Here's an article addressing the question of profitable investments and current investment recommendations, optimized for SEO and adhering to Google's content guidelines:

Unlocking Profitability: Navigating the Investment Landscape

The quest for financial security and growth often leads individuals to the complex world of investments. The question, "What investments generate profit?" is a foundational one, and the answer is multifaceted, dependent on risk tolerance, investment timeline, and market conditions. There is no single "magic bullet" investment; rather, a diversified approach tailored to individual needs is usually the most prudent strategy. Furthermore, understanding where to invest now requires a constant awareness of the current economic climate and emerging trends.

Understanding the Spectrum of Investment Options

Before diving into specific investment recommendations, it's crucial to grasp the broad categories of assets and their inherent characteristics.

-

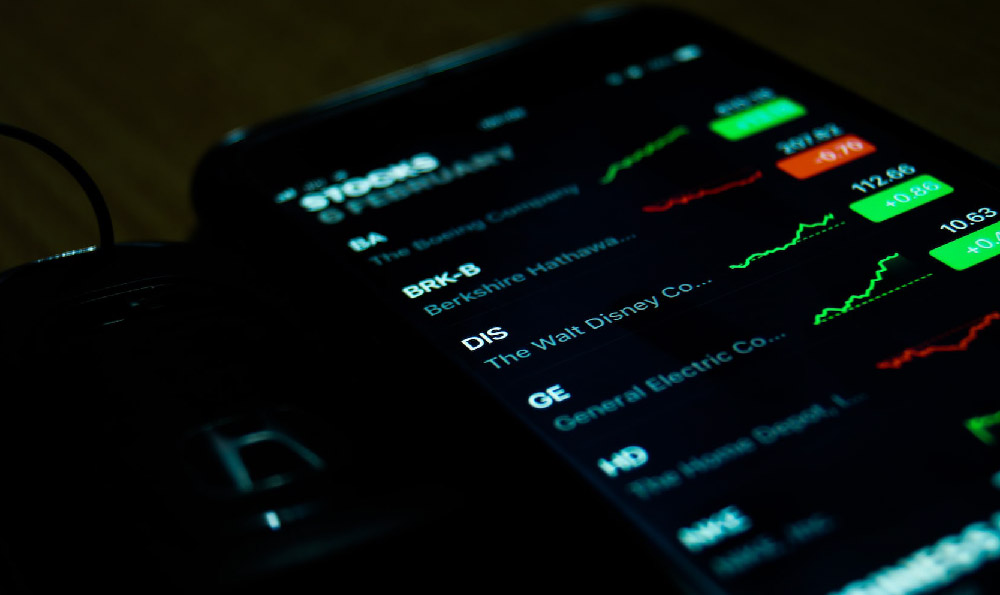

Stocks (Equities): Representing ownership in a company, stocks offer the potential for high growth but also carry higher risk. Stock prices fluctuate based on company performance, industry trends, and overall market sentiment. Investing in stocks can be done directly or through mutual funds and Exchange-Traded Funds (ETFs).

-

Bonds (Fixed Income): Bonds are essentially loans to a government or corporation. They typically offer a more stable, predictable income stream compared to stocks, but with lower potential returns. Bond yields are influenced by interest rates and the creditworthiness of the issuer.

-

Real Estate: Investing in real estate can generate profit through rental income and property appreciation. However, real estate investments are often illiquid and require significant capital. Factors like location, property type, and local market conditions greatly impact profitability.

-

Commodities: Raw materials like oil, gold, and agricultural products can be traded on commodity exchanges. Commodity prices are often influenced by supply and demand dynamics, geopolitical events, and global economic growth. Commodities are generally considered higher-risk investments.

-

Cryptocurrencies: Digital or virtual currencies that use cryptography for security. Bitcoin and Ethereum are the most well-known. Cryptocurrencies are highly volatile and speculative investments. Their value is driven by supply and demand and perceived future utility.

Current Market Dynamics and Investment Opportunities

The current economic environment plays a crucial role in shaping investment strategies. Interest rate hikes, inflation concerns, and geopolitical uncertainty are all factors that investors must consider. With those caveats in mind, here are some areas showing potential in the current environment:

Areas of Potential Growth:

-

Renewable Energy: The transition to a sustainable future is creating significant opportunities in the renewable energy sector. Companies involved in solar, wind, and other clean energy technologies are poised for growth as governments and businesses invest in these alternatives. Investing in this sector can be done via individual stocks or ETFs that focus on renewable energy companies. This also can qualify for some tax benefits in various countries.

-

Technology (with a Focus on AI and Cybersecurity): While the tech sector has experienced some volatility, certain areas within technology remain promising. Artificial intelligence (AI) is rapidly transforming industries, and companies developing and implementing AI solutions are likely to benefit. Cybersecurity is also a crucial area, as businesses and governments face increasing threats from cyberattacks. Investing in these areas requires careful selection of companies with strong fundamentals and competitive advantages.

-

Healthcare Innovation: Healthcare is a consistently growing sector, driven by aging populations and advancements in medical technology. Companies involved in developing new treatments, diagnostic tools, and healthcare services have the potential for long-term growth. Biotechnology and personalized medicine are particularly promising areas.

-

Emerging Markets: Selected emerging markets may offer higher growth potential than developed economies. These markets often have younger populations, growing middle classes, and untapped resources. However, investing in emerging markets also carries higher risks, including political instability and currency fluctuations. Thorough research and due diligence are essential.

-

Dividend-Paying Stocks: In times of uncertainty, dividend-paying stocks can provide a steady stream of income. Companies with a history of consistent dividend payments are often considered more stable investments. Dividend yields should be carefully evaluated, as high yields may indicate underlying problems.

Diversification: The Cornerstone of a Sound Investment Strategy

Regardless of the specific investments chosen, diversification is paramount. Spreading investments across different asset classes, sectors, and geographic regions can help mitigate risk and improve overall portfolio performance. A well-diversified portfolio is less susceptible to the impact of any single investment performing poorly.

Seeking Professional Advice

Navigating the investment landscape can be daunting, especially for beginners. Consulting with a qualified financial advisor is highly recommended. A financial advisor can assess your individual needs, risk tolerance, and investment goals and develop a personalized investment strategy. They can also provide ongoing guidance and support as your financial circumstances and market conditions change.

Due Diligence and Continuous Learning

Investing requires continuous learning and due diligence. Before investing in any asset, research the company, industry, and market conditions. Stay informed about economic trends and geopolitical events that may impact your investments. By staying informed and actively managing your portfolio, you can increase your chances of achieving your financial goals. Don't be afraid to invest in your own financial education. Read books, attend seminars, and follow reputable financial news sources to enhance your understanding of the markets.

Disclaimer: This information is for general guidance only and does not constitute financial advice. All investment decisions should be made based on your own research and consultation with a qualified financial advisor. Investment involves risk, and the value of your investments may go down as well as up.