Navigating the world of side hustles and generating extra income is an increasingly common pursuit, driven by factors ranging from supplemental income needs to entrepreneurial aspirations. The phrase "under the table" often conjures images of clandestine activities, but its essence revolves around transactions that circumvent formal reporting channels, specifically to tax authorities. This creates a critical juncture: legality and safety become paramount considerations. Engaging in practices that skirt the edges of the law, even with good intentions, can lead to serious repercussions, undermining the very financial stability you're striving to achieve.

The allure of undeclared income is undeniable. It presents a seemingly direct route to increasing your cash flow without the immediate burden of taxation. However, this immediate gain can mask significant long-term risks. Tax evasion is a federal offense, carrying penalties ranging from substantial fines and interest charges to potential imprisonment. The IRS possesses sophisticated mechanisms for detecting discrepancies between reported income and actual earnings, including data matching with banks, payment processors, and even social media platforms. A seemingly minor omission can trigger an audit, revealing the full extent of unreported income and leading to a cascade of legal and financial challenges.

Beyond the legal implications, safety is a crucial factor. Undeclared income often relies on informal arrangements, lacking the legal protections afforded by formal employment contracts or documented transactions. This can leave you vulnerable to exploitation, non-payment, or disputes without recourse. For instance, if you're providing freelance services and your client refuses to pay, pursuing legal action becomes significantly more difficult, if not impossible, without proper documentation. Moreover, operating outside the formal economy deprives you of benefits such as worker's compensation insurance, unemployment benefits, and the ability to build a verifiable credit history.

Considering the inherent risks, exploring legitimate avenues for generating extra income is not just prudent; it's essential for long-term financial well-being. The gig economy offers a plethora of opportunities, from online freelancing platforms to ride-sharing services and delivery apps. While these activities require reporting income and paying taxes, they provide a structured framework with clear terms of service, payment guarantees (through the platform), and often, some form of dispute resolution mechanism.

Furthermore, building a sustainable side hustle involves strategic planning and financial literacy. Instead of focusing on methods that circumvent regulations, invest your time and effort in developing marketable skills, establishing a professional online presence, and understanding your tax obligations. Consider consulting with a tax professional to ensure you're complying with all applicable laws and maximizing deductions. Tracking your income and expenses meticulously is crucial, not only for tax purposes but also for managing your finances effectively.

Another avenue for generating extra income involves leveraging existing assets. Renting out a spare room through platforms like Airbnb, renting your car when not in use, or selling unused items online can provide a consistent stream of income without resorting to undeclared activities. These options offer transparency and accountability, allowing you to build a positive reputation and establish a reliable income source.

Moreover, consider the opportunity cost of engaging in "under the table" activities. The time and energy spent on clandestine endeavors could be better invested in building a legitimate business, acquiring new skills, or pursuing higher education. These long-term investments have the potential to generate significantly greater returns and provide a more secure financial future.

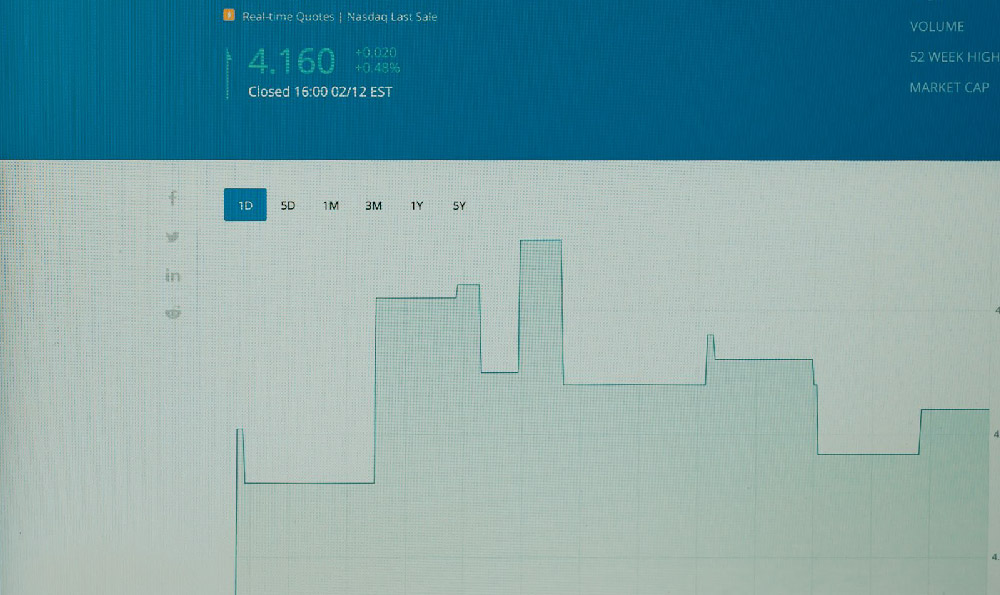

Embrace the power of financial planning. Even small amounts of extra income can make a significant difference when strategically invested. Setting clear financial goals, creating a budget, and exploring various investment options, such as stocks, bonds, or real estate, can help you build wealth over time. The key is to adopt a disciplined approach, avoid impulsive decisions, and seek professional advice when needed.

In conclusion, while the temptation to earn extra money "under the table" may seem appealing in the short term, the legal and financial risks far outweigh the perceived benefits. Prioritizing transparency, compliance, and long-term financial sustainability is crucial for achieving lasting financial security. Exploring legitimate avenues for income generation, building marketable skills, and developing a sound financial plan are the cornerstones of a secure and prosperous future. Remember, true financial success lies not in shortcuts, but in informed decisions, diligent effort, and a commitment to ethical practices.