Okay, I understand. Here's an article addressing the question "How to invest in businesses? Where can I start?" written in a style suitable for an investment advice context, avoiding bullet points, numbered lists, and overly simplistic transitional phrases, and aiming for a comprehensive and informative approach.

Investing in businesses represents a potent pathway to wealth creation, offering the potential for significant returns and a sense of direct involvement in the growth of promising ventures. However, navigating the landscape of business investment requires careful planning, due diligence, and a thorough understanding of the risks involved. If you're contemplating venturing into this arena, knowing where to begin is paramount.

The initial step involves self-assessment. Honestly evaluate your risk tolerance. Are you comfortable with the possibility of losing your entire investment, or do you prefer a more conservative approach? Consider your investment horizon. How long are you willing to wait before seeing a return on your investment? Business investments, particularly in early-stage companies, can be illiquid and require patience. Finally, assess your available capital. Determine how much you can realistically afford to invest without jeopardizing your financial stability. Remember, diversification is key; spreading your investments across multiple ventures mitigates risk.

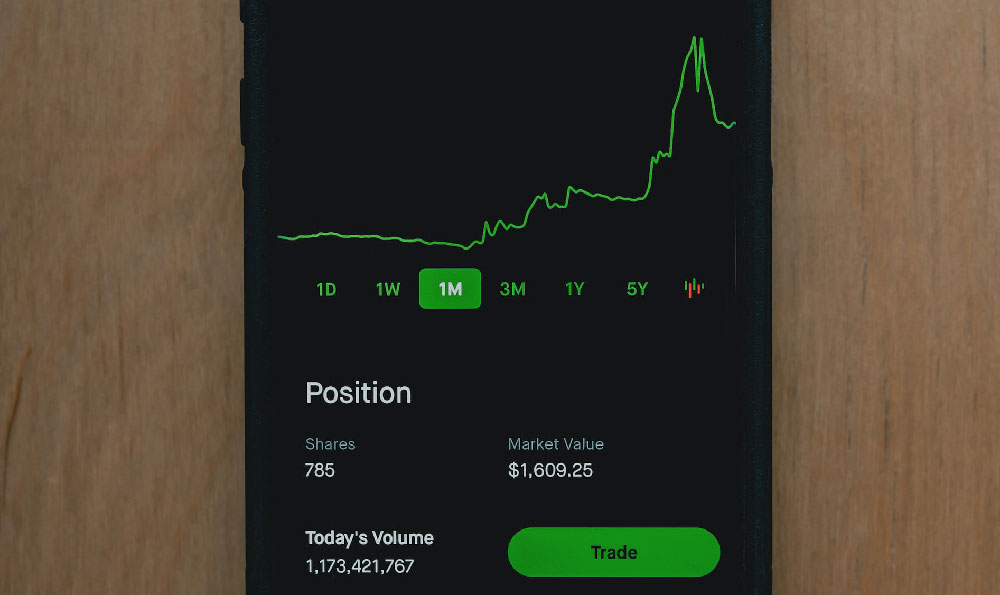

With a clear understanding of your risk profile and financial capacity, you can start exploring potential investment avenues. One common starting point is the public market. Investing in publicly traded companies through the stock market provides access to a wide range of businesses across various sectors. Researching individual companies before investing is crucial. Analyze their financial statements, understand their business models, and assess their competitive landscape. Consider factors like revenue growth, profitability, debt levels, and management quality. A good understanding of the industry the company operates in is essential. Consider using various financial analysis tools and reports to better understand the company you're investing in.

Another avenue to explore is private equity. This involves investing in privately held companies, which are not listed on the stock exchange. Private equity investments typically require larger capital outlays and are often less liquid than public market investments. However, they can also offer the potential for higher returns. To access private equity opportunities, you can consider investing through private equity funds, which are managed by professional investment firms. These funds pool capital from multiple investors and invest in a portfolio of private companies. Before investing in a private equity fund, carefully review the fund's investment strategy, track record, and fees.

Venturing into angel investing is a more direct, hands-on approach to business investment. This involves investing in early-stage startups and small businesses, often in exchange for equity. Angel investing can be highly rewarding, but it also carries significant risk. Startups are inherently unpredictable, and many fail. To succeed as an angel investor, it is crucial to conduct thorough due diligence on the companies you are considering investing in. Evaluate their business plan, management team, market potential, and competitive advantages. Consider joining an angel investor network, which can provide access to deal flow, mentorship, and expertise. Networking within the entrepreneurial community can also lead to valuable insights and opportunities.

Crowdfunding platforms have emerged as a relatively accessible avenue for investing in businesses, particularly startups. These platforms allow companies to raise capital from a large number of investors, often in small amounts. Crowdfunding investments can range from equity crowdfunding, where investors receive shares in the company, to debt crowdfunding, where investors lend money to the company. While crowdfunding offers the opportunity to invest in a diverse range of businesses, it is crucial to exercise caution. Scrutinize the company's business plan, financials, and management team. Be aware that crowdfunding investments are often illiquid and carry a high risk of loss.

Investing in franchises can be another appealing option for aspiring business investors. Franchises offer a proven business model and established brand recognition, which can reduce the risk compared to starting a business from scratch. However, franchising also involves certain obligations and costs, such as franchise fees and royalties. Before investing in a franchise, carefully review the franchise agreement and conduct thorough due diligence on the franchisor. Assess the franchisor's reputation, financial stability, and support system. Talk to existing franchisees to gain insights into their experiences.

Beyond specific investment types, developing a robust investment strategy is crucial. This strategy should align with your risk tolerance, investment horizon, and financial goals. Consider diversifying your portfolio across different industries, geographies, and investment types. Regularly monitor your investments and adjust your strategy as needed. Stay informed about market trends, economic conditions, and regulatory changes that could impact your investments.

Seeking professional advice from a financial advisor or investment consultant can provide valuable guidance and expertise. A qualified professional can help you assess your risk profile, develop a suitable investment strategy, and identify promising investment opportunities. They can also provide ongoing support and advice to help you navigate the complexities of business investment. Remember to carefully evaluate the credentials and experience of any financial advisor before engaging their services.

Ultimately, successful business investing requires a blend of knowledge, discipline, and patience. By understanding the different investment avenues, conducting thorough due diligence, and developing a well-defined investment strategy, you can increase your chances of achieving your financial goals and participating in the growth of promising businesses. The journey requires dedication, continuous learning, and a willingness to adapt to changing market conditions.