Alan Keating, a name that has become synonymous with financial acumen and entrepreneurial success, is often studied as a case study in how to build long-term wealth through strategic income diversification and calculated business ventures. While his journey is not a carbon copy of any single person's path, the principles he applied resonate across generations of investors and entrepreneurs. His story reveals a blend of discipline, adaptability, and an unyielding focus on value creation, which together formed the foundation of his fortune. At its core, Keating’s approach was not about chasing quick riches but about cultivating multiple streams of income that could compound over time while also engaging in ventures that aligned with his vision for growth.

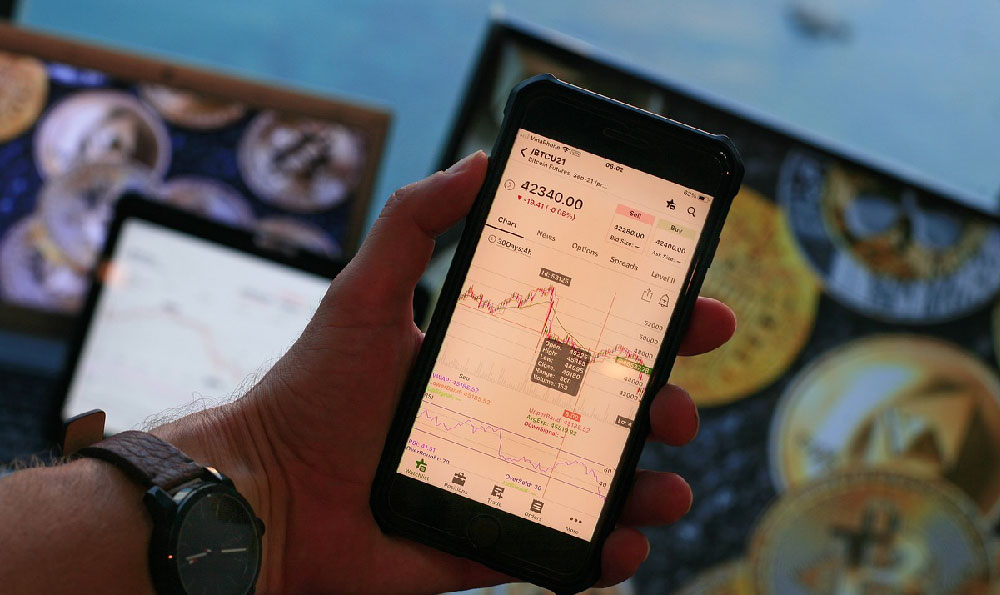

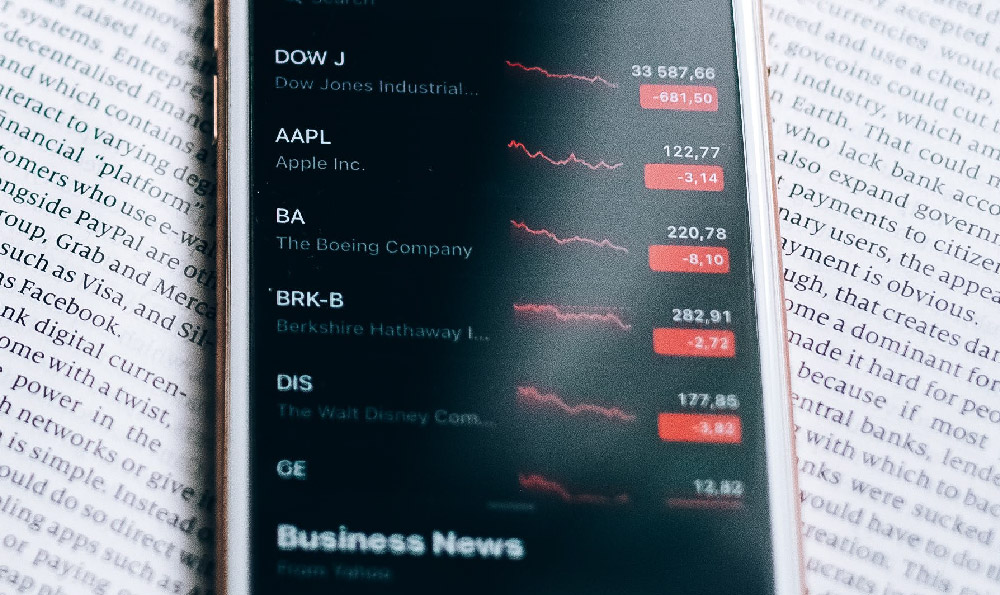

One of the defining characteristics of Keating’s financial strategy was his ability to identify and capitalize on market inefficiencies. He began his career in the financial sector, starting as a junior analyst before transitioning into private equity and venture capital. This early exposure allowed him to develop a deep understanding of how markets function and how to evaluate opportunities with precision. During this phase, he honed the skill of patience, often waiting for years to invest in companies or assets that showed potential but were undervalued by the market. His income sources were initially tied to traditional financial instruments, such as stocks and bonds, but he gradually shifted towards more dynamic avenues. This transition was not abrupt; instead, it was a gradual process of learning and refining his approach, guided by the principle that wealth is created through persistent value appreciation rather than short-term speculation.

Keating’s business ventures were another pillar of his financial strategy. He recognized that creating wealth requires more than managing money—it requires generating it. His first major venture was in the technology sector, where he invested in a fledgling startup during the early 2000s. At the time, the market was volatile, but Keating identified a gap in digital solutions for small businesses. He allocated a portion of his savings to the company, which eventually grew into a multinational corporation. This success was not just about timing but about understanding the underlying trends in technology adoption and consumer behavior. Over time, he expanded his portfolio to include other sectors, such as real estate and renewable energy, ensuring that his income sources were not concentrated in a single industry. By doing so, he created a diversified income stream that could withstand market fluctuations and provide consistent returns.

What set Keating apart from his contemporaries was his ability to integrate his personal investments with his business ventures. He believed that the two were not mutually exclusive but complementary. For instance, he used the profits from his investment portfolio to fund his startups, creating a cycle of reinvestment and growth. This approach allowed him to leverage his capital effectively, as the income from one domain could fuel the expansion of another. His business model was also built on the idea of creating value for others, which in turn generated value for himself. By focusing on scalable solutions and long-term partnerships, he ensured that his ventures were not just profitable but also sustainable.

Keating’s story also highlights the importance of continuous learning and adaptability. He understood that the financial landscape is ever-changing, and to remain competitive, he had to evolve with it. This meant staying informed about economic trends, technological advancements, and regulatory changes. He invested in education, both formal and informal, to enhance his knowledge base. Whether it was attending seminars, reading industry reports, or networking with other professionals, he never stopped seeking ways to improve his skills. This habit of lifelong learning enabled him to make informed decisions and pivot his strategy when necessary, avoiding the pitfalls that have ensnared many investors.

Another key aspect of Keating’s success was his meticulous risk management. He approached every investment and business opportunity with a clear understanding of the risks involved, yet he was not deterred by them. Instead, he developed a framework to assess risks objectively, ensuring that his decisions were based on data and analysis rather than emotions. This framework included diversification across asset classes, setting clear financial goals, and maintaining a buffer for unexpected events. His ability to balance risk and reward was a testament to his financial expertise and his commitment to long-term stability.

Ultimately, Keating’s fortune was not built overnight but through a combination of disciplined investing, visionary business ventures, and a commitment to continuous learning. His approach was rooted in the idea that wealth creation is a marathon, not a sprint, and that the most successful investors are those who remain patient, adaptable, and focused on value. By diversifying his income sources and aligning his investments with his business objectives, he created a resilient financial structure that allowed him to weather market downturns and capitalize on opportunities when they arose. His journey is a reminder that building a fortune requires more than luck; it demands strategy, execution, and an unwavering belief in the power of compound growth.