Rental property, a tangible asset with the allure of passive income and long-term appreciation, often finds itself at the crossroads of investment wisdom and potential peril. The question of whether it's a wise investment or a risky gamble is far from a simple yes or no. It hinges on a confluence of factors, demanding a nuanced understanding of market dynamics, financial acumen, and personal risk tolerance.

On the surface, the appeal is undeniable. Owning a rental property allows investors to generate consistent cash flow through rental income. This income stream, ideally exceeding mortgage payments, property taxes, insurance, and maintenance expenses, can provide a reliable source of passive income, supplementing existing earnings or even serving as a primary source of revenue. Furthermore, the potential for long-term appreciation adds another layer of attractiveness. As property values generally rise over time, the investment can yield significant capital gains upon eventual sale. The physical nature of real estate offers a sense of security, particularly in times of economic uncertainty, as it provides a tangible asset that can weather market volatility better than some paper assets. Tax advantages also play a crucial role in the appeal. Deductions for mortgage interest, depreciation, and operating expenses can significantly reduce taxable income, boosting overall returns.

However, the road to rental property success is rarely paved with gold. It's a landscape fraught with potential pitfalls that can quickly transform a promising investment into a financial burden. Vacancy is a perennial concern. An empty property generates no income, yet expenses continue to accrue. Extended vacancies can severely impact cash flow, potentially leading to financial strain. Tenant management presents another set of challenges. Dealing with late payments, property damage, and tenant disputes can be time-consuming, stressful, and costly. Landlord-tenant laws vary significantly by jurisdiction, requiring landlords to stay informed and compliant to avoid legal complications.

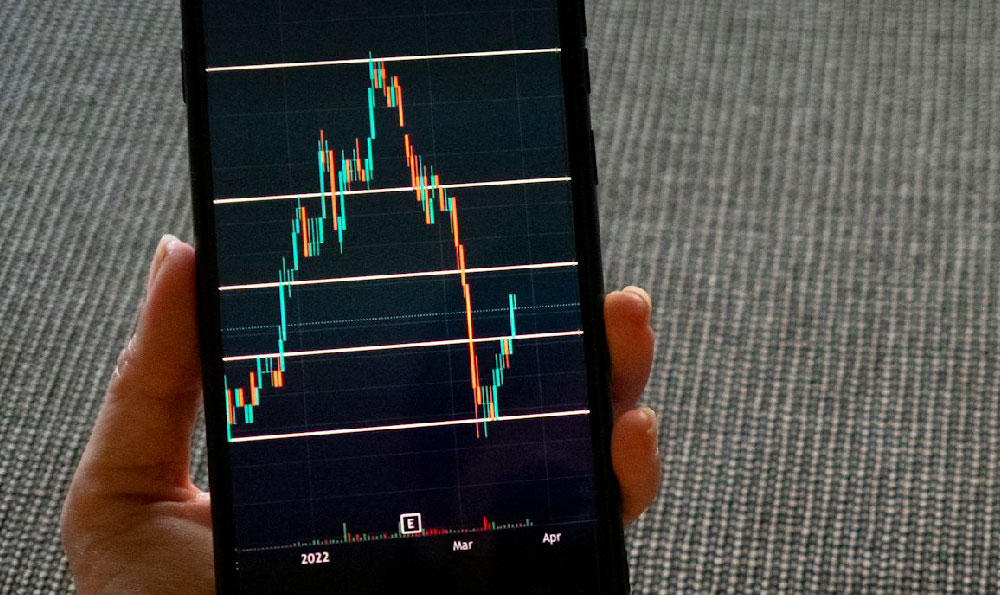

Maintenance and repairs are unavoidable aspects of property ownership. Unexpected repairs, such as a burst pipe or a faulty HVAC system, can quickly erode profits. Regular maintenance, while necessary to preserve property value and attract tenants, also adds to the expense. Furthermore, property taxes and insurance rates can fluctuate, impacting profitability. Market fluctuations represent a significant risk. Real estate markets are cyclical, and property values can decline, especially during economic downturns. Buying at the peak of the market can lead to negative equity, where the outstanding mortgage balance exceeds the property's value. Illiquidity is another key consideration. Unlike stocks or bonds, real estate is not easily converted to cash. Selling a property can take time, and there's no guarantee of finding a buyer at the desired price, potentially creating a liquidity crunch. Interest rate hikes can also dampen the enthusiasm for investing in rental properties, because it increases the cost of borrowing money. If mortgage rates are high, it will be much more difficult to profit from a rental property.

Before venturing into the world of rental properties, a thorough due diligence process is paramount. Researching the local market is crucial. Understanding rental demand, vacancy rates, average rents, and property values in the target area is essential for making informed decisions. Conducting a comprehensive financial analysis is equally important. Estimating potential rental income, factoring in all expenses, and calculating key metrics such as cash flow, return on investment (ROI), and capitalization rate (cap rate) will provide a realistic assessment of the property's profitability. A professional property inspection is a non-negotiable step. Identifying potential problems, such as structural issues, plumbing defects, or electrical hazards, can help avoid costly surprises down the road. Securing adequate insurance coverage is vital to protect against potential losses from fire, natural disasters, or liability claims.

Developing a robust management strategy is critical for maximizing returns and minimizing risks. Deciding whether to self-manage or hire a property manager is a key consideration. Self-management can save money on management fees, but it requires significant time and effort. Hiring a property manager can free up time and provide professional expertise, but it comes at a cost. Implementing a thorough tenant screening process is essential for selecting responsible and reliable tenants. Conducting credit checks, background checks, and rental history verification can help minimize the risk of late payments, property damage, and evictions. Establishing clear and comprehensive lease agreements is crucial for defining the rights and responsibilities of both the landlord and the tenant. Regularly inspecting the property and promptly addressing maintenance issues can help preserve its value and maintain tenant satisfaction.

Ultimately, the decision of whether rental property is a wise investment or a risky gamble depends on individual circumstances, financial goals, and risk tolerance. A well-researched, strategically managed rental property can be a valuable asset in a diversified investment portfolio, generating passive income and long-term appreciation. However, a poorly planned, ill-managed property can quickly become a financial drain, leading to frustration and losses. Approaching rental property investment with a cautious, informed, and disciplined mindset is essential for maximizing the potential rewards and mitigating the inherent risks. Diversification is also a key strategy in mitigating risk. Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce the impact of market fluctuations on your overall portfolio.

Therefore, rather than viewing rental property as inherently good or bad, consider it a tool. Like any tool, its effectiveness depends on the skill and knowledge of the user. With careful planning, diligent management, and a healthy dose of realism, rental property can be a powerful instrument for building wealth. Without these elements, it can easily become a source of financial hardship.