Here's an article addressing the safety and investment potential of USDC, optimized for SEO and reader engagement:

USDC: Navigating the Stability and Risks of This Popular Stablecoin

Stablecoins have emerged as a pivotal element in the cryptocurrency landscape, offering a bridge between the volatile world of digital assets and the relative stability of traditional fiat currencies. Among the leading stablecoins, USD Coin (USDC) stands out due to its focus on transparency, regulatory compliance, and widespread adoption. However, the question remains: Is USDC truly safe, and should it be a part of your investment portfolio? Understanding the nuances of USDC is crucial before making any investment decisions.

What Exactly is USDC and How Does It Work?

USDC is a stablecoin pegged to the US dollar on a 1:1 basis. This means that for every USDC in circulation, there is supposed to be one US dollar (or assets of equivalent fair value) held in reserve. These reserves are held in custody accounts with regulated financial institutions, and regular audits are conducted by independent accounting firms to verify the accuracy of these holdings. This mechanism is designed to ensure that USDC maintains its stability and that users can redeem their USDC for US dollars at any time. The issuance and redemption of USDC are managed by Circle, a fintech company, and Coinbase, a cryptocurrency exchange, through a consortium called Centre.

The Allure of USDC: Why Investors Are Drawn to It

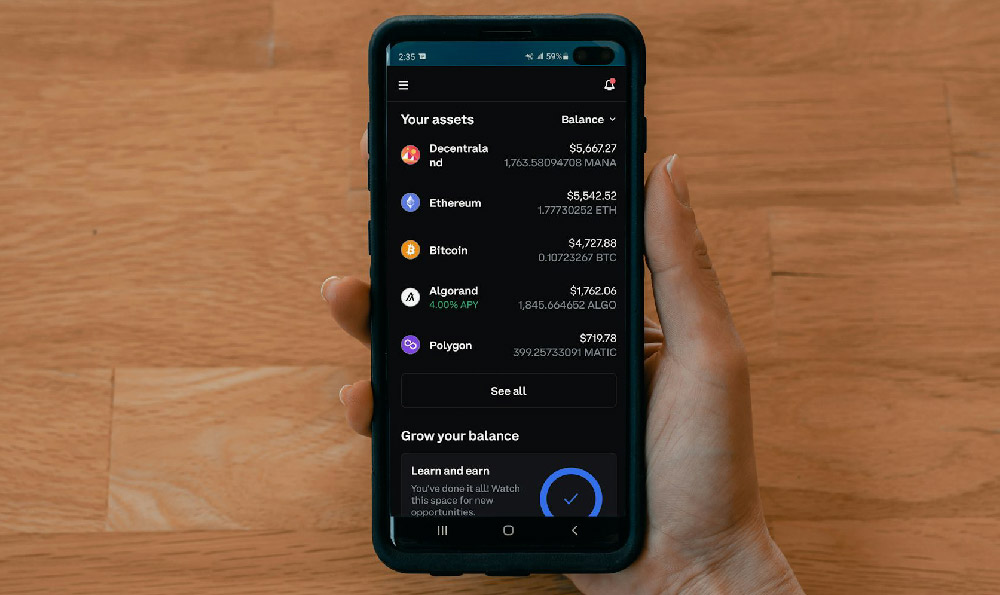

The appeal of USDC stems from several key advantages. First and foremost is its stability. In a market characterized by wild price swings, USDC provides a haven for investors looking to preserve their capital or temporarily park their funds. This makes it particularly useful for traders looking to take profits or wait for better entry points into other cryptocurrencies.

Secondly, USDC offers easy accessibility to the crypto ecosystem. It's widely listed on numerous cryptocurrency exchanges and DeFi platforms, allowing users to seamlessly transfer funds between different platforms and participate in various decentralized finance activities. This accessibility makes it a convenient on-ramp and off-ramp for fiat currency.

Furthermore, USDC's transparency and regulatory compliance contribute to its perceived safety. Circle publishes monthly attestation reports from Grant Thornton LLP, providing assurance regarding the reserves backing USDC. This level of transparency helps build trust and distinguishes USDC from other stablecoins with less transparent backing.

Assessing the Risks: Where Could USDC Fall Short?

Despite its advantages, USDC is not without its risks. One of the primary concerns revolves around reserve management. While Circle claims to hold reserves equal to the amount of USDC in circulation, the composition of these reserves has been a subject of scrutiny. Initially, a portion of the reserves included commercial paper, which are short-term unsecured debt instruments. While Circle has since shifted its reserves to consist primarily of cash and US Treasury securities, the risk of unforeseen events impacting the value of these reserves remains a possibility.

Another potential risk lies in regulatory uncertainty. The regulatory landscape surrounding stablecoins is still evolving, and stricter regulations could potentially impact the operations of Circle and the overall stability of USDC. Changes in regulations could affect how USDC is issued, redeemed, and used.

Moreover, counterparty risk is also a factor to consider. USDC relies on regulated financial institutions to hold its reserves. While these institutions are generally considered safe, the possibility of bank failures or other unforeseen events impacting the safety of these reserves cannot be entirely ruled out. The failure of one or more of these institutions could create a liquidity crisis.

Finally, smart contract risk is inherent in any cryptocurrency. Although USDC itself is not a decentralized application (dApp), it is frequently used in DeFi protocols, which are governed by smart contracts. Bugs or vulnerabilities in these smart contracts could potentially lead to the loss of funds.

Is USDC Right for Your Investment Portfolio? A Balanced Perspective

Whether or not to invest in USDC depends on your individual investment goals, risk tolerance, and understanding of the associated risks.

For investors seeking a stable store of value within the cryptocurrency space, USDC can be a viable option. Its peg to the US dollar and focus on transparency make it a relatively safe haven compared to other cryptocurrencies.

For those looking to earn passive income through DeFi protocols, USDC can be used to provide liquidity and earn interest or rewards. However, it's crucial to carefully research the DeFi platforms you're using and understand the associated risks of impermanent loss and smart contract vulnerabilities.

Before investing in USDC, it's important to conduct your own research and understand the risks involved. Keep an eye on Circle's reserve composition, regulatory developments, and potential risks associated with the broader cryptocurrency market.

Comparing USDC to Other Stablecoins

USDC is not the only stablecoin available. Other popular options include Tether (USDT), Dai (DAI), and Binance USD (BUSD). Each stablecoin has its own strengths and weaknesses.

USDT is the most widely used stablecoin, but it has faced criticism regarding its transparency and reserve backing. DAI is a decentralized stablecoin backed by a basket of cryptocurrencies, making it more resistant to censorship but also potentially more volatile. BUSD is another stablecoin backed by Binance, a cryptocurrency exchange, and is subject to similar regulatory considerations as USDC.

When choosing a stablecoin, it's important to consider factors such as transparency, regulatory compliance, liquidity, and perceived risk.

Conclusion: Informed Decision-Making with USDC

USDC offers a compelling combination of stability, accessibility, and transparency, making it a popular choice for investors in the cryptocurrency space. However, it's essential to be aware of the risks involved, including reserve management, regulatory uncertainty, counterparty risk, and smart contract vulnerabilities. By carefully weighing the potential benefits and risks, and conducting thorough research, you can make an informed decision about whether USDC is the right investment for your portfolio. Consider your risk tolerance, investment goals, and the broader market conditions before allocating any capital to USDC. Remember, diversification is key to managing risk in any investment portfolio, including cryptocurrencies.