Alright, let's delve into the realm of millionaires and their wealth-building strategies. The pursuit of financial independence and substantial wealth is a common aspiration, but understanding the actual mechanics behind millionaires' success often unveils a multifaceted picture that extends beyond mere luck.

Millionaires, in general, don't simply stumble into wealth. Their journey typically involves a deliberate combination of disciplined saving, strategic investment, and an understanding of risk management. One of the bedrock principles many adhere to is delayed gratification. Rather than indulging in immediate consumption, they prioritize saving a significant portion of their income. This savings rate is often far higher than the average person's, allowing them to accumulate capital more rapidly. This initial capital then becomes the seed for further investment and growth.

Beyond sheer saving, millionaires typically deploy their capital across a diverse range of asset classes. Relying on a single source of income or investment is generally considered too risky. Diversification, a key risk management technique, helps mitigate potential losses by spreading investments across various sectors, industries, and even geographic regions. This can include stocks, bonds, real estate, commodities, and increasingly, alternative investments like private equity or venture capital.

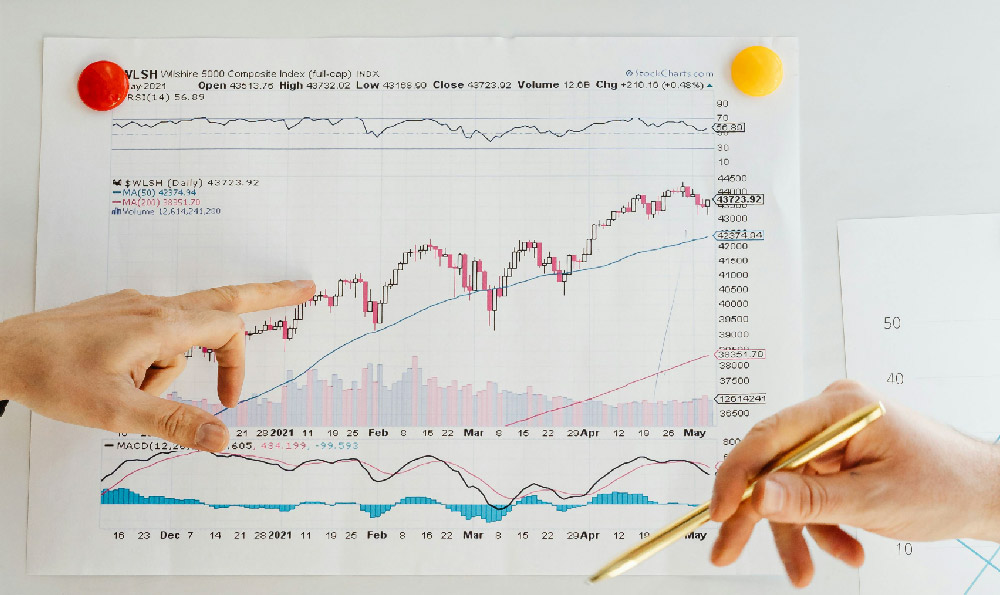

Stocks, particularly those of well-established and growing companies, represent a significant component of many millionaires' portfolios. They understand that while the stock market can be volatile in the short term, historically, it has provided attractive long-term returns. They also favor investing in high-growth sectors and emerging markets, recognizing the potential for outsized gains. However, they don't blindly chase returns; rather, they conduct thorough research, analyze company financials, and assess industry trends before making investment decisions. Value investing, a strategy of purchasing undervalued assets with the expectation of future appreciation, is also a popular approach.

Real estate, often viewed as a tangible and relatively stable asset, also plays a crucial role. Millionaires might own residential properties, commercial buildings, or land. They leverage the power of rental income and property appreciation to generate wealth. Furthermore, they understand the importance of strategic location and property management to maximize their returns. While real estate can be illiquid compared to stocks, it offers the potential for long-term capital gains and a hedge against inflation.

Bonds, while generally offering lower returns than stocks, provide stability and income within a portfolio. Millionaires utilize bonds to balance their overall risk profile and provide a source of cash flow, especially during economic downturns. They might invest in government bonds, corporate bonds, or municipal bonds, depending on their individual risk tolerance and investment goals.

Beyond traditional investments, many millionaires are increasingly exploring alternative investments. Private equity, venture capital, and hedge funds offer the potential for higher returns but also come with increased risk and illiquidity. These investments often require significant capital and sophisticated knowledge, making them more suitable for accredited investors with a higher risk tolerance.

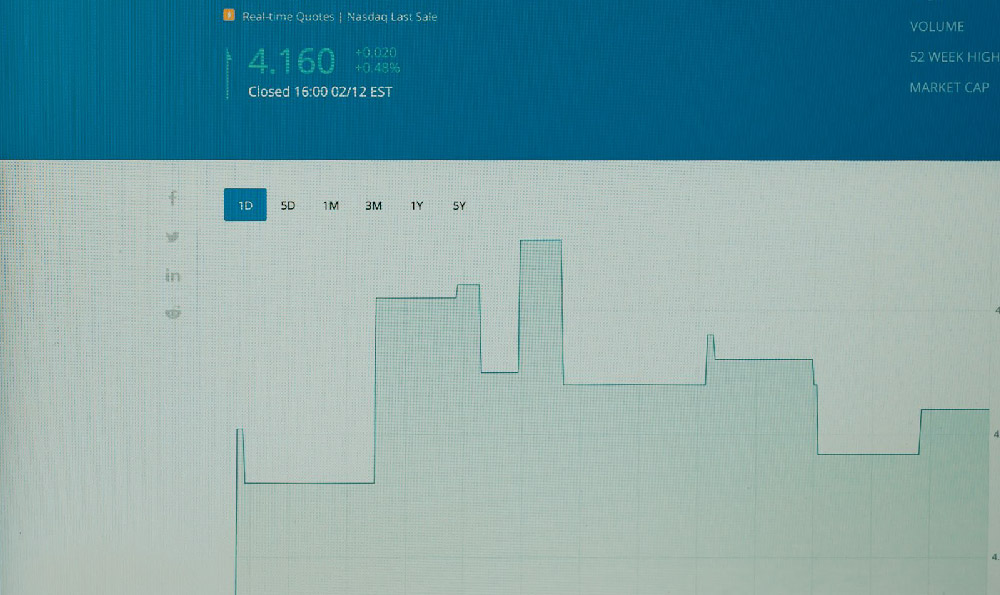

Now, turning specifically to the world of cryptocurrencies. While some millionaires may be hesitant to fully embrace this nascent asset class, others recognize the potential for significant gains and are allocating a portion of their portfolio to cryptocurrencies like Bitcoin or Ethereum. However, they approach this investment with extreme caution and a deep understanding of the underlying technology and market dynamics.

They understand that the cryptocurrency market is highly volatile and subject to regulatory uncertainty. Therefore, they typically invest a small percentage of their overall portfolio in cryptocurrencies, ensuring that potential losses do not significantly impact their overall financial well-being. They also conduct thorough research on the specific cryptocurrencies they are considering, evaluating their technological capabilities, market adoption, and security features. Diversification within the cryptocurrency space is also crucial, spreading investments across multiple cryptocurrencies to mitigate the risk of any single cryptocurrency failing.

Moreover, millionaires who invest in cryptocurrencies are often active participants in the blockchain community, staying informed about industry developments and regulatory changes. They understand the importance of securing their cryptocurrency holdings through hardware wallets and other security measures to protect against hacking and theft.

Furthermore, a crucial element often overlooked is the millionaire's mindset. They possess a long-term perspective, focusing on building wealth over time rather than chasing short-term gains. They are patient and disciplined, sticking to their investment strategies even during market volatility. They are also continuously learning and adapting to changing market conditions, seeking out new investment opportunities and refining their strategies. A growth mindset, a belief in their ability to improve and learn new skills, is also common.

Another factor is their proactive approach to financial management. Millionaires typically work with financial advisors, tax professionals, and estate planning attorneys to ensure that their wealth is managed efficiently and effectively. They understand the importance of minimizing taxes and protecting their assets for future generations. They regularly review their financial plans and make adjustments as needed to reflect changes in their circumstances and the market environment.

Entrepreneurship is another common path to wealth. Starting and scaling a successful business can generate significant wealth, but it also requires hard work, dedication, and risk-taking. Many millionaires are entrepreneurs who have built successful businesses from the ground up. They are passionate about their work and are willing to take calculated risks to achieve their goals.

Finally, the ability to identify and capitalize on opportunities is a key differentiator. Millionaires are often astute observers of the market and are able to spot trends and opportunities before others do. They are not afraid to invest in innovative companies or technologies, even if they are considered risky. They are also adept at negotiating deals and securing financing.

In conclusion, becoming a millionaire is not about getting rich quick; it's about building wealth slowly and deliberately through disciplined saving, strategic investment, and a long-term perspective. It requires a commitment to continuous learning, a proactive approach to financial management, and a willingness to take calculated risks. While the specific strategies may vary depending on individual circumstances and market conditions, the underlying principles remain the same. It's a marathon, not a sprint.