Investing in EnergyX, or any cryptocurrency related to the energy sector, presents a unique opportunity to tap into the intersection of two rapidly evolving industries: finance and energy. Understanding the potential benefits and navigating the initial steps requires a diligent and informed approach. Let's delve into the advantages and a practical guide to getting started.

One of the primary benefits of investing in EnergyX stems from the inherent growth potential within the energy sector itself. As the world transitions towards cleaner and more sustainable energy sources, companies and technologies focused on renewable energy, energy storage, and grid optimization are poised for significant expansion. EnergyX, acting as a facilitator or infrastructure component within this ecosystem, could potentially benefit from this overall growth. Think of it like investing in the internet backbone in the early 2000s. Specific projects leveraging EnergyX might involve tokenizing renewable energy credits, streamlining the process of funding renewable energy projects, or enabling peer-to-peer energy trading on a decentralized platform. The utility of EnergyX, should it gain widespread adoption within a promising area of energy, will drive up demand and, theoretically, its value.

Furthermore, cryptocurrencies offer several advantages over traditional investment vehicles. They operate on decentralized networks, which can lead to greater transparency, efficiency, and security. In the context of energy, this could mean more transparent pricing, faster transactions, and reduced reliance on intermediaries. For example, if EnergyX is used to facilitate the trading of renewable energy certificates (RECs), it could potentially streamline the process, reduce fraud, and provide greater access to smaller energy producers. The 24/7 nature of cryptocurrency markets provides liquidity and allows investors to react quickly to market developments. However, this also implies the need for constant vigilance and risk management.

Another compelling benefit is the potential for portfolio diversification. Adding EnergyX to a portfolio that already includes traditional assets like stocks and bonds could reduce overall risk by providing exposure to a different asset class with low correlation. Cryptocurrencies, including EnergyX, can act as a hedge against inflation, as their supply is often limited or predetermined. This is particularly relevant in the current economic climate, where concerns about inflation are rising. It's vital to remember that cryptocurrency markets are highly volatile, and this diversification benefit only applies if it constitutes a small portion of the overall portfolio.

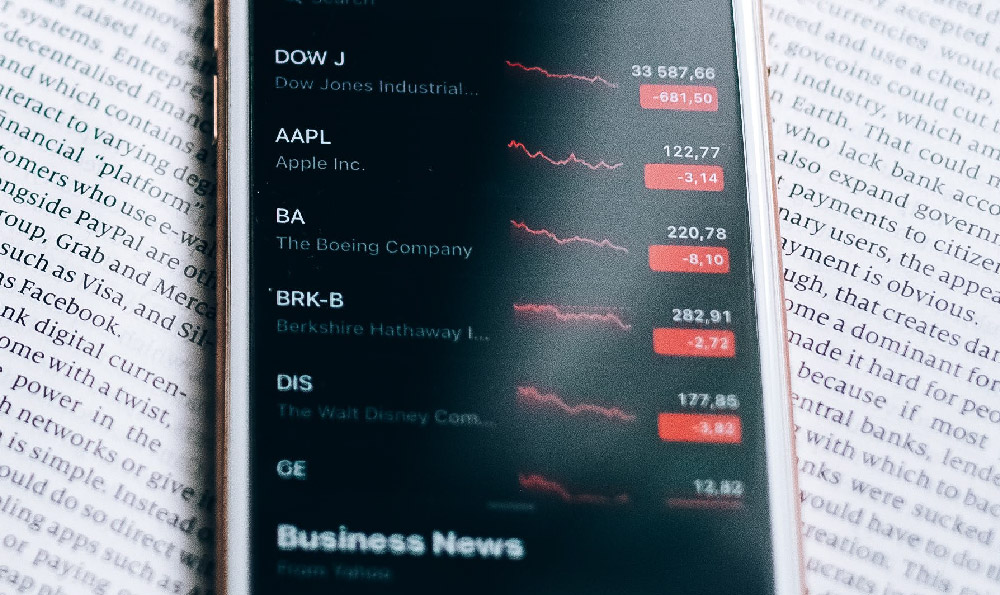

However, potential investors must understand the risks associated with investing in EnergyX, or any cryptocurrency. The cryptocurrency market is notorious for its volatility. Prices can fluctuate wildly in short periods, leading to significant losses. This volatility is driven by a variety of factors, including regulatory uncertainty, market sentiment, and technological developments. Therefore, it is crucial to approach this investment with a long-term perspective and a strong risk tolerance.

Another key risk is the regulatory landscape. The regulatory environment for cryptocurrencies is constantly evolving, and governments around the world are grappling with how to regulate this emerging asset class. Unfavorable regulations could negatively impact the value of EnergyX. It is also essential to research the specific technology and team behind EnergyX. Understanding the project's whitepaper, roadmap, and team members' experience is crucial for assessing its long-term viability. Scrutinize the project's partnerships, real-world adoption, and community engagement.

Finally, security is paramount. Cryptocurrencies are susceptible to hacking and theft. It is crucial to store your EnergyX tokens in a secure wallet, preferably a hardware wallet, and to follow best practices for online security, such as using strong passwords and enabling two-factor authentication. Never share your private keys with anyone.

So, how do you begin investing in EnergyX? The first step is to conduct thorough research. Understand the specific use case of EnergyX, its underlying technology, and its potential competitors. Read the project's whitepaper, follow industry news, and engage with the community on social media and forums. This research will help you make an informed decision about whether EnergyX aligns with your investment goals and risk tolerance.

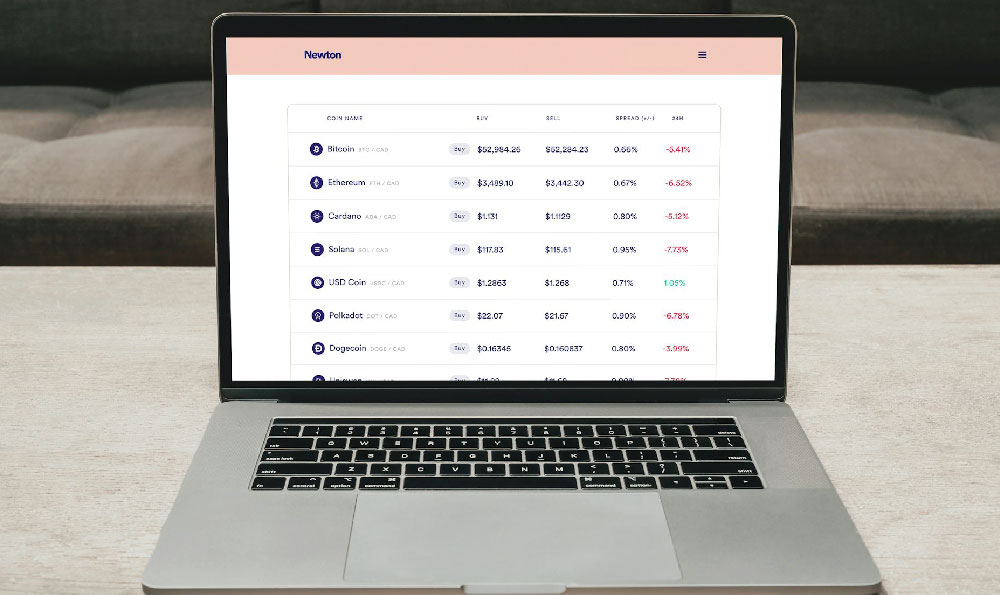

Once you have done your research, you will need to choose a cryptocurrency exchange that lists EnergyX. Popular exchanges include Binance, Coinbase, Kraken, and KuCoin, among others. Ensure the exchange is reputable, secure, and compliant with regulations. Create an account on the exchange and complete the necessary verification procedures.

Next, you will need to fund your account with fiat currency (e.g., USD, EUR) or other cryptocurrencies. Most exchanges offer a variety of funding options, including bank transfers, credit cards, and debit cards. Choose the option that is most convenient and cost-effective for you.

Once your account is funded, you can purchase EnergyX. Simply enter the amount of EnergyX you want to buy and execute the trade. Be mindful of the current market price and any fees associated with the trade. Consider using limit orders to buy EnergyX at a specific price, rather than market orders, which execute immediately at the current price.

After purchasing EnergyX, it is crucial to store your tokens securely. Leaving your tokens on the exchange carries the risk of hacking or theft. It is recommended to transfer your tokens to a personal wallet, preferably a hardware wallet, which provides the highest level of security.

Continuously monitor your investment and stay informed about developments in the cryptocurrency market and the energy sector. Adjust your investment strategy as needed based on market conditions and your risk tolerance. Remember that investing in cryptocurrencies is inherently risky, and it is essential to only invest what you can afford to lose.

In conclusion, investing in EnergyX offers potential benefits related to growth in the energy sector and the unique advantages of cryptocurrencies. However, it also carries significant risks, including volatility, regulatory uncertainty, and security threats. Approaching this investment with a well-informed, diligent, and cautious mindset is paramount for maximizing potential returns and minimizing potential losses. Remember to conduct thorough research, choose a reputable exchange, secure your tokens, and continuously monitor your investment.