Unlocking wealth in real estate requires a strategic approach, combining meticulous planning, diligent research, and a clear understanding of market dynamics. It's not a get-rich-quick scheme, but rather a path paved with calculated risks and patient execution. Successful real estate investing hinges on identifying undervalued assets, maximizing returns, and mitigating potential losses.

One of the fundamental strategies is to determine your investment goals and risk tolerance. Are you looking for long-term appreciation, steady cash flow, or a combination of both? Your answer will dictate the type of properties you should target, the financing methods you should explore, and the overall timeline of your investment strategy. For instance, if you prioritize cash flow, you might consider investing in rental properties, focusing on locations with high rental demand and strong occupancy rates. If appreciation is your primary goal, you might look at properties in emerging markets or areas undergoing significant development, anticipating future price increases.

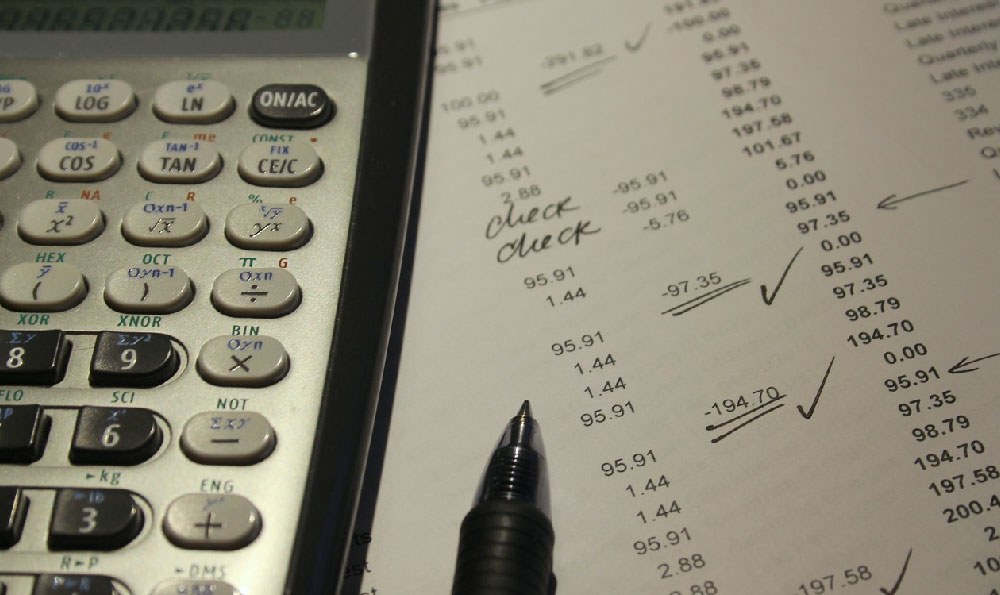

Thorough market research is paramount. Don't rely solely on online listings or hearsay. Delve into local market data, analyze comparable sales (comps), and understand the economic drivers influencing property values in your target area. Consider factors such as employment rates, population growth, infrastructure development, and school district quality. Understanding the supply and demand dynamics is crucial for identifying opportunities and avoiding overpaying for properties. Moreover, connect with local real estate agents, property managers, and other investors to gain insights into the nuances of the market. They can provide valuable information on upcoming developments, hidden gems, and potential pitfalls.

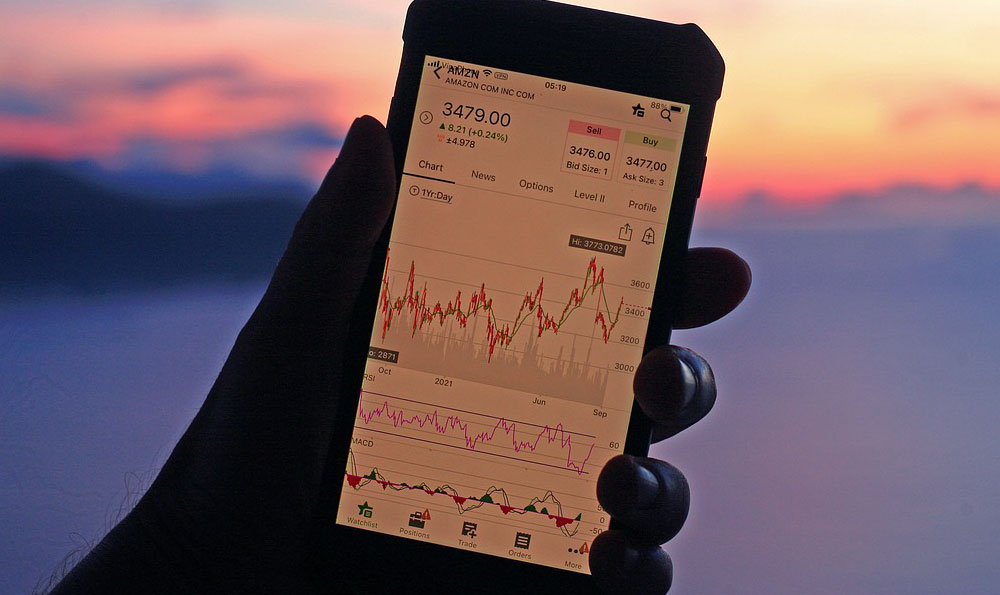

Securing financing is a critical aspect of real estate investing. Explore different financing options, including traditional mortgages, hard money loans, private lending, and government-backed programs like FHA loans. Understand the terms and conditions of each option, including interest rates, loan fees, repayment schedules, and potential penalties. Shop around for the best rates and terms, and don't hesitate to negotiate. Consider the down payment requirements and the impact of interest rates on your cash flow. A well-structured financing plan can significantly impact your profitability and long-term financial success. Additionally, leverage can be a powerful tool in real estate investing, allowing you to control larger assets with less capital. However, it also increases your risk, so it's essential to manage your leverage responsibly and avoid overextending yourself.

Beyond traditional buy-and-hold strategies, consider exploring alternative real estate investment approaches. Fix-and-flip projects, for example, involve purchasing distressed properties, renovating them, and selling them for a profit. This strategy requires a keen eye for potential, strong project management skills, and a reliable network of contractors. Wholesale real estate involves finding undervalued properties and assigning the purchase contract to another investor for a fee. This strategy requires minimal capital but demands excellent networking and negotiation skills. Real estate investment trusts (REITs) offer a way to invest in real estate without directly owning properties. REITs are companies that own and operate income-generating real estate, and investors can purchase shares in these companies. REITs provide diversification and liquidity, making them a suitable option for investors who prefer a hands-off approach.

Adding value to your properties is essential for maximizing returns. This can involve simple cosmetic upgrades, such as painting, flooring, and landscaping, or more extensive renovations, such as kitchen and bathroom remodels. Focus on improvements that will appeal to your target market and increase the perceived value of the property. Consider energy-efficient upgrades to reduce operating costs and attract environmentally conscious tenants. Smart home technology can also enhance the appeal of your properties and command higher rents. Regularly maintain your properties to prevent costly repairs and ensure tenant satisfaction. Promptly address any maintenance issues and provide excellent customer service to retain tenants and minimize vacancies.

Risk management is crucial in real estate investing. Obtain adequate insurance coverage to protect your properties from damage, liability, and other potential losses. Conduct thorough due diligence on all potential investments, including property inspections, title searches, and environmental assessments. Understand the zoning regulations and building codes in your target area to avoid potential legal issues. Diversify your portfolio by investing in different types of properties and locations to reduce your overall risk exposure. Have a contingency plan in place to address unexpected expenses or challenges, such as vacancies, repairs, or economic downturns.

Furthermore, building a strong network is invaluable. Connect with other investors, real estate agents, contractors, property managers, and lenders. Attend industry events, join online forums, and participate in local real estate meetups. Learn from the experiences of others and share your own insights. A strong network can provide access to off-market deals, valuable advice, and potential financing opportunities. Consider partnering with other investors to pool resources and share risks. Joint ventures can be a great way to enter new markets or tackle larger projects.

Finally, patience and discipline are essential virtues in real estate investing. It takes time to build a successful portfolio and generate significant wealth. Avoid making impulsive decisions based on emotions or market hype. Stick to your investment strategy and resist the temptation to chase after quick profits. Continuously educate yourself on market trends, investment strategies, and legal regulations. Stay informed about changes in tax laws and regulations that may impact your investments. Review your portfolio regularly and make adjustments as needed to ensure that you are on track to achieve your financial goals. Real estate investing is a marathon, not a sprint. With careful planning, diligent execution, and a long-term perspective, you can unlock the potential for significant wealth creation.