Natural gas, a crucial energy source powering homes and industries, presents a compelling yet complex investment opportunity. The allure of high returns often clashes with the inherent volatility of the natural gas market. Deciding whether to approach natural gas investing as a strategic guide or a high-stakes gamble hinges on understanding the market dynamics, available investment vehicles, and, most importantly, your own risk tolerance.

Understanding the Natural Gas Market Landscape

Before diving into investment strategies, grasping the fundamentals of the natural gas market is paramount. The price of natural gas is influenced by a multitude of factors:

- Supply and Demand: This is the most fundamental driver. Supply is affected by production levels (drilling activity, technological advancements), storage levels, and imports. Demand fluctuates seasonally (heating in winter, cooling in summer), driven by power generation, industrial consumption, and exports (Liquefied Natural Gas - LNG).

- Weather Patterns: Extreme weather events, such as unusually cold winters or hot summers, can significantly impact demand, leading to price spikes. Weather forecasts are closely monitored by traders.

- Economic Growth: A robust economy typically leads to increased industrial activity, boosting natural gas demand. Conversely, economic slowdowns can dampen demand.

- Government Regulations: Policies regarding energy production, emissions standards, and infrastructure development can have a profound impact on the natural gas market.

- Geopolitical Events: International conflicts, political instability in gas-producing regions, and disruptions to pipelines can all influence prices.

- Storage Levels: The amount of natural gas stored in underground facilities provides a buffer against supply disruptions and demand surges. Storage levels are closely monitored and reported by government agencies.

Exploring Natural Gas Investment Avenues

Several avenues exist for investors looking to participate in the natural gas market, each with its own risk-reward profile:

- Natural Gas Futures Contracts: Futures contracts obligate the buyer to purchase or the seller to deliver a specified quantity of natural gas at a predetermined price and date. These are highly leveraged instruments, meaning a small price change can result in significant gains or losses. Futures are generally suitable for sophisticated investors with a high-risk tolerance. The high leverage can amplify both gains and losses.

- Natural Gas Exchange-Traded Funds (ETFs): These funds track the price of natural gas futures or a basket of natural gas-related companies. ETFs offer a more diversified and accessible way to invest in natural gas than directly trading futures. However, it's crucial to understand how the ETF is structured and what assets it holds. Some ETFs track short-term futures contracts, which can be subject to "contango," a phenomenon where the price of future contracts is higher than the spot price, leading to erosion of returns over time.

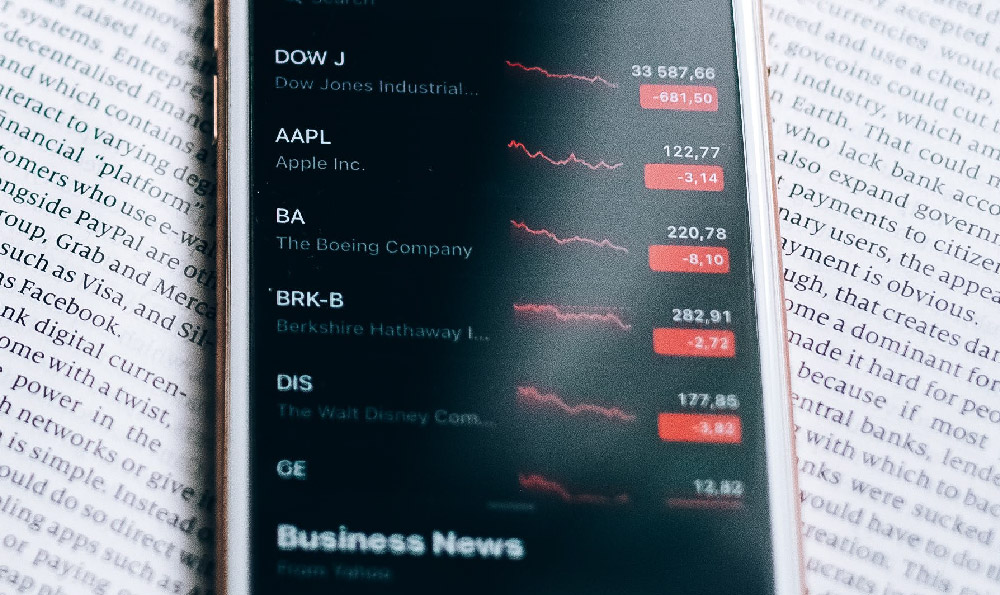

- Natural Gas Stocks: Investing in companies involved in the exploration, production, transportation, and distribution of natural gas offers another way to gain exposure to the market. These stocks can be less volatile than futures or ETFs that directly track natural gas prices, but their performance is also tied to the overall health of the company and the broader stock market. Analyzing financial statements and understanding the company's operations is crucial before investing in natural gas stocks.

- Master Limited Partnerships (MLPs): MLPs are publicly traded partnerships that own and operate energy infrastructure assets, such as pipelines and storage facilities. They typically offer attractive dividend yields but have unique tax implications. Understanding the MLP structure and its tax implications is essential.

Crafting a Prudent Investment Strategy

The optimal strategy for investing in natural gas depends on individual circumstances, risk tolerance, and investment goals. Here's a framework for developing a sound approach:

- Assess Your Risk Tolerance: Determine how much risk you are comfortable taking. Natural gas investments can be highly volatile, so only invest capital you can afford to lose.

- Define Your Investment Goals: Are you seeking short-term gains or long-term growth? Your investment timeline will influence your choice of investment vehicles and strategies.

- Conduct Thorough Research: Understand the fundamentals of the natural gas market, the specific investment vehicles you are considering, and the companies you are investing in.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket. Allocate a portion of your portfolio to natural gas, but also diversify across other asset classes.

- Consider Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of the price of natural gas. This can help mitigate the risk of buying high and lower your average cost per share over time.

- Monitor Your Investments Regularly: Stay informed about market developments and adjust your strategy as needed.

- Seek Professional Advice: If you are unsure about how to invest in natural gas, consult with a qualified financial advisor.

The Verdict: Guide, Gamble, or Informed Decision?

Natural gas investing isn't inherently a gamble, but it can quickly become one without proper knowledge and planning. A well-researched and carefully executed strategy transforms the venture from a blind gamble into an informed decision, guided by market understanding and risk management. The best strategy combines understanding market fundamentals, selecting appropriate investment vehicles, and diligently monitoring the investment. Approach natural gas investing with a clear understanding of the risks involved, a well-defined strategy, and a commitment to ongoing learning. This is the roadmap to turning a potential gamble into a strategically guided investment.