The allure of part-time work, especially in the dynamic realm of cryptocurrency investment, is undeniable. The promise of supplementing income, exploring a passion, or simply dipping a toe into the world of digital assets without sacrificing a stable career is incredibly appealing. However, the question remains: Is a part-time approach truly right for everyone when it comes to cryptocurrency investment? And if so, what constitutes an ideal hour commitment? The answer, as with most things in finance, is nuanced and highly individual.

Understanding the Landscape: Crypto Investing is Not a Passive Activity

Before delving into the specifics of time commitment, it's crucial to dispel the myth that cryptocurrency investing is a passive, set-it-and-forget-it activity. While some investment strategies, such as long-term holding of established coins like Bitcoin and Ethereum, require less active management, the overall crypto market is characterized by volatility, rapid technological advancements, and a constant stream of new projects and developments.

Success in crypto investing, even on a part-time basis, demands a certain level of engagement. This engagement encompasses research, market analysis, security practices, and ongoing education. Failing to dedicate sufficient time to these activities can significantly increase the risk of making poorly informed decisions, falling prey to scams, or missing out on potentially lucrative opportunities.

Defining "Part-Time": A Spectrum of Commitment

The term "part-time" itself is subjective. For some, it might mean dedicating a few hours per week to monitoring the market and making occasional trades. For others, it could involve spending several hours each day actively researching projects, participating in online communities, and executing more complex trading strategies.

The ideal hour commitment depends heavily on several factors:

- Investment Goals: Are you looking to generate a small side income, accumulate long-term wealth, or actively trade for higher returns? The more ambitious your goals, the more time you'll need to invest.

- Investment Strategy: A buy-and-hold strategy typically requires less active management than day trading or swing trading. Similarly, investing in established, well-researched coins requires less ongoing monitoring than venturing into new and emerging altcoins.

- Experience Level: Beginners typically need to dedicate more time to learning the fundamentals of cryptocurrency, understanding risk management principles, and developing a solid investment strategy. Experienced investors may be able to manage their portfolios more efficiently.

- Capital Allocation: The amount of capital you're investing also plays a role. A smaller portfolio might require less active management, while a larger portfolio demands closer attention to risk mitigation and diversification.

- Personal Circumstances: Your available time, financial resources, and risk tolerance will all influence the optimal level of commitment.

A Practical Guide to Time Allocation: Where Should Your Hours Go?

Instead of focusing on a specific number of hours, consider allocating your time across several key areas:

-

Research (30-40%): This is arguably the most critical aspect of part-time crypto investing. Dedicate time to researching different cryptocurrencies, understanding their underlying technology, analyzing their market potential, and evaluating the teams behind them. Read whitepapers, follow industry news, and participate in relevant online communities. Look for information from reputable sources and be wary of hype and misinformation.

-

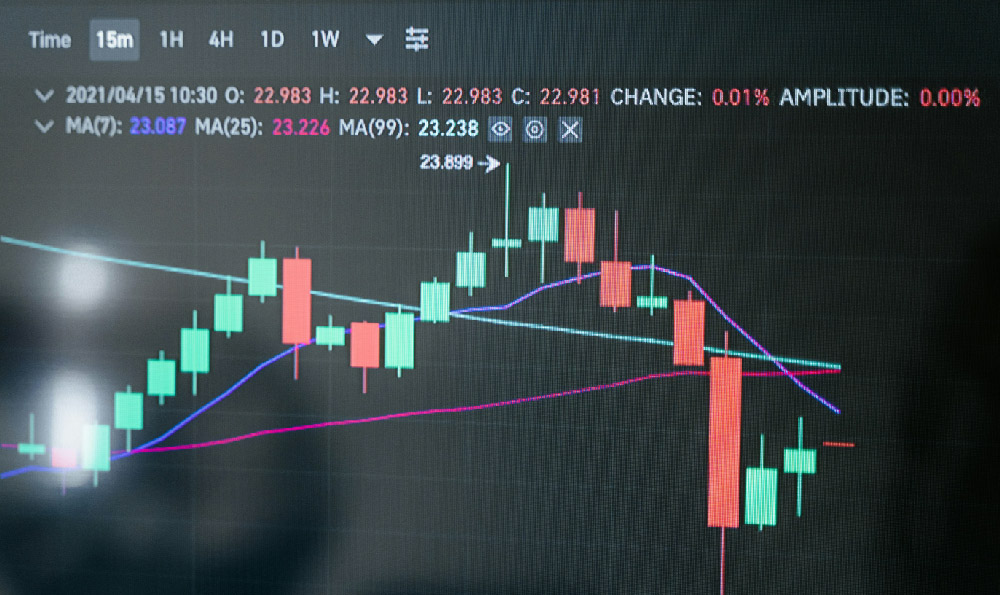

Market Analysis (20-30%): Monitor market trends, analyze price charts, and identify potential entry and exit points. Learn basic technical analysis techniques, such as identifying support and resistance levels, and understanding candlestick patterns. However, remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

-

Security (10-15%): Prioritize the security of your crypto assets. Learn about different types of wallets (hardware, software, exchange wallets), understand the risks associated with each, and choose the most appropriate option for your needs. Use strong passwords, enable two-factor authentication, and be vigilant against phishing scams. Store your private keys securely and never share them with anyone.

-

Portfolio Management (10-15%): Regularly review your portfolio, rebalance your holdings as needed, and adjust your strategy based on market conditions. Track your performance, identify areas for improvement, and learn from your mistakes. Consider using portfolio management tools to help you track your investments and monitor your performance.

-

Education (5-10%): The cryptocurrency landscape is constantly evolving, so it's essential to stay up-to-date on the latest developments. Dedicate time to reading articles, watching videos, and attending webinars to expand your knowledge and improve your skills.

Avoiding Common Pitfalls: Protecting Your Investments and Your Time

Part-time crypto investors are particularly vulnerable to certain pitfalls:

-

FOMO (Fear of Missing Out): Don't let the hype of a particular coin or project drive you to make impulsive decisions. Stick to your investment strategy and avoid chasing quick profits.

-

Lack of Due Diligence: Rushing into investments without conducting thorough research can lead to significant losses. Take the time to understand what you're investing in and assess the risks involved.

-

Overtrading: Constantly buying and selling coins in an attempt to time the market can result in higher transaction fees and increased emotional stress. Focus on long-term strategies and avoid excessive trading.

-

Neglecting Security: Failing to prioritize security can make you a target for hackers and scammers. Take the necessary steps to protect your assets and be cautious of suspicious emails or websites.

-

Emotional Investing: Making investment decisions based on emotions, such as fear or greed, can lead to poor outcomes. Stay calm, rational, and disciplined in your approach.

Conclusion: Finding Your Ideal Balance

Ultimately, the ideal hour commitment for part-time cryptocurrency investment is a personal decision that depends on individual circumstances, goals, and risk tolerance. There is no one-size-fits-all answer. However, by prioritizing research, market analysis, security, and education, part-time investors can significantly increase their chances of success while avoiding common pitfalls. The key is to find a balance that allows you to participate in the exciting world of cryptocurrency without sacrificing your existing commitments or compromising your financial well-being. Remember to start small, learn as you go, and never invest more than you can afford to lose. A well-planned and diligently executed part-time approach can be a rewarding way to participate in the future of finance.