Investing in real estate, often considered a cornerstone of wealth building, doesn't always necessitate the traditional route of outright property ownership. While purchasing a house or apartment is the most common approach, several alternative strategies offer exposure to the real estate market without the burdens of mortgages, property taxes, and landlord responsibilities. These methods cater to diverse investment goals, risk tolerances, and capital availability, opening doors for individuals who might otherwise be excluded from this lucrative asset class.

One prevalent avenue for real estate investment without direct ownership is through Real Estate Investment Trusts (REITs). REITs are companies that own, operate, or finance income-producing real estate across various sectors, including commercial properties, residential buildings, healthcare facilities, and infrastructure. By purchasing shares of a REIT, investors effectively gain a proportional ownership stake in the underlying real estate portfolio. REITs are publicly traded on stock exchanges, providing liquidity and ease of access. The appeal of REITs lies in their mandated distribution of a significant portion of their taxable income to shareholders in the form of dividends. This makes them an attractive option for income-seeking investors. Moreover, REITs offer diversification benefits, as they often hold a basket of properties across different geographic locations and property types, mitigating risk associated with a single property or tenant. Different types of REITs cater to specific investment preferences. Equity REITs primarily own and operate properties, generating income through rental revenue. Mortgage REITs, on the other hand, invest in mortgages and mortgage-backed securities, deriving income from interest payments. Hybrid REITs combine both equity and mortgage investments.

Another increasingly popular method is real estate crowdfunding. Crowdfunding platforms connect investors with real estate developers or operators seeking capital for specific projects. Investors pool their funds together to finance the acquisition, development, or renovation of a property. In return, they receive a share of the project's profits, typically through rental income or capital appreciation upon sale. Real estate crowdfunding allows individuals with smaller amounts of capital to participate in larger, more complex projects that would otherwise be inaccessible. However, it's crucial to conduct thorough due diligence on the projects and platforms involved, as risks can vary significantly. Factors to consider include the sponsor's experience, the project's location and market conditions, and the terms of the investment agreement. Unlike REITs, real estate crowdfunding investments are generally illiquid, meaning they cannot be easily sold or traded before the project's completion.

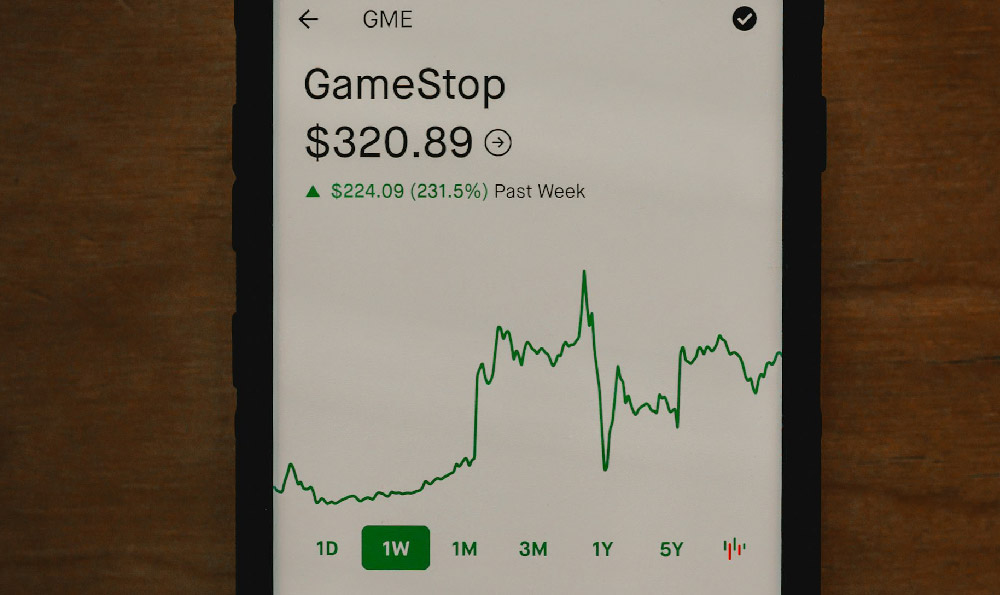

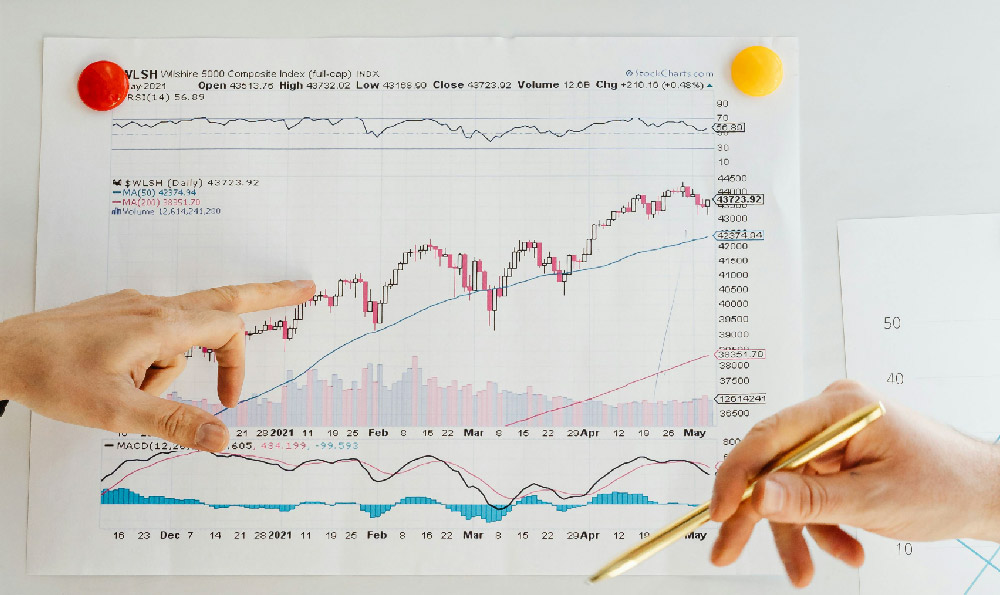

Furthermore, investing in real estate-related stocks can provide indirect exposure to the sector. These stocks represent companies involved in various aspects of the real estate industry, such as homebuilders, construction companies, property management firms, and suppliers of building materials. The performance of these companies is often correlated with the overall health of the real estate market. Investing in these stocks can offer diversification benefits and potential for capital appreciation, but it's important to remember that they are also subject to broader market volatility. The success of these companies depends on factors beyond just property values, including economic growth, interest rates, and regulatory changes.

Beyond these more mainstream options, consider investing in mortgage-backed securities (MBS). These are bonds secured by a pool of mortgages. Investors receive payments from the cash flows generated by these mortgages. While offering exposure to the housing market, MBS are complex instruments and require a strong understanding of fixed-income securities and the factors that influence mortgage rates. Risks associated with MBS include prepayment risk (borrowers paying off their mortgages early, reducing the yield for investors) and credit risk (borrowers defaulting on their mortgages).

Each of these investment vehicles has its own set of advantages and disadvantages. REITs offer liquidity and diversification, but are subject to market fluctuations. Real estate crowdfunding provides access to unique projects but lacks liquidity. Real estate-related stocks are correlated with the real estate market but are also influenced by broader economic factors. MBS provide exposure to mortgage cash flows but carry prepayment and credit risks.

Before venturing into any of these options, it's essential to conduct thorough research, understand the risks involved, and align your investment strategy with your financial goals and risk tolerance. Consult with a qualified financial advisor to determine the most suitable approach for your individual circumstances. Diversification is key, and a well-balanced portfolio should include a mix of different asset classes to mitigate risk. Ultimately, investing in real estate without buying offers a range of opportunities for individuals to participate in this valuable asset class, regardless of their capital constraints or risk appetite. By understanding the nuances of each option and carefully considering their suitability, investors can potentially reap the rewards of real estate investment without the direct burdens of property ownership. The key is informed decision-making and a long-term perspective. Remember that all investments carry risk, and past performance is not indicative of future results.