Embarking on the investment journey can feel daunting, but with the right approach and foundational knowledge, it's an achievable goal for anyone, regardless of their current financial situation. The key is to start small, learn consistently, and tailor your investment strategy to your individual circumstances and risk tolerance. Think of it as learning a new language; you wouldn't expect to be fluent overnight, but with consistent effort and the right tools, you can certainly achieve proficiency.

Before diving into specific investment products, it's crucial to establish a solid financial foundation. This means creating a budget, tracking your income and expenses, and identifying areas where you can save more money. Building an emergency fund is paramount. This fund, ideally containing three to six months' worth of living expenses, acts as a safety net, preventing you from having to sell investments at a loss to cover unexpected costs like medical bills or job loss. Paying off high-interest debt, such as credit card debt, should also be a priority. The interest rates on these debts can significantly erode your potential investment returns, making it more advantageous to eliminate them before investing aggressively.

Once your financial house is in order, you can begin exploring the world of investing. A logical first step is to understand the fundamental concepts that underpin successful investing. This includes understanding risk and return. Every investment carries a certain level of risk, and generally, higher potential returns come with higher risks. Learn to assess your own risk tolerance – how comfortable are you with the possibility of losing money in exchange for potentially higher gains? This will significantly influence your investment choices.

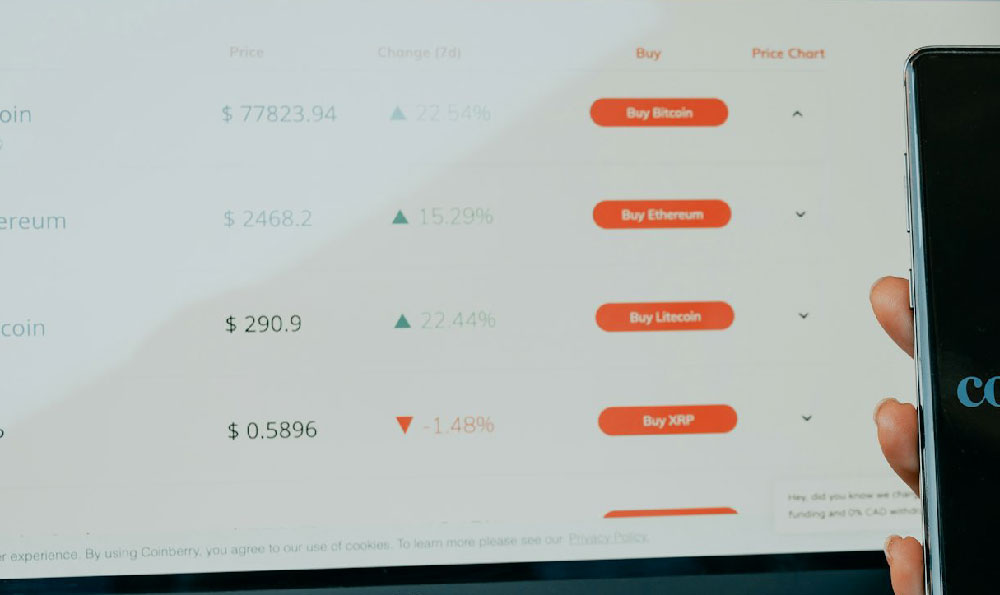

Another crucial concept is diversification. Don't put all your eggs in one basket. Spreading your investments across different asset classes, industries, and geographic regions can help mitigate risk. If one investment performs poorly, the others may cushion the impact. Consider investments like stocks (representing ownership in companies), bonds (loans to governments or corporations), and real estate (property). Each asset class has its own risk and return profile, and a well-diversified portfolio will include a mix of these.

Understanding the power of compounding is also essential. Compounding refers to the process of earning returns on your initial investment, as well as on the accumulated returns. Over time, this can lead to exponential growth of your wealth. The earlier you start investing, the more time your money has to compound, making even small investments potentially significant over the long term.

Now, what specific investments should you consider when starting out? For beginners, index funds and Exchange-Traded Funds (ETFs) are often recommended. These are investment funds that track a specific market index, such as the S&P 500. They offer instant diversification and typically have low expense ratios (fees). Investing in an S&P 500 index fund, for example, gives you exposure to the 500 largest publicly traded companies in the United States. This is a simple and cost-effective way to get broad market exposure.

Another popular option is target-date retirement funds. These funds automatically adjust their asset allocation over time, becoming more conservative as you approach your target retirement date. They are designed for long-term investing and offer a hands-off approach to asset allocation.

When choosing a brokerage account, consider factors such as fees, investment options, research tools, and customer service. Many online brokers offer commission-free trading, making it more affordable to invest in small amounts. Look for brokers that provide educational resources and tools to help you make informed investment decisions.

Beyond the basics, continuous learning is crucial for successful investing. Read books on personal finance and investing, follow reputable financial news sources, and consider taking online courses or workshops. Understanding financial statements, analyzing market trends, and staying informed about economic developments can all help you become a more knowledgeable and confident investor.

Avoid get-rich-quick schemes and be wary of investments that sound too good to be true. Investing is a long-term game, and patience is key. Don't panic sell during market downturns. Instead, view them as opportunities to buy more investments at lower prices. Remember that market fluctuations are a normal part of investing, and trying to time the market is often a losing proposition.

Finally, consider seeking professional financial advice if you feel overwhelmed or uncertain. A financial advisor can help you create a personalized investment plan based on your goals, risk tolerance, and time horizon. They can also provide ongoing guidance and support as your financial situation evolves. While there are costs associated with financial advice, the benefits of having a professional help you navigate the complexities of the investment world can outweigh the costs. Starting small, learning consistently, and seeking professional guidance when needed are the keys to building a successful investment portfolio and achieving your financial goals.