Individual Retirement Accounts (IRAs) have long been a cornerstone of retirement planning, offering individuals a way to save for the future while benefiting from tax incentives designed to encourage long-term wealth accumulation. In recent years, the intersection of traditional retirement vehicles and modern digital assets has become increasingly relevant, particularly with the rise of cryptocurrencies. This convergence presents unique opportunities for both income generation and capital preservation, but it also requires careful consideration of regulatory frameworks, market dynamics, and strategic investment approaches. For those seeking to leverage IRAs to invest in tax-advantaged assets that include cryptocurrencies, understanding the nuances of this integration is essential to navigating a complex and evolving financial landscape.

The tax advantages of IRAs are rooted in their structure, which allows for either tax-deferred growth or tax-free growth depending on the type of account. Traditional IRAs, for example, offer contributions that may be tax-deductible, with earnings growing tax-free until withdrawal. Roth IRAs, on the other hand, require after-tax contributions but allow for tax-free withdrawals in retirement. When incorporating cryptocurrencies into these portfolios, investors must weigh how the specific tax treatment of each account aligns with the volatility and regulatory uncertainty inherent to digital assets. Regulatory clarity in the United States is gradually improving, with the Internal Revenue Service (IRS) clarifying that cryptocurrency transactions are treated as property for tax purposes. This classification means that capital gains taxes apply to profits from trades, and investors must report these gains on their tax returns. However, the institutionalization of crypto within retirement frameworks is still in its infancy, with many custodians offering limited or no support for digital asset storage. For those intrigued by the prospect of harnessing crypto's growth potential within an IRA, it is crucial to explore custodians that provide secure, compliant, and diversified investment solutions.

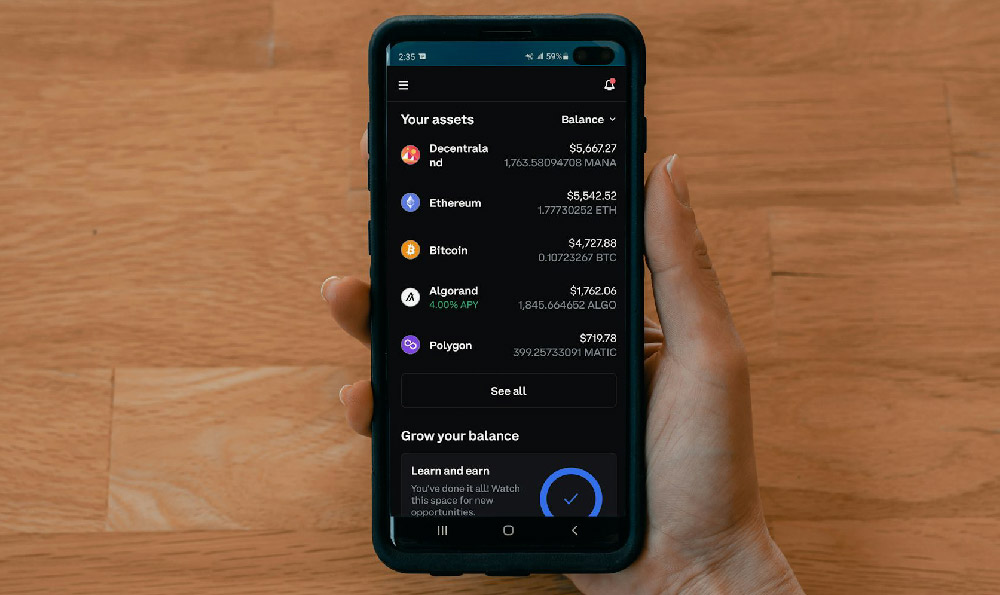

Cryptocurrencies, as a class of assets, present a compelling case for inclusion in tax-advantaged portfolios due to their potential for high returns and the compounding effect they can generate over time. Unlike traditional assets such as stocks or bonds, which have historically shown steady growth, cryptocurrencies have demonstrated explosive growth in certain periods, driven by technological innovation, adoption trends, and macroeconomic factors. For instance, the adoption of blockchain technology by corporations and governments has spurred interest in digital assets, while global events like geopolitical tensions or changes in monetary policy have influenced market sentiment. Moreover, the ability to invest in a diversified range of cryptocurrencies, including Bitcoin, Ethereum, and emerging altcoins, allows for a broader risk profile. However, the high volatility of these assets necessitates a strategic approach to portfolio management that balances potential rewards with prudent risk mitigation.

One of the most effective strategies for leveraging IRAs in crypto investments is to prioritize long-term holding and compounding. This approach aligns with the core principles of retirement planning, where sustained growth over decades is more valuable than short-term spikes. By investing in a diversified portfolio of cryptocurrencies through a tax-advantaged IRA, individuals can benefit from the compounding effect of returns while minimizing the impact of short-term market fluctuations. Additionally, the use of dollar-cost averaging (DCA) can be particularly advantageous for those new to crypto investing, as it involves investing a fixed amount regularly regardless of market conditions. This method reduces the risk associated with timing the market and ensures steady capital allocation to digital assets over time.

Another critical aspect is the importance of portfolio diversification. Unlike traditional IRAs, which typically focus on stocks, bonds, and mutual funds, crypto portfolios can include a variety of assets with different risk profiles and growth potentials. This diversification not only helps spread risk across multiple sectors but also allows for exposure to new technologies and market trends. For example, investing in a mix of established cryptocurrencies like Bitcoin and emerging projects in decentralized finance (DeFi) or non-fungible tokens (NFTs) can create a more resilient portfolio. However, diversification must be balanced with careful research and due diligence to avoid overexposure to risky or speculative assets.

Risk management is equally paramount in this context. Cryptocurrencies are inherently volatile, and their integration into a retirement portfolio requires a robust framework to navigate market downturns. This includes setting clear investment goals, allocating capital based on risk tolerance, and implementing strategies such as stop-loss orders or hedging techniques. Additionally, the heightened risk of fraud and market manipulation in the crypto space necessitates the use of secure storage solutions, such as cold wallets or institutional-grade crypto custodians, to protect against theft or hacking. For those considering this approach, it is also essential to stay informed about regulatory developments and market trends to make timely and informed decisions.

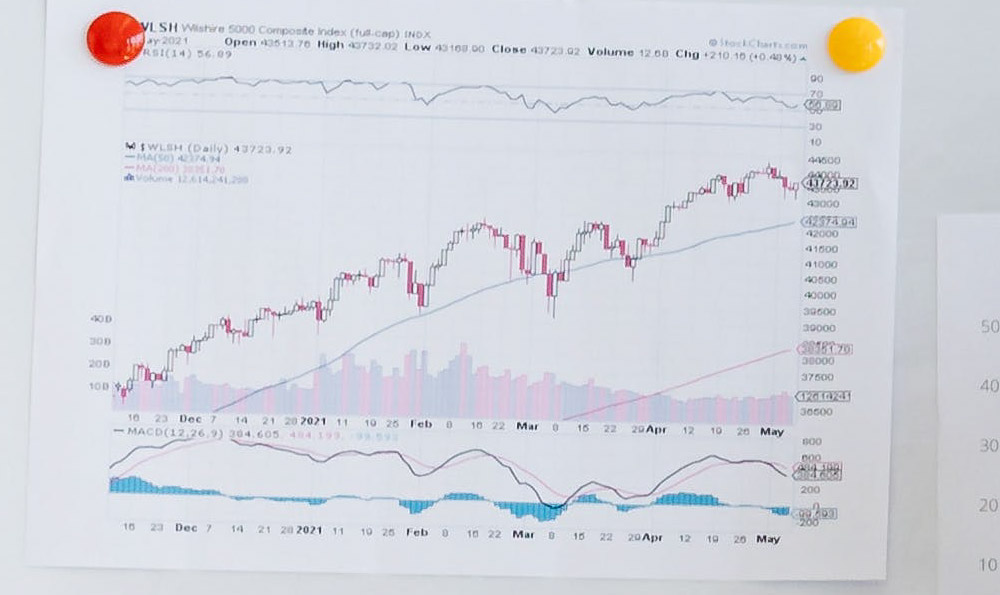

The long-term growth potential of cryptocurrencies within an IRA is closely tied to their adoption rate and technological advancements. As global economies increasingly integrate blockchain technology into financial systems, the value of digital assets is expected to rise, creating opportunities for substantial returns. However, this growth trajectory is not linear, and investors must be prepared to weather short-term volatility. The ability to invest in a tax-advantaged account means that gains can compound over time without being subject to immediate taxation, providing a significant advantage for long-term wealth accumulation.

In conclusion, the integration of cryptocurrencies into IRAs offers a unique opportunity to leverage tax-advantaged investments for long-term financial growth. However, this requires a careful balance of strategic planning, risk management, and regulatory awareness. By adopting a diversified approach, focusing on long-term holding, and utilizing secure storage solutions, investors can harness the potential of digital assets while minimizing their exposure to risks. As the market continues to evolve, staying informed and adaptable will be key to maximizing the benefits of this innovative investment strategy.