Investing in SpaceX, a pioneering force in space exploration and technology, is a question that ignites the curiosity of many investors. The allure of being a part of a company that's revolutionizing space travel, satellite internet, and potentially even interplanetary colonization is undeniably strong. However, the path to directly investing in SpaceX isn't as straightforward as purchasing shares of a publicly traded company.

SpaceX, at present, remains a privately held entity. This means its shares are not available on major stock exchanges like the NYSE or NASDAQ. Elon Musk, the CEO of SpaceX, has repeatedly stated that he has no immediate plans to take the company public. His reasons often revolve around maintaining long-term strategic control, avoiding the pressures of short-term earnings expectations that publicly traded companies often face, and preserving the flexibility to pursue ambitious, high-risk projects without constantly needing to appease shareholders focused on quarterly returns.

Despite the lack of direct access, several indirect avenues exist for those keen on gaining exposure to SpaceX's endeavors. One of the most common approaches is to invest in companies that have significant business ties with SpaceX.

For example, Alphabet (Google's parent company) and Fidelity Investments both hold stakes in SpaceX through private equity investments. While investing in Alphabet or Fidelity won't give you a pure play on SpaceX's performance, it does offer a diluted exposure to its potential success. It's crucial to remember that these companies are vast conglomerates with diverse revenue streams, and SpaceX's impact on their overall financial performance might be marginal. Therefore, it's essential to carefully analyze the investment before making a decision.

Another option is to consider investing in companies that supply SpaceX with critical components or services. These companies might be publicly traded and directly benefit from SpaceX's growth. Identifying these suppliers requires thorough research and due diligence. Understanding their dependence on SpaceX, the strength of their contracts, and their overall financial health is paramount. The aerospace and defense sectors house numerous companies that could potentially be involved in SpaceX's supply chain.

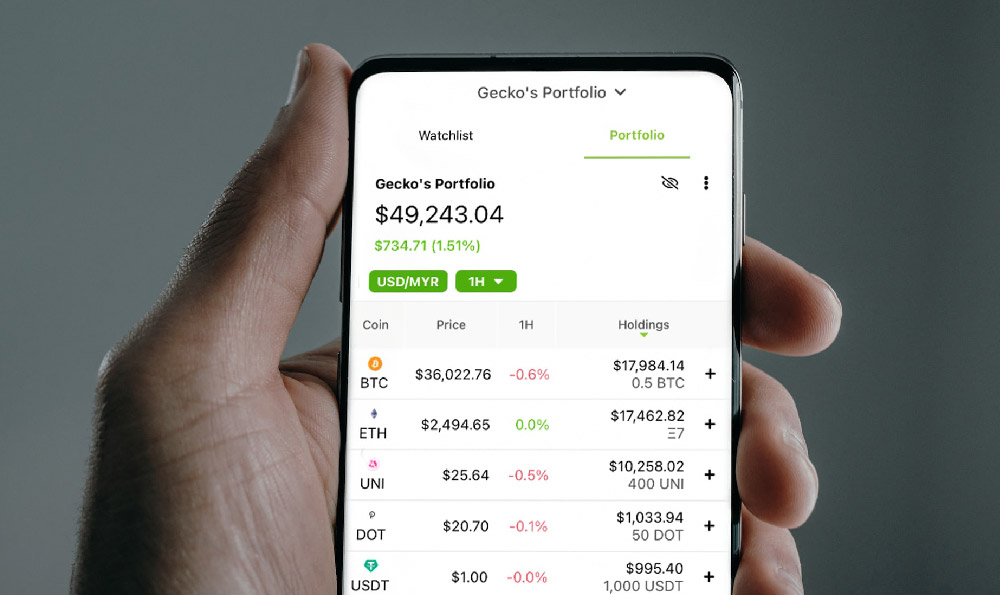

Furthermore, the emergence of space-focused exchange-traded funds (ETFs) provides an alternative avenue. These ETFs invest in a basket of companies involved in various aspects of the space industry, including satellite manufacturing, launch services, and related technologies. While these ETFs might not hold a direct stake in SpaceX, they often include companies that are integral to SpaceX's ecosystem, offering indirect exposure to the sector's overall growth. Again, careful scrutiny of the ETF's holdings is necessary to understand the extent of its exposure to SpaceX and the overall risk profile of the fund.

Another possibility, albeit less accessible for the average retail investor, is participation in pre-IPO (Initial Public Offering) markets. These markets allow accredited investors (individuals or institutions meeting specific income or net worth criteria) to buy and sell shares of private companies before they go public. However, access to these markets is typically limited, and the minimum investment amounts can be substantial. Additionally, investing in pre-IPO shares carries significant risks, including the possibility of illiquidity and the potential for the company to never actually go public.

Crowdfunding platforms have also occasionally presented opportunities to invest in companies indirectly related to SpaceX or the broader space industry. These platforms allow individuals to pool their resources and invest in early-stage ventures. While these opportunities might seem appealing, it's essential to exercise extreme caution. The risk associated with early-stage companies is inherently high, and due diligence is crucial to avoid potentially fraudulent or unsustainable ventures.

Beyond the financial considerations, it's important to understand the regulatory landscape surrounding space-related investments. The space industry is subject to complex regulations from various government agencies, including the Federal Aviation Administration (FAA) in the United States, which oversees commercial space launches. These regulations can impact the operations and profitability of space companies, and investors should be aware of these factors.

Looking ahead, the possibility of a SpaceX IPO remains a topic of speculation. While Elon Musk has consistently downplayed the idea, market conditions and the company's future capital needs could potentially influence his decision. If SpaceX were to go public, it would undoubtedly be one of the most highly anticipated IPOs in history, attracting significant investor interest. However, it's important to remember that an IPO is not guaranteed, and potential investors should not base their investment decisions solely on the expectation of a future offering.

In conclusion, while directly investing in SpaceX is not currently possible for the average investor, several indirect avenues exist to gain exposure to the company's potential success. These options range from investing in companies with business ties to SpaceX to participating in space-focused ETFs. Each avenue carries its own set of risks and rewards, and thorough research and due diligence are essential before making any investment decisions. Ultimately, the decision to invest in SpaceX, or any company indirectly related to it, should be based on a careful assessment of your individual investment goals, risk tolerance, and financial situation. The space industry holds tremendous promise, but it also presents unique challenges and uncertainties, and investors should approach it with a well-informed and cautious perspective.