In 2023, the stock market continues to present a complex yet rewarding landscape for investors, shaped by a combination of macroeconomic factors, technological disruptions, and evolving consumer behaviors. The key to capitalizing on this environment lies in understanding how to adapt traditional investment principles to contemporary conditions while maintaining a disciplined approach to risk management. Unlike the past, where the focus was often on simple capital appreciation through equity exposure, today's investor must navigate a world where short-term volatility is amplified by geopolitical tensions, monetary policy shifts, and the rapid pace of innovation. To achieve consistent profits, one must develop a multifaceted strategy that balances long-term growth with tactical adjustments to mitigate exposure to market fluctuations.

The foundation of successful stock investing remains rooted in fundamental analysis, but the execution has become more nuanced. Companies in sectors such as technology, renewable energy, and healthcare have demonstrated resilience and growth potential amid economic uncertainty, driven by their ability to innovate and meet ongoing demand. For example, the continued expansion of artificial intelligence has created opportunities for investors in companies that are at the forefront of this transformation, even as traditional industries face headwinds. However, the importance of diversification cannot be overstated. A well-structured portfolio should include a mix of growth-oriented stocks, value stocks, and income-generating assets to provide stability while capturing different market cycles. Investors who allocate their capital across multiple sectors and geographies are better positioned to weather market downturns and capitalize on emerging trends.

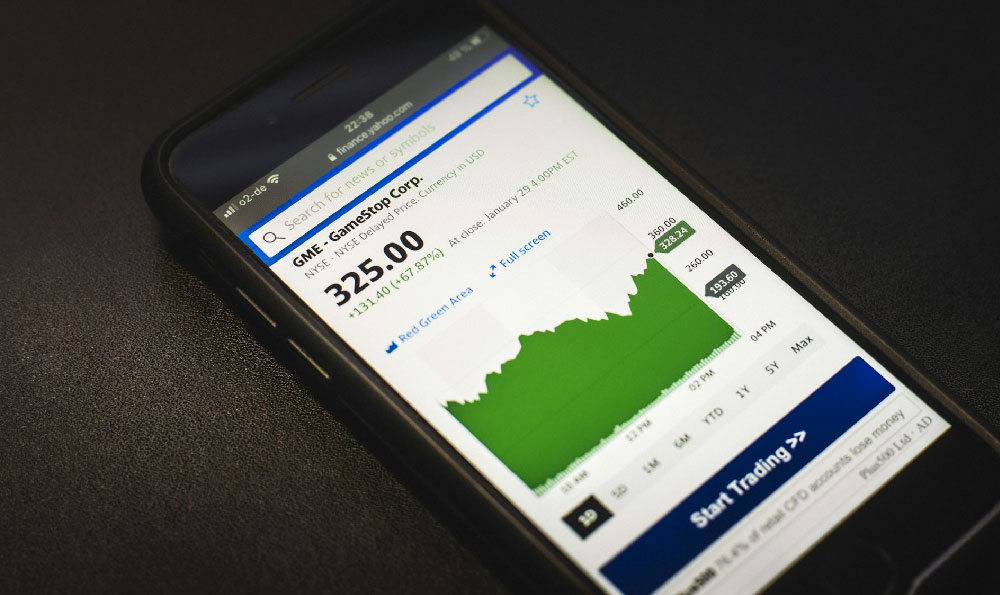

While long-term investing is a proven method for generating profits, 2023 has also seen the rise of tactical strategies that allow investors to exploit short-term opportunities. The momentum-driven strategies, for instance, hinge on identifying stocks that are breaking out of consolidation patterns, often fueled by strong earnings reports or news that boosts investor confidence. These strategies are particularly effective in markets with high liquidity, where order flow and market sentiment can create temporary mispricings. However, the appeal of such tactics must be tempered with caution, as short-term gains are often accompanied by higher risk. Investors should avoid chasing fleeting trends without a clear understanding of the underlying fundamentals, as this can lead to significant losses if the market reverses course.

A critical component of achieving profitability in the stock market is mastering risk management techniques. The markets of 2023 exhibit heightened volatility, making it essential for investors to protect their capital while maintaining exposure to growth opportunities. One approach is to utilize stop-loss orders, which automatically sell a stock when it reaches a predetermined price level, limiting potential losses in case of sudden downturns. Additionally, maintaining a diversified portfolio across different asset classes – such as equities, bonds, and cash – can help balance risk and reward. In times of uncertainty, defensive stocks in sectors like utilities and consumer staples often provide a buffer against market turbulence. Furthermore, investors should consider hedging strategies, such as using inverse ETFs or options, to offset potential losses in specific sectors or indices.

The role of technology in modern stock investing has become increasingly important, with tools like algorithmic trading and data analytics enabling more precise decision-making. Investors who leverage these technologies can identify patterns, assess market sentiment, and execute trades with greater efficiency. However, the integration of technology should not replace fundamental analysis; instead, it should complement it. For instance, while algorithmic models can predict price movements based on historical data, they may not account for macroeconomic shifts or company-specific risks. Therefore, combining quantitative analysis with qualitative insights ensures a more holistic approach to investing.

Another pivotal factor for profitability is the psychological discipline required to stay invested through market cycles. The stock market is inherently cyclical, with periods of optimism and pessimism that can significantly impact performance. In 2023, investors who remain patient and avoid panic selling during market corrections tend to outperform those who react impulsively. This requires a long-term mindset, where decisions are based on data and analysis rather than emotions. Additionally, staying informed about market developments and economic indicators – such as interest rates, inflation data, and sector-specific trends – empowers investors to make timely and informed decisions.

As the markets evolve, the importance of continuous learning and adaptation becomes evident. The financial landscape in 2023 is punctuated by unprecedented changes, including the rise of ESG (Environmental, Social, and Governance) investing and the ongoing shift toward a more digital economy. Investors who embrace these changes and adjust their strategies accordingly are better positioned to capitalize on new opportunities. For example, companies with strong ESG credentials are increasingly attracting institutional investors and consumers, creating a distinct advantage in the long term. Similarly, the digital transformation has created a surge in demand for tech-driven solutions, positioning innovation-oriented stocks as a key asset class for future growth.

Ultimately, the path to earning profits from stock investments in 2023 requires a balance of knowledge, patience, and adaptability. By focusing on sectors with strong fundamentals, implementing risk management strategies, and leveraging technology to enhance decision-making, investors can navigate the complex market environment with greater confidence. The journey toward financial success through stocks is not linear, but with a well-structured approach and a commitment to continuous learning, it remains one of the most viable paths to wealth creation.