Okay, here's an article addressing the money-making options for a 12-year-old, with a focus on safety, ethical considerations, and getting started, written in a professional and informative tone, without using numbered lists or introductory phrases like "Firstly."

The question of how a 12-year-old can start earning money is a significant one, often sparking discussions about responsibility, financial literacy, and the delicate balance between childhood and entrepreneurship. Navigating this territory requires careful consideration of age-appropriateness, legal restrictions, and the potential for both personal growth and unforeseen risks. While the landscape of available options might seem limited, it's surprising how much a motivated young person can achieve with the right guidance and a bit of creativity.

Traditional avenues like babysitting (where age regulations permit and with appropriate certification), lawn mowing, and pet-sitting remain viable choices. These activities not only offer a direct exchange of labor for income but also foster important life skills such as responsibility, time management, and customer service. The key to success in these endeavors lies in building a strong reputation within the local community. Word-of-mouth referrals are invaluable, and creating simple flyers or utilizing local online groups can significantly expand reach. Pricing should be competitive yet reflect the quality of service provided. Crucially, adult supervision and support are essential, especially when dealing with strangers or handling significant sums of money. It's advisable for a parent or guardian to be involved in initial client interactions and to oversee the financial aspects.

Beyond these established options, the digital age presents a plethora of new opportunities, albeit ones that require even greater scrutiny. Creating and selling digital artwork, designing simple websites for local businesses (with appropriate training and supervision), or offering online tutoring services (in subjects where the child excels) can be lucrative. However, it's imperative to prioritize online safety and privacy. Any online activity should be conducted under the watchful eye of a parent or guardian, and personal information should never be shared with strangers. Platforms like Etsy (with parental approval and account management) can provide a safe environment for selling crafts or digital products.

Another avenue, increasingly popular, involves content creation. Starting a YouTube channel, writing a blog, or creating content on platforms like TikTok can generate income through advertising, sponsorships, and affiliate marketing. However, this path demands a significant time commitment and consistent effort. Furthermore, understanding the nuances of copyright law, advertising regulations, and platform monetization policies is crucial. Parental guidance is paramount in navigating these complex issues and ensuring that the content created is appropriate, ethical, and adheres to legal requirements. It's important to emphasize the importance of originality and avoiding plagiarism, as well as being mindful of the potential impact of online content on future opportunities.

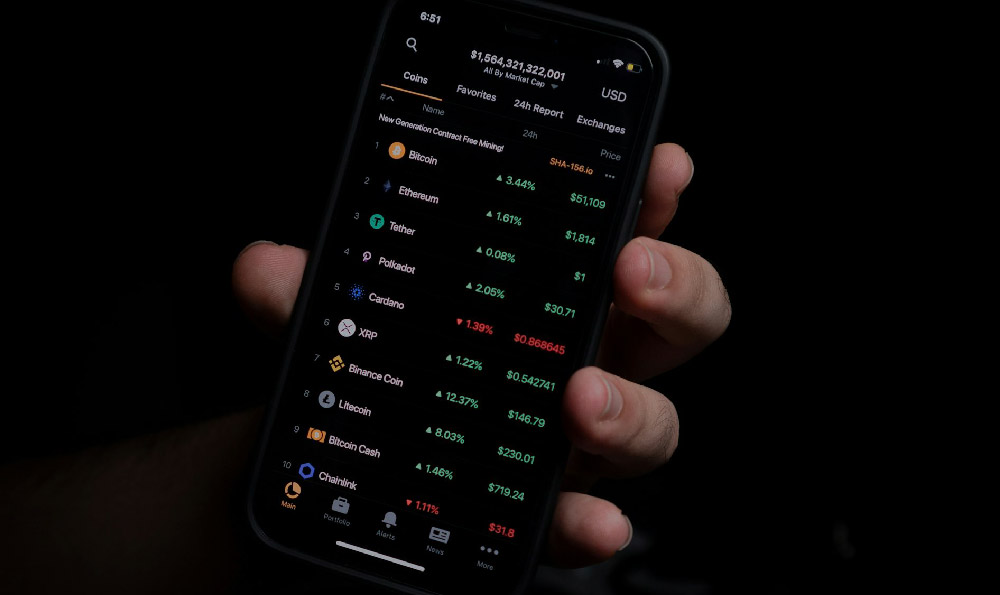

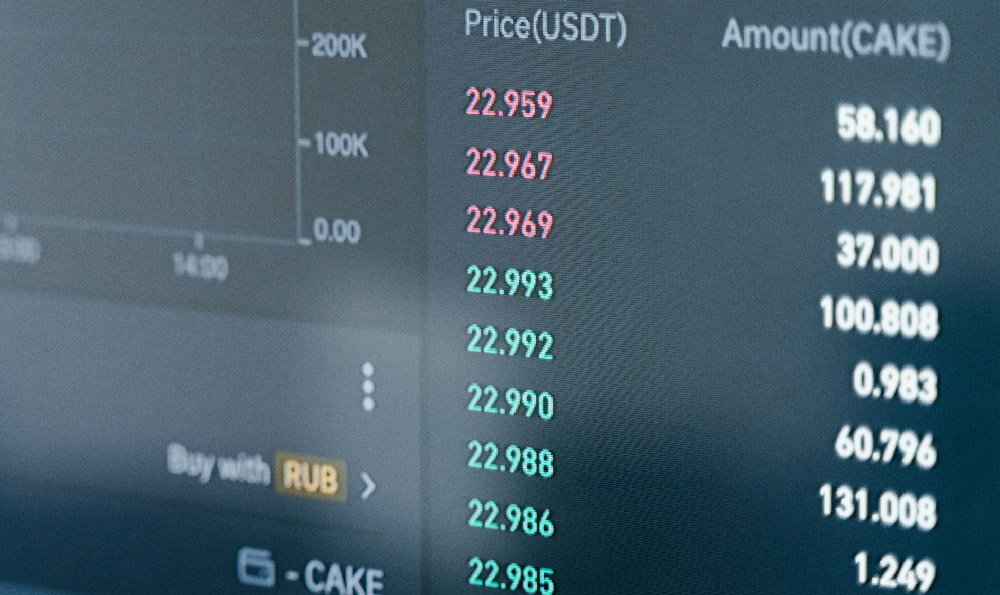

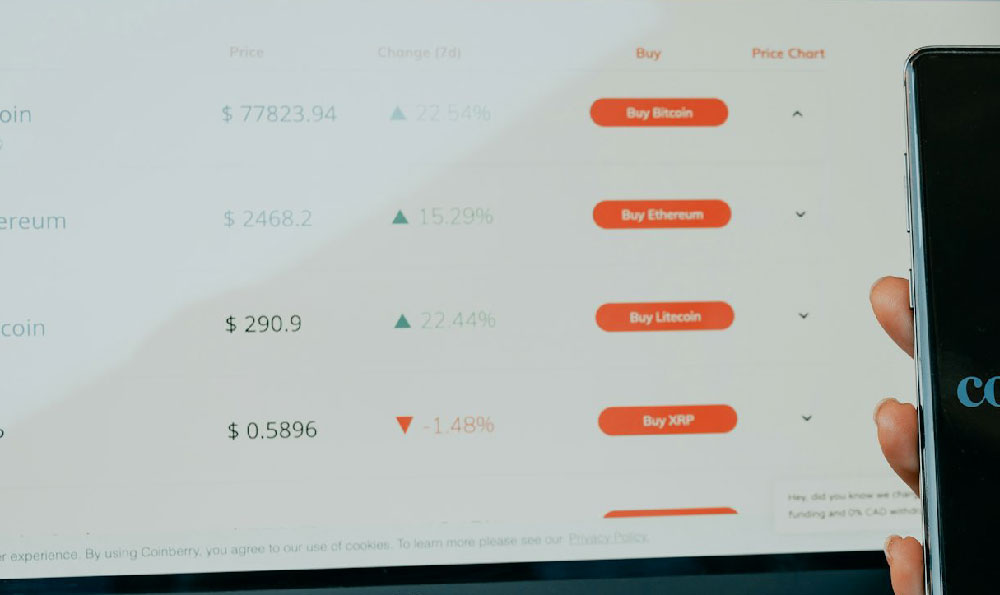

However, it is vital to emphasize the investment aspect. The stock market and, by extension, cryptocurrency markets, are generally unsuitable for a 12-year-old. The inherent risks associated with these investments, coupled with the lack of understanding of market dynamics, make them a potentially dangerous area. While learning about finance is commendable, actively participating in speculative investments should be delayed until adulthood.

Instead, focus should be placed on building financial literacy and fostering responsible spending habits. Opening a savings account or a custodial account (under the supervision of a parent or guardian) allows the child to learn about interest, budgeting, and the importance of saving for future goals. Setting realistic financial goals, such as saving for a specific item or contributing to a charitable cause, can further motivate responsible financial behavior. Teaching the difference between needs and wants, and encouraging mindful spending, will lay a solid foundation for financial success in the future.

Regarding how to get started, the first step involves a conversation with parents or guardians. This discussion should cover the child's interests, skills, and the amount of time they are willing to dedicate to earning money. Together, they can research age-appropriate options, assess the potential risks and benefits, and establish clear guidelines and expectations.

Building a support network is equally important. Connecting with other young entrepreneurs, mentors, or experienced adults can provide valuable advice, encouragement, and resources. Local community centers, youth organizations, and online forums (under adult supervision) can serve as valuable networking platforms.

Finally, documenting the entire process is beneficial. Keeping track of income and expenses, recording customer feedback, and reflecting on both successes and failures provides valuable learning opportunities and helps develop essential business skills. This documentation can also be useful for tax purposes, although the earnings of a 12-year-old are unlikely to reach the threshold for tax liability.

In conclusion, enabling a 12-year-old to earn money can be a positive and empowering experience, fostering financial literacy, responsibility, and valuable life skills. However, it requires careful consideration of age-appropriateness, legal regulations, and the potential risks involved. By prioritizing safety, providing guidance, and fostering responsible financial habits, parents and guardians can help young people navigate the world of earning money and lay a solid foundation for future financial success. The focus should be on learning, growth, and building a strong foundation for responsible financial decision-making, rather than solely on maximizing immediate profits.