Okay, I understand. Please provide the title and I will craft a comprehensive article for you, adhering to your specifications. I will focus on cryptocurrency investment strategies, risk management, and avoiding common pitfalls, all while maintaining a professional, insightful, and cautious tone.

The allure of quick profits in the cryptocurrency market is undeniable. Many are drawn to the potential for substantial returns, but it’s crucial to understand that this arena is fraught with volatility and inherent risks. Building wealth in crypto demands a strategic approach, disciplined execution, and a thorough understanding of the underlying technologies and market dynamics. Forget overnight riches; sustainable wealth creation requires a long-term perspective and a commitment to continuous learning.

One of the fundamental aspects of successful cryptocurrency investing is diversification. Placing all your capital into a single asset, even one with promising potential, significantly amplifies your risk exposure. A well-diversified portfolio, on the other hand, spreads your risk across multiple assets, mitigating the impact of any single investment performing poorly. Consider allocating your capital across different types of cryptocurrencies, such as established projects with strong fundamentals (like Bitcoin and Ethereum), promising altcoins with innovative use cases, and even stablecoins to provide stability and liquidity. The specific allocation should be tailored to your individual risk tolerance, investment goals, and time horizon. Don't simply chase the hype; research each project thoroughly before investing. Look beyond the marketing and delve into the project's whitepaper, team, technology, and community. Assess its potential for long-term adoption and its competitive advantage in the market.

Beyond diversification, a robust risk management strategy is essential for safeguarding your capital. This involves setting realistic expectations, defining your risk tolerance, and implementing stop-loss orders. Realistic expectations are crucial. While significant gains are possible, the cryptocurrency market is highly volatile. Be prepared for periods of drawdown and avoid making impulsive decisions based on short-term price fluctuations. Understand your risk tolerance. This is the level of risk you are comfortable taking on in pursuit of your investment goals. If you are risk-averse, you may prefer to allocate a larger portion of your portfolio to stablecoins or established cryptocurrencies with lower volatility. If you are more risk-tolerant, you may be willing to allocate a smaller portion to higher-risk altcoins with the potential for higher returns. Stop-loss orders are a critical tool for limiting potential losses. These orders automatically sell your cryptocurrency if the price falls below a predetermined level, preventing you from holding onto a losing asset for too long. Implementing stop-loss orders requires careful consideration of market volatility and your risk tolerance. Setting the stop-loss level too tight may result in premature liquidation, while setting it too loose may expose you to excessive losses.

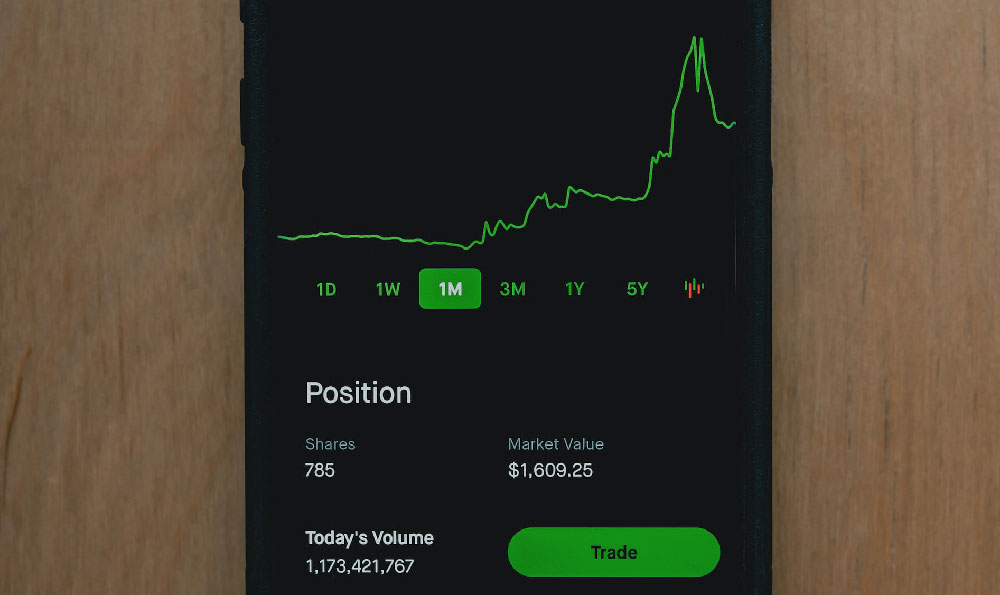

Technical analysis plays a crucial role in identifying potential entry and exit points in the cryptocurrency market. This involves studying price charts, trading volumes, and various technical indicators to identify patterns and trends. Common technical indicators include moving averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Fibonacci retracements. These indicators can provide valuable insights into market sentiment, momentum, and potential support and resistance levels. However, it’s important to remember that technical analysis is not foolproof. It should be used in conjunction with fundamental analysis and risk management to make informed investment decisions. Relying solely on technical indicators without considering the underlying fundamentals of a cryptocurrency project can be a recipe for disaster.

Beware of scams and pump-and-dump schemes, which are prevalent in the cryptocurrency market. These schemes often involve artificially inflating the price of a cryptocurrency through misleading marketing and hype, only to sell off the assets at a profit, leaving unsuspecting investors with substantial losses. Do not fall victim to the fear of missing out (FOMO). Avoid investing in cryptocurrencies solely based on hype or social media buzz. Conduct your own independent research and due diligence before investing in any project. Be wary of projects that promise guaranteed returns or unrealistic profits. No investment is guaranteed, and the cryptocurrency market is particularly volatile. Protect your private keys and other sensitive information. Store your cryptocurrencies in a secure wallet and never share your private keys with anyone. Enable two-factor authentication (2FA) on all your cryptocurrency accounts to add an extra layer of security.

Regulation is another key factor to consider. The regulatory landscape for cryptocurrencies is still evolving, and regulations can vary significantly from country to country. Stay informed about the regulations in your jurisdiction and how they may impact your investments. Understanding the legal and regulatory framework surrounding cryptocurrencies is essential for ensuring compliance and protecting your assets. Ignoring regulations can lead to legal issues and financial penalties.

Finally, remember that the cryptocurrency market is a constantly evolving landscape. New technologies, projects, and regulations are emerging all the time. Continuous learning and adaptation are essential for staying ahead of the curve and making informed investment decisions. Subscribe to reputable news sources, attend industry conferences, and engage with the cryptocurrency community to stay up-to-date on the latest developments. The more you learn, the better equipped you will be to navigate the complexities of the cryptocurrency market and achieve your financial goals. Patience and discipline are your greatest assets. Don't let emotions dictate your investment decisions. Stay focused on your long-term goals and stick to your strategy, even during periods of market volatility. By following these principles, you can increase your chances of success and build sustainable wealth in the cryptocurrency market.