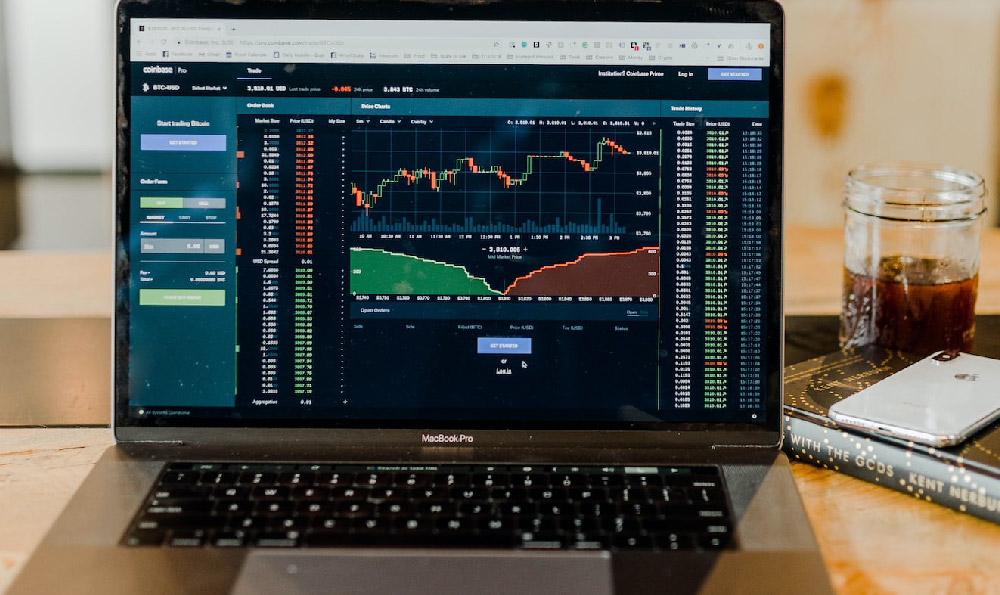

- Online Brokerage Platforms: Most online brokers provide research tools, analyst ratings, and stock screeners that can help you identify potential investments. These tools allow you to filter stocks based on various criteria, such as industry, market capitalization, and financial metrics.

- Financial News Websites and Publications: Websites like Yahoo Finance, Google Finance, Bloomberg, and The Wall Street Journal provide up-to-date financial news, market analysis, and company profiles. These resources can help you stay informed about market trends and identify promising investment opportunities.

- Investment Research Firms: Companies like Morningstar and CFRA offer in-depth research reports and analyst ratings on a wide range of stocks. These reports can provide valuable insights into a company's financial performance, competitive position, and growth prospects.

- SEC Filings: The Securities and Exchange Commission (SEC) requires publicly traded companies to file regular reports, such as 10-K (annual report) and 10-Q (quarterly report). These filings contain detailed information about the company's financial performance, business operations, and risk factors.

- Industry-Specific Conferences and Events: Attending industry-specific conferences and events can provide valuable insights into emerging trends and potential investment opportunities. These events often feature presentations from company executives and industry experts.

- Following Seasoned Investors: While you should always conduct your own research, observing the investments of successful investors like Warren Buffett or Cathie Wood can provide ideas. Remember to understand the rationale behind their investments and assess whether they align with your own investment goals and risk tolerance.

Once you've identified a few promising stocks, it's important to do your due diligence and conduct thorough research. Don't rely solely on the recommendations of others. Read the company's annual reports, listen to earnings calls, and analyze its financial statements. Understand the risks and potential rewards before making any investment decisions.

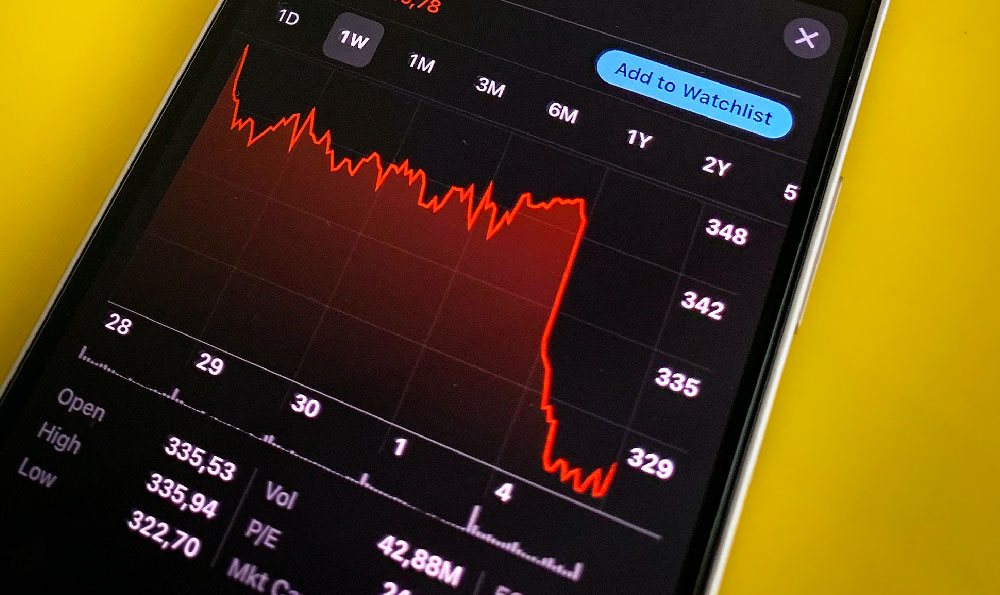

Remember that investing in stocks involves risk, and there is no guarantee of returns. Market conditions can change rapidly, and even well-researched stocks can experience declines in value. Invest only what you can afford to lose, and be prepared to hold your investments for the long term. A long-term investment horizon allows you to ride out market fluctuations and benefit from the compounding effect of returns.

Finally, consider consulting with a financial advisor. A qualified advisor can help you assess your risk tolerance, develop a diversified investment strategy, and provide personalized recommendations based on your financial goals. They can also help you stay disciplined and avoid making emotional investment decisions.

In conclusion, investing in stocks requires careful planning, thorough research, and a long-term perspective. By understanding the fundamentals of stock investing, conducting due diligence on individual companies, and diversifying your portfolio, you can increase your chances of achieving your financial goals. Remember to stay informed, stay disciplined, and seek professional advice when needed. Happy investing!