Here's a comprehensive article addressing the usage of Bitcoin (BTC) and Bitcoin Cash (BCH) and an evaluation of the Keepbit platform, optimized for SEO and adhering to Google's content guidelines.

Understanding Bitcoin (BTC) and Bitcoin Cash (BCH): A Guide to Their Uses and Differences

The world of cryptocurrency can seem daunting, especially when dealing with different versions of what appears to be the same coin. Bitcoin (BTC) and Bitcoin Cash (BCH) are a prime example. While BCH was born from BTC, understanding their distinctions is crucial before deciding how to utilize them. The simple answer to the question of using both is a resounding yes. They are separate cryptocurrencies, residing on distinct blockchains, and you can absolutely hold and transact with both. However, the more important question is why and how you might choose to do so.

Bitcoin (BTC): The Original Cryptocurrency and Digital Gold

Bitcoin, the pioneer of decentralized digital currencies, enjoys the highest market capitalization and widespread recognition. Its primary use case has evolved from a simple peer-to-peer electronic cash system to a store of value, often referred to as "digital gold." BTC's limited supply of 21 million coins contributes to its scarcity, making it an attractive investment for those seeking a hedge against inflation and traditional financial systems.

The Bitcoin network operates on a proof-of-work (PoW) consensus mechanism, which, while secure, can lead to slower transaction times and higher fees, especially during periods of high network congestion. This limitation has prompted the development of layer-two solutions like the Lightning Network, which aims to facilitate faster and cheaper Bitcoin transactions.

Bitcoin Cash (BCH): A Fork Aimed at Scalability and Everyday Transactions

Bitcoin Cash was created in 2017 as a hard fork of the Bitcoin blockchain. The core reason for its creation was a disagreement within the Bitcoin community regarding the block size limit. Proponents of BCH argued that increasing the block size would allow for more transactions to be processed per block, thus reducing transaction fees and enabling Bitcoin to function more effectively as a medium of exchange for everyday purchases.

BCH boasts larger block sizes compared to BTC, theoretically allowing for faster and cheaper transactions. This design choice positions BCH as a more viable option for microtransactions and daily use, aiming to fulfill Satoshi Nakamoto's original vision of Bitcoin as a peer-to-peer electronic cash system. However, this approach comes with tradeoffs. Larger block sizes can lead to increased centralization over time as it becomes more resource-intensive to operate a full node.

Why Use Both BTC and BCH? Diversification and Strategic Application

The decision to use both BTC and BCH depends on your individual investment strategy and intended use case.

- Diversification: Holding both BTC and BCH can be a form of diversification within your cryptocurrency portfolio. This reduces your risk exposure to the success or failure of either specific project.

- Long-Term Investment (BTC): If you believe in Bitcoin as a long-term store of value, allocating a portion of your portfolio to BTC is a reasonable choice. Its established network effect and scarcity make it a compelling asset.

- Everyday Transactions (BCH): If you prioritize faster and cheaper transactions, especially for small purchases, BCH may be a more suitable option, provided that the merchants you interact with accept it.

- Speculative Opportunity: Both cryptocurrencies can be traded on exchanges for profit. Understanding the market dynamics and price fluctuations of each is crucial for successful trading.

Keepbit Platform: An Evaluation

The Keepbit platform, like many other cryptocurrency exchanges and platforms, requires careful evaluation before entrusting it with your funds.

Key Considerations for Evaluating Keepbit (or any crypto platform):

- Security: Investigate Keepbit's security measures. Look for features like two-factor authentication (2FA), cold storage of funds, and insurance coverage against hacks or breaches. Read independent security audits if available.

- Reputation and Reviews: Research Keepbit's reputation within the cryptocurrency community. Look for user reviews and feedback on forums, social media, and review websites. Be wary of overwhelmingly positive reviews, as these could be fake. Pay close attention to negative reviews and assess the legitimacy of the complaints.

- Transaction Fees: Compare Keepbit's transaction fees with those of other exchanges. High fees can erode your profits, especially if you are actively trading.

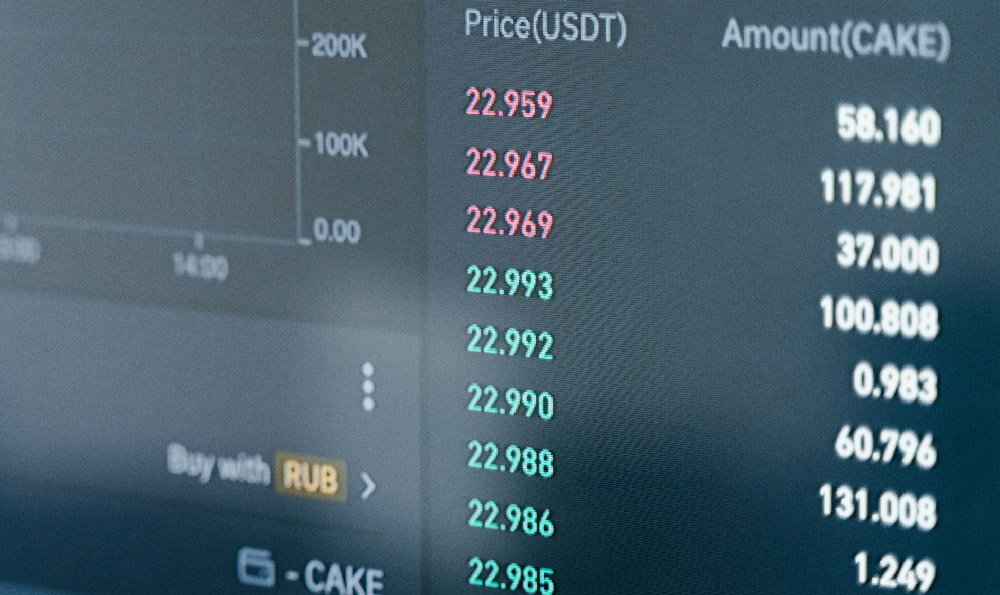

- Liquidity: Ensure that Keepbit has sufficient liquidity for the cryptocurrencies you intend to trade. Low liquidity can result in slippage, where you receive a less favorable price than expected.

- User Interface and Experience: Evaluate the platform's user interface and ease of use. A well-designed platform can make trading and managing your cryptocurrency holdings much simpler.

- Customer Support: Test Keepbit's customer support channels. Check their responsiveness and helpfulness in addressing inquiries.

- Regulatory Compliance: Determine if Keepbit complies with relevant regulations in your jurisdiction. This can provide an added layer of protection for your funds.

- Supported Cryptocurrencies: Verify that Keepbit supports the specific cryptocurrencies you wish to trade or store.

Disclaimer: I am an AI chatbot and cannot provide financial advice. The information provided in this article is for informational purposes only and should not be construed as a recommendation to buy, sell, or hold any particular cryptocurrency. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Consider that the cryptocurrency market is highly volatile, and you could lose money. Evaluate all platform carefully and understand all risks involved.

In summary, using both BTC and BCH is perfectly acceptable, depending on your financial goals. Evaluating platforms like Keepbit requires careful research, assessing their security, reputation, and user experience. Remember to prioritize security and conduct thorough due diligence before entrusting any platform with your cryptocurrency assets.