Investing in the stock market can feel like stepping onto a rollercoaster – thrilling, a little daunting, and potentially rewarding if you know what you’re doing. The allure of stocks lies in their potential for growth, often outpacing other investment avenues like bonds or savings accounts over the long term. But where does a novice investor begin, and why might now be a particularly opportune time to consider dipping your toes into the equities market?

Let's address the 'where to begin' part first. The initial step is self-assessment. Before allocating even a single dollar, honestly evaluate your financial situation. This involves understanding your income, expenses, debts, and overall net worth. Constructing a detailed budget is crucial. This provides a clear picture of how much capital you can realistically afford to invest without jeopardizing your financial stability. Investing should be a surplus activity, not one that compromises your ability to meet essential obligations.

Next, defining your investment goals and risk tolerance is paramount. Are you investing for retirement, a down payment on a house, your children's education, or simply to grow your wealth? The timeframe for your goals significantly impacts the types of investments you should consider. For instance, if you're decades away from retirement, you can afford to take on more risk, potentially allocating a larger portion of your portfolio to stocks. Conversely, if you need the money in a few years, a more conservative approach with a greater allocation to bonds or other less volatile assets might be more suitable. Risk tolerance, on the other hand, reflects your comfort level with potential losses. Can you stomach seeing your portfolio value decline by 20% or 30% without panicking and selling? A higher risk tolerance generally allows for greater potential returns, but also carries the possibility of larger losses.

Once you have a clear understanding of your financial situation, goals, and risk tolerance, you can begin exploring different investment options. For beginners, Exchange-Traded Funds (ETFs) and mutual funds are excellent starting points. These investment vehicles offer instant diversification, spreading your investment across a basket of stocks, bonds, or other assets. Diversification is a crucial risk management strategy, as it reduces the impact of any single investment performing poorly. ETFs typically track a specific index, such as the S&P 500, providing broad market exposure at a low cost. Mutual funds are actively managed by professional fund managers who aim to outperform a specific benchmark. While actively managed funds may potentially generate higher returns, they also typically come with higher fees. Index funds, a type of passively managed mutual fund, mirror the performance of an index and offer a low-cost alternative.

Individual stocks can be tempting, promising potentially higher returns than ETFs or mutual funds. However, investing in individual stocks requires significantly more research and due diligence. You need to analyze the company's financial statements, understand its business model, assess its competitive landscape, and evaluate its management team. Picking individual stocks successfully requires time, effort, and a certain level of financial expertise. For beginners, it's generally advisable to start with ETFs or mutual funds and gradually transition to individual stocks as they gain more experience and knowledge.

Opening a brokerage account is the next practical step. Several online brokers offer commission-free trading, making it easier and more affordable to invest in stocks. Some popular options include Fidelity, Charles Schwab, and Robinhood. When choosing a broker, consider factors such as fees, account minimums, investment options, research tools, and customer support.

Now, addressing the 'why now?' aspect is crucial. The stock market is inherently cyclical, experiencing periods of growth and decline. While predicting the future is impossible, there are several factors that might make now a reasonably good time to consider investing.

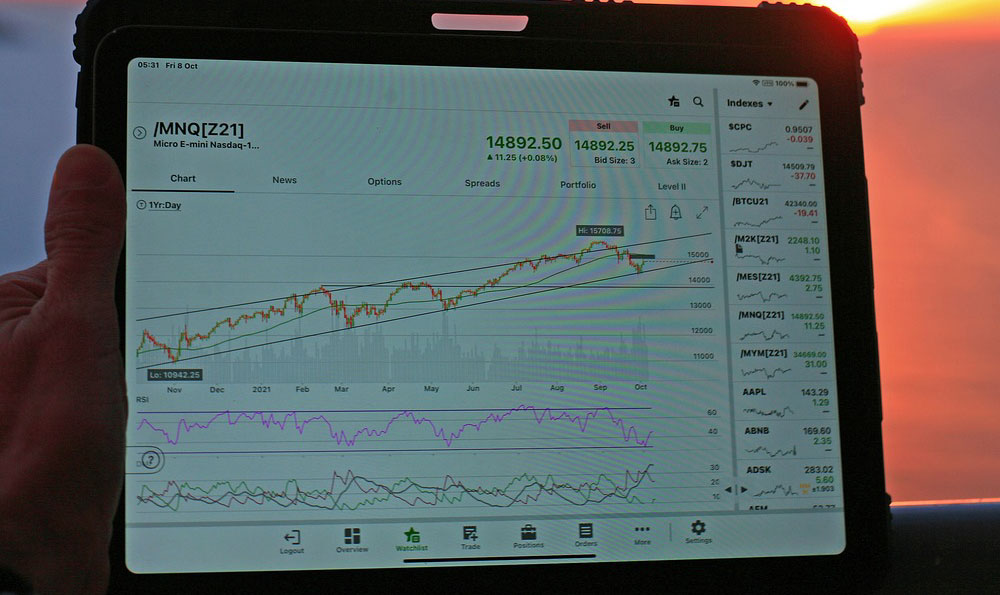

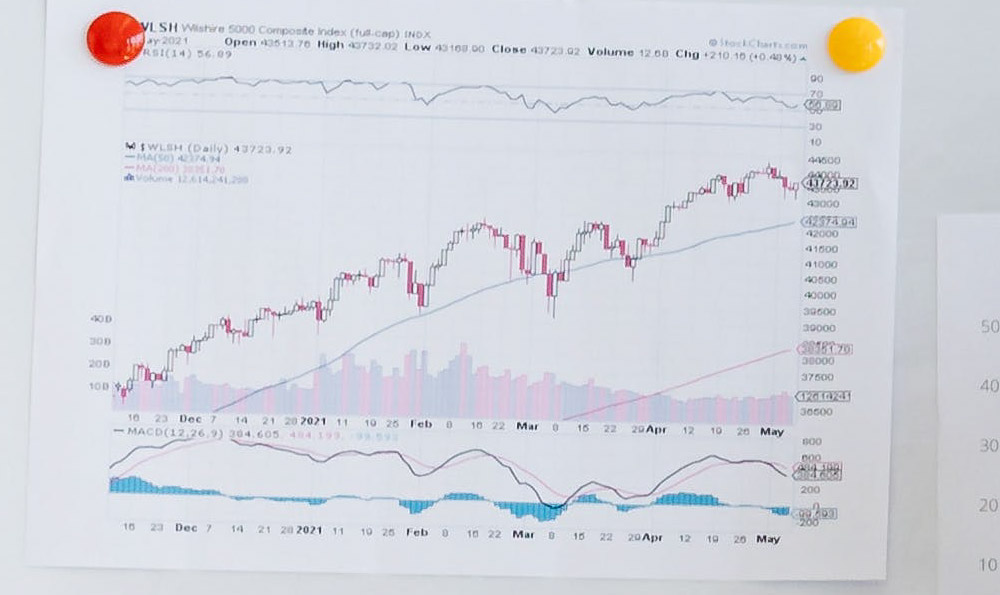

Firstly, economic conditions play a significant role. Monitoring key economic indicators like GDP growth, inflation, and interest rates can provide insights into the overall health of the economy and the potential direction of the stock market. While past performance is not indicative of future results, historically, periods of economic recovery have often been followed by periods of stock market growth.

Secondly, market corrections can present buying opportunities. A market correction is a decline of 10% or more in the stock market. While corrections can be unsettling, they also allow investors to buy stocks at lower prices. Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful." A market correction can be an opportunity to buy quality stocks at a discount.

Thirdly, long-term investing is key. Investing in the stock market is not a get-rich-quick scheme. It's a long-term strategy that requires patience and discipline. Trying to time the market is generally a losing game. Instead, focus on building a diversified portfolio of quality investments and holding them for the long term. The power of compounding, where your earnings generate further earnings, is a significant driver of wealth creation over time.

Finally, consider the alternative. Leaving money in a savings account earning minimal interest means that inflation erodes its purchasing power over time. Investing in the stock market, while riskier, offers the potential to outpace inflation and grow your wealth.

In conclusion, investing in stocks can be a rewarding endeavor, but it requires careful planning, research, and a long-term perspective. Start by assessing your financial situation, defining your goals and risk tolerance, and choosing appropriate investment vehicles. ETFs and mutual funds are excellent starting points for beginners. Open a brokerage account and begin investing gradually. Remember that the stock market is inherently cyclical, and market corrections can present buying opportunities. Most importantly, focus on building a diversified portfolio and holding it for the long term. While there are always risks involved, the potential rewards of investing in stocks can be significant, especially when approached with a well-thought-out strategy and a patient mindset. It's always wise to consult with a qualified financial advisor before making any investment decisions, as they can provide personalized guidance based on your specific circumstances.