Okay, I'm ready to analyze Mitt Romney's financial success and its implications. Here's an essay fulfilling your requirements:

Mitt Romney's accumulation of wealth is a story deeply intertwined with the evolution of modern finance, private equity, and the political landscape. Understanding how he amassed his fortune requires delving into his career at Bain Capital, the intricacies of leveraged buyouts, and the broader economic forces that shaped his opportunities. Furthermore, the scrutiny surrounding his wealth isn't merely academic; it touches upon issues of tax policy, economic inequality, and the relationship between wealth, power, and political accountability.

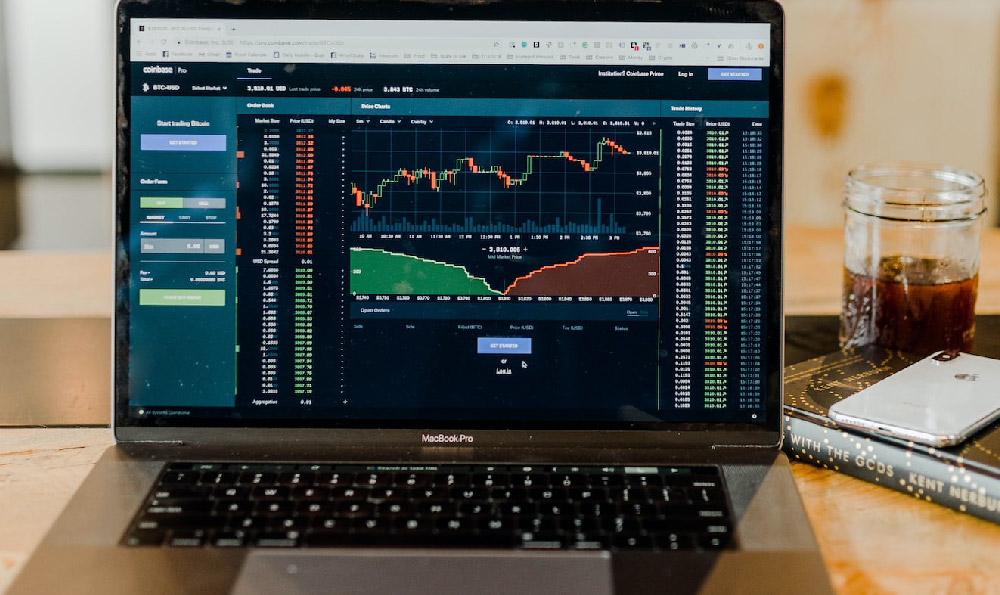

Romney's wealth primarily originated from his long and successful career at Bain Capital, a private equity firm he helped found. Private equity operates on a model of acquiring companies, often through leveraged buyouts – transactions where a significant portion of the purchase price is financed with debt. Bain Capital would then restructure the acquired companies, improve their operations, and ultimately sell them, ideally at a substantial profit. These profits were distributed among the firm's partners, including Romney.

The mechanics of leveraged buyouts are crucial to understanding how private equity firms generate returns. By using debt to finance acquisitions, the initial capital investment required by the firm is reduced. This allows for a higher return on equity if the acquired company performs well. However, it also places a significant burden on the acquired company, which must generate sufficient cash flow to service the debt. This often leads to cost-cutting measures, including layoffs, and a relentless focus on efficiency. While these measures can improve profitability, they can also have negative consequences for employees and communities.

Bain Capital's track record under Romney's leadership is a complex one. Some investments proved highly successful, generating significant returns for investors and creating jobs. Staples, for example, was an early Bain Capital investment that grew into a national chain. However, other investments resulted in job losses and financial distress for the acquired companies. The steel mill GS Technologies, later renamed GST Steel, filed for bankruptcy after Bain Capital's involvement, leading to the loss of hundreds of jobs. These cases highlight the inherent risks and potential downsides of the private equity model. The inherent tension lies in the pursuit of maximizing shareholder value, which doesn't always align with the interests of other stakeholders, such as employees or the broader community.

The tax treatment of carried interest also plays a significant role in understanding the financial landscape within which Romney and other private equity executives operated. Carried interest is the share of profits that private equity managers receive as compensation. Under current tax laws, carried interest is typically taxed at the capital gains rate, which is lower than the ordinary income tax rate. This has been a subject of considerable debate, with critics arguing that it provides an unfair tax advantage to wealthy investors. Romney himself has defended the tax treatment of carried interest, arguing that it incentivizes investment and job creation. However, proponents of reform argue that it disproportionately benefits the wealthy and contributes to income inequality. The discussion around carried interest reveals fundamental disagreements about fairness in the tax system and the appropriate level of taxation for different types of income.

The public scrutiny of Romney's wealth intensified during his presidential campaigns. His tax returns were closely examined, revealing complex financial arrangements and investments held in offshore accounts. While these arrangements were legal, they raised questions about his commitment to paying his fair share of taxes and his understanding of the economic challenges faced by ordinary Americans. The sheer scale of his wealth also became a point of contention, fueling debates about income inequality and the influence of money in politics. Critics argued that Romney's background in private equity made him out of touch with the struggles of working-class families and that his policies would disproportionately benefit the wealthy.

Moreover, his defense of his business practices and wealth accumulation were often perceived as tone-deaf during a period of economic hardship for many Americans. His comments about the "47 percent" of Americans who pay no income taxes were particularly damaging, reinforcing the perception that he was disconnected from the concerns of a large segment of the population. These gaffes highlighted the challenges faced by wealthy candidates in connecting with voters who are struggling financially.

Beyond the individual case of Mitt Romney, the broader implications of wealth accumulation and its role in society deserve consideration. In an era of increasing income inequality, the concentration of wealth in the hands of a few raises fundamental questions about fairness, opportunity, and social mobility. While wealth creation is essential for economic growth, it is also important to ensure that the benefits of growth are shared more broadly. This requires addressing systemic issues such as access to education, affordable healthcare, and fair wages.

Ultimately, understanding how Mitt Romney made his money matters because it sheds light on the evolving nature of capitalism, the complexities of the financial system, and the ongoing debate about the role of wealth in a democratic society. His career at Bain Capital exemplifies the potential rewards and inherent risks of private equity, while the scrutiny surrounding his wealth highlights the challenges of navigating the political landscape in an era of economic inequality. It forces us to confront uncomfortable questions about fairness, opportunity, and the responsibility of the wealthy to contribute to the common good. The story isn't just about one man's success; it's about the system that enabled it and the questions it raises about the future of our economy and our society.