Make Good Money Online Quickly: A Strategic Approach to Digital Wealth Generation

In the rapidly evolving digital landscape, the pursuit of financial growth has transcended traditional boundaries, giving rise to innovative opportunities that blend technology, market dynamics, and strategic foresight. While the allure of quick returns often tempts individuals into high-risk ventures, navigating this terrain requires a careful balance of adaptability, analytical rigor, and risk-aware decision-making. To achieve sustainable gains in online financial markets, one must first recognize that the path to prosperity is not built on shortcuts, but on informed choices and a deep understanding of the ecosystems in which digital assets operate.

The cryptocurrency market, for instance, has emerged as a prime example of this shift. Over the past decade, it has transformed from a niche industry into a global financial phenomenon, driven by technological advancements such as blockchain, decentralized finance (DeFi), and non-fungible tokens (NFTs). These innovations have created unique avenues for capital appreciation, yet their volatility and complexity demand more than superficial engagement. A strategic investor acknowledges that while the allure of rapid profits is enticing, long-term success in virtual currencies hinges on identifying trends, mastering technical analysis, and aligning investments with broader macroeconomic indicators. Unlike traditional markets, where stability is often the norm, the crypto sector thrives on disruption, requiring participants to think beyond conventional frameworks.

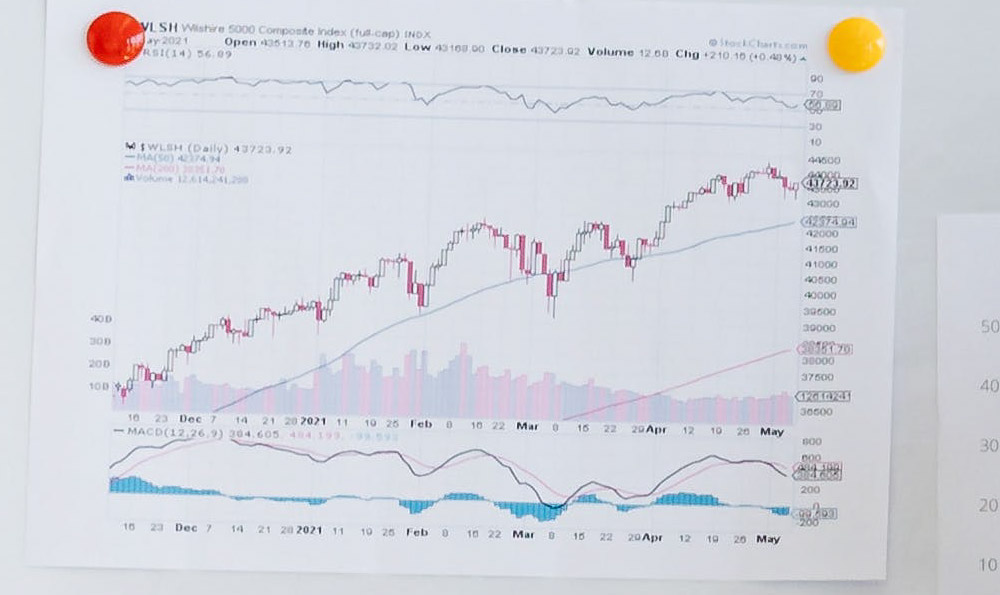

To leverage this opportunity effectively, one must study the interplay between market sentiment and technical signals. For example, the rise and fall of altcoins often correlates with broader economic factors, such as inflation rates, global trade tensions, and regulatory updates. A seasoned investor understands that sentiment analysis, derived from social media trends, news cycles, and institutional behavior, can provide early warnings about asset movements. However, this is not a substitute for understanding key technical indicators like moving averages, relative strength index (RSI), or Fibonacci retracements. These metrics help assess whether a price is overbought, oversold, or aligning with long-term trends—information that is critical for making decisions in fast-moving markets.

Yet, the road to quick returns is fraught with pitfalls. Many individuals are drawn to unverified projects or speculative trading strategies that promise exponential growth, only to face significant losses when the market corrects. A forward-thinking investor avoids these traps by prioritizing due diligence, such as evaluating a project's fundamentals, team credibility, and real-world utility. For example, the success of a cryptocurrency project often depends on its ability to solve a tangible problem, whether it's enabling cross-border payments, enhancing data security, or revolutionizing supply chains. Investors who recognize this axiom are more likely to invest in projects with enduring value rather than fleeting hype.

In addition to fundamentals, the role of liquidity in quick money generation cannot be overstated. Markets with high trading volumes allow for easier entry and exit, reducing slippage and enhancing profitability. Conversely, low-liquidity assets may experience extreme price fluctuations, making them unsuitable for short-term goals. A savvy participant learns to assess the market's depth and volume before committing capital, ensuring that their strategies align with the practical realities of trade execution.

The advent of new financial instruments, such as leveraged tokens, futures contracts, and staking platforms, has further expanded the possibilities for quick wealth creation. These tools enable investors to participate in market movements without owning the underlying asset, but they also come with amplified risks. For example, leveraged trading allows for borrowed funds to magnify gains, yet a single adverse event can result in cascading losses. A strategic investor treats these instruments as advanced tools, not get-rich-quick shortcuts, by employing conservative leverage ratios and setting strict risk thresholds.

However, the most effective strategies in online finance often blend short-term opportunities with long-term vision. For instance, while the price of a major cryptocurrency may fluctuate daily, its adoption rate and network effects are long-term drivers of value. A forward-thinking participant recognizes that quick money is not about time but about timing—identifying the right moment to buy, hold, or sell based on a combination of technical analysis and fundamental research. This approach minimizes the risk of chasing trends that may not materialize, while maximizing potential returns from well-positioned investments.

The rise of decentralized exchanges (DEXs) and custodial wallets has also reshaped the landscape of digital finance, granting users unprecedented control over their assets. These platforms eliminate intermediaries, reducing fees and enhancing security, but they also require users to have a clear understanding of risks such as hacking, network congestion, and market volatility. A prudent investor leverages these tools by adopting robust security measures, like multi-factor authentication and cold storage, while maintaining a diversified portfolio to mitigate single-point risks.

In the broader context of online financial opportunities, quick money generation is not confined to virtual currencies alone. Stock market arbitrage, algorithmic trading, and peer-to-peer (P2P) lending are alternative avenues that can yield fast returns, provided they are approached with discipline. For example, the use of algorithms to analyze real-time data and execute trades can outperform human intuition, but it also requires significant capital for training and infrastructure. A strategic participant recognizes that technology is a multiplier, not a guarantee, and invests in tools that align with their risk tolerance and financial objectives.

The key to navigating this dynamic environment lies in continuous learning and adaptability. Markets evolve rapidly, and what works today may not work tomorrow. For instance, the shift toward Web3 and decentralized applications (dApps) has created new investment niches, yet it also requires understanding of smart contract vulnerabilities and governance structures. An informed investor stays ahead of these changes by monitoring industry developments, participating in online forums, and educating themselves on emerging trends. This ongoing process of knowledge acquisition ensures that their strategies remain relevant and effective.

Ultimately, the pursuit of quick money online is a delicate dance between opportunity and caution. While the digital age has opened new doors for financial growth, it has also introduced new challenges that demand a strategic approach. By combining technical expertise with fundamental research, and by prioritizing risk management over greed, participants can navigate this terrain with confidence. The path to prosperity is not about speed, but about precision—crafting a roadmap that aligns with their goals, values, and the ever-changing dynamics of the financial world.