Alright, let's delve into the fascinating, and sometimes perplexing, question of "How to invest in Elon Musk?" and address whether direct investment is even feasible. It’s a nuanced topic that requires understanding the structure of Musk’s various ventures.

The simple answer is: you can't directly invest in "Elon Musk" as an individual. He isn't a publicly traded entity. However, you can invest in the companies he leads and heavily influences, which, in a practical sense, translates to betting on his vision and leadership.

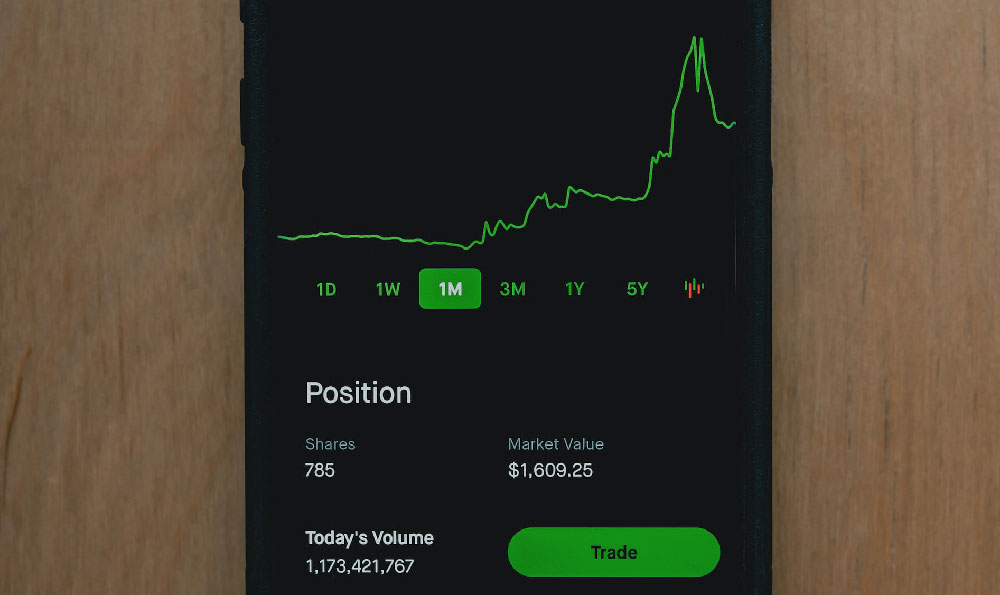

The most obvious avenue is through investing in Tesla (TSLA). As a publicly traded company, anyone with a brokerage account can purchase shares of Tesla. When you buy Tesla stock, you're investing in the company's potential for growth in the electric vehicle market, energy storage solutions, and potentially even future ventures like autonomous driving and robotics. The stock’s price is heavily influenced by Musk’s pronouncements, innovations within the company, production figures, and overall market sentiment surrounding electric vehicles. Tesla's stock is known for its volatility, which means that while the potential for high returns exists, so does the risk of significant losses. Carefully consider your risk tolerance before investing in Tesla.

Another major company helmed by Musk is SpaceX. This company isn't publicly traded. Its shares are privately held. This means regular investors cannot directly buy shares on a stock exchange. However, there are potential pathways for investment, though they are typically reserved for accredited investors or institutions. Occasionally, SpaceX may conduct private funding rounds where shares become available to qualified investors. These opportunities are less accessible and require a substantial financial commitment. Rumors of a potential SpaceX IPO surface periodically, but there's no concrete timeline. An IPO would create a significant opportunity for public investment, but it's crucial to remember that IPOs can be risky, and it's essential to conduct thorough research before investing. Another way to consider an "investment" in SpaceX is to analyze companies that are its major suppliers. The fortune of these smaller companies are often closely linked to SpaceX's performance.

Beyond Tesla and SpaceX, Musk co-founded and is involved with Neuralink and The Boring Company. Like SpaceX, these companies are also privately held. Neuralink focuses on developing brain-machine interfaces, a highly speculative but potentially revolutionary technology. The Boring Company aims to revolutionize tunneling and infrastructure development. Investing in these companies directly is exceptionally difficult for the average investor, typically requiring access to private equity markets or participation in funding rounds.

It's important to emphasize the risks associated with investing in companies heavily reliant on the vision of a single individual, even someone as seemingly successful as Elon Musk. These are often referred to as "founder-led" companies. While Musk's leadership has undoubtedly propelled Tesla and SpaceX to incredible heights, his personality and sometimes unpredictable behavior can also introduce significant volatility. His tweets, public statements, and even personal decisions can significantly impact the stock prices of the companies he leads. Furthermore, these companies often operate in rapidly evolving and highly competitive industries. Technological advancements, regulatory changes, and economic fluctuations can all pose significant challenges.

Before making any investment decisions, conduct extensive due diligence. This includes researching the company's financials, understanding its competitive landscape, and carefully evaluating the risks involved. Don't rely solely on media hype or social media chatter. Read independent analyses, consult with financial advisors, and consider your own investment goals and risk tolerance.

For example, with Tesla, analyze their production figures, revenue growth, profitability, and debt levels. Understand their position in the electric vehicle market and the challenges they face from established automakers and emerging competitors. Evaluate the regulatory environment surrounding electric vehicles and renewable energy. Assess the potential impact of technological advancements, such as improved battery technology or the development of autonomous driving systems.

Furthermore, be aware of the potential for "Musk risk." Consider the impact of his pronouncements on stock prices and the potential for controversies or setbacks. It's crucial to have a long-term perspective and be prepared for volatility.

For those seeking indirect exposure to Musk’s broader ventures, consider investing in exchange-traded funds (ETFs) that hold significant positions in Tesla or other companies involved in related industries, like space exploration technology or electric vehicle components. This provides diversification and reduces the risk associated with investing in a single company. However, remember that ETFs also come with their own fees and potential risks.

Investing in companies associated with Elon Musk can be exciting and potentially rewarding, but it requires careful consideration, thorough research, and a healthy dose of skepticism. Remember, past performance is not indicative of future results, and no investment guarantees a profit. Approach these investments with a long-term perspective, a well-defined risk management strategy, and a clear understanding of the potential rewards and risks. Don’t invest more than you can afford to lose, and always seek professional financial advice before making any investment decisions.