Investing in the Indian stock exchanges, while potentially rewarding, requires a structured approach, diligent research, and a solid understanding of the market dynamics. It's crucial to remember that all investments carry inherent risks, and the stock market is no exception. Therefore, a cautious and well-informed strategy is paramount.

The initial step involves opening a Demat (Dematerialized) and Trading account. A Demat account holds your shares in electronic form, while a Trading account facilitates the buying and selling of shares. Several brokers in India offer both, including full-service brokers and discount brokers. Full-service brokers provide research reports, advisory services, and personalized support, but typically charge higher brokerage fees. Discount brokers, on the other hand, offer lower brokerage fees but limited advisory services. The choice depends on your investment style, knowledge, and comfort level. Prominent brokers include Zerodha, Upstox, Angel Broking, and ICICI Direct. Thoroughly research and compare different brokers based on brokerage charges, account opening fees, platform usability, and customer service before making a decision. Ensure the broker is registered with SEBI (Securities and Exchange Board of India) to guarantee regulatory compliance and investor protection.

Once the accounts are opened, you'll need to complete the KYC (Know Your Customer) process, which involves submitting identification and address proofs as mandated by SEBI. This process is crucial for preventing money laundering and ensuring transparency in financial transactions. Commonly accepted documents include PAN card, Aadhar card, passport, and driving license. The KYC process is generally straightforward and can be completed online through the broker's platform.

Next, funding your trading account is necessary before you can start investing. This can be done through various methods, including net banking, UPI (Unified Payments Interface), and debit/credit cards. It's advisable to start with a smaller amount that you're comfortable losing, especially when you're new to the market. Avoid investing borrowed money or funds earmarked for essential expenses. Consider this initial investment as a learning experience.

Now, begins the crucial phase of research and analysis. Understanding the fundamentals of the Indian stock market is essential. This includes familiarizing yourself with key indices like the Nifty 50 and the Sensex, which represent the performance of the top 50 and 30 companies listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), respectively. Monitor economic indicators such as GDP growth, inflation rates, and interest rate policies, as these factors significantly impact the stock market.

Fundamental analysis involves evaluating a company's financial health, including its revenues, profits, debt levels, and management quality. Examine the company's annual reports, quarterly earnings releases, and financial ratios like Price-to-Earnings (P/E), Price-to-Book (P/B), and Debt-to-Equity (D/E). Understand the company's business model, competitive landscape, and growth prospects. Utilize resources like company websites, financial news websites, and research reports from reputable analysts.

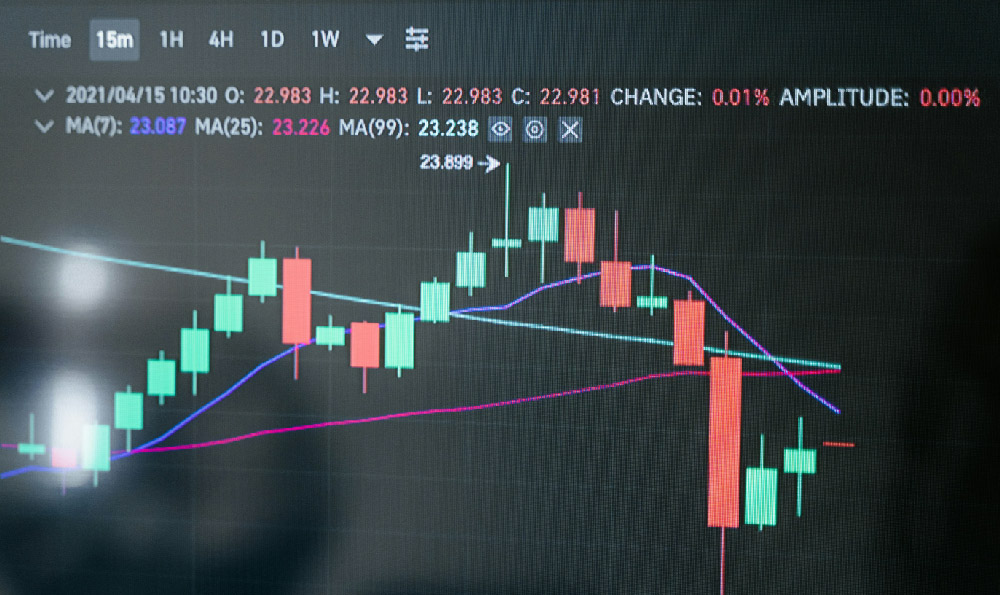

Technical analysis, on the other hand, involves studying historical price and volume data to identify patterns and trends that can predict future price movements. This includes using charts, indicators like Moving Averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence), and candlestick patterns. While technical analysis can be helpful for short-term trading, it's important to remember that it's not foolproof and should be used in conjunction with fundamental analysis.

Before investing in any stock, conduct thorough due diligence. Understand the risks associated with the company and the industry it operates in. Avoid blindly following tips or recommendations from unverified sources. Develop your own investment thesis based on your research and analysis. It's also wise to diversify your portfolio by investing in different sectors and companies to mitigate risk. Don't put all your eggs in one basket.

Once you have identified potential investment opportunities, you can place orders through your trading account. There are different types of orders, including market orders (which execute immediately at the current market price), limit orders (which execute only when the price reaches a specified level), and stop-loss orders (which automatically sell your shares if the price falls below a certain level, helping to limit your losses). Understanding these order types is essential for effective risk management.

Finally, and critically, monitor your investments regularly. Keep track of the performance of your portfolio and make adjustments as needed. The stock market is dynamic, and economic conditions, company performance, and market sentiment can change rapidly. Be prepared to re-evaluate your investment thesis and make informed decisions based on new information. Stay disciplined and avoid emotional trading, which can lead to impulsive decisions and losses. Learn from your mistakes and continuously improve your investment knowledge and skills. Remember that investing is a long-term game, and patience and perseverance are key to success. Regularly reviewing and rebalancing your portfolio helps to ensure that your asset allocation aligns with your investment goals and risk tolerance. Consider consulting with a financial advisor for personalized guidance and support. Investing in the Indian stock exchanges requires a commitment to continuous learning and a disciplined approach to risk management.