Okay, I understand. Here's an article based on the prompt, focusing on the allure and dangers of seeking quick returns, and exploring potential (though often risky) avenues for faster cash generation through investments, all while maintaining a disclaimer about the inherent risks involved. The article is written in English and exceeds 800 words.

The Siren Song of Speed: Navigating the Pursuit of Rapid Investment Returns

The financial landscape is littered with enticing promises of overnight riches. The allure of generating quick cash through investments is undeniable, particularly in a world where instant gratification is increasingly prevalent. However, the pursuit of rapid returns is fraught with peril, demanding a high degree of vigilance, a thorough understanding of the risks involved, and a healthy dose of skepticism. Before diving headfirst into strategies promising fast cash, it's crucial to understand the fundamental trade-off: higher potential returns almost always come hand-in-hand with significantly elevated risk.

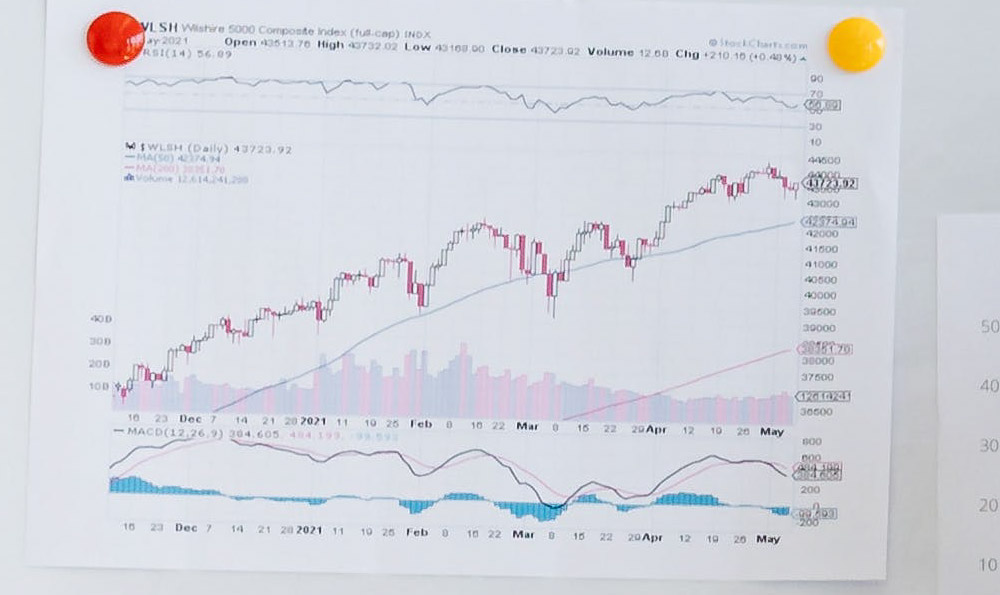

The concept of "quick returns" is inherently subjective. What constitutes "quick" to one investor may seem agonizingly slow to another. Generally, it implies generating profit within a relatively short timeframe, ranging from weeks or months to a year or two, rather than the decades often associated with traditional long-term investing. This compressed timeframe necessitates investment choices that are inherently more volatile and speculative.

One area often associated with the promise of rapid gains is the realm of high-growth stocks. These are typically companies, often in emerging industries or with disruptive technologies, that are expected to experience rapid revenue and profit growth. Investing in such companies can yield substantial returns in a short period if the company performs as expected. However, the operative word is "if." High-growth stocks are notoriously sensitive to market sentiment, economic downturns, and any signs that their growth trajectory is faltering. Their valuations are often based on future projections rather than current earnings, making them particularly vulnerable to sudden and dramatic price swings. Due diligence is paramount here; thoroughly researching the company's financials, competitive landscape, and management team is essential before committing any capital.

Another tempting avenue for faster cash is options trading. Options provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Options can be leveraged to amplify potential gains (and losses) significantly. A small investment in options can control a larger position in the underlying asset, allowing for potentially substantial profits if the market moves in the anticipated direction. However, options are complex instruments, and their value can erode rapidly due to time decay and volatility. Without a solid understanding of options strategies and a high tolerance for risk, options trading can quickly lead to significant losses. Furthermore, the short-term nature of options contracts often necessitates constant monitoring and active management, making it a time-consuming and stressful endeavor.

Cryptocurrencies have also entered the quick-return narrative, particularly with the explosive growth and volatility of Bitcoin and other digital assets. The potential for substantial gains in a short timeframe has drawn many investors to the crypto market. However, the cryptocurrency market is characterized by extreme volatility, regulatory uncertainty, and the potential for fraud and manipulation. Prices can fluctuate wildly in a matter of hours, and the lack of regulatory oversight makes it a particularly risky environment. While some investors have realized significant profits in cryptocurrencies, many others have suffered substantial losses. It's crucial to approach cryptocurrency investments with extreme caution, investing only what you can afford to lose and diversifying your portfolio to mitigate risk. Understand the underlying technology (blockchain) and the specific cryptocurrency you are investing in, and be wary of hype and unsubstantiated claims.

Real estate flipping, the practice of buying properties with the intention of quickly renovating and reselling them for a profit, is another strategy touted for generating fast cash. However, real estate flipping requires significant capital, expertise in property valuation and renovation, and a strong understanding of the local real estate market. Unexpected repairs, delays in renovations, and fluctuations in the market can all eat into profits and even lead to losses. Moreover, the real estate market is inherently illiquid, meaning it can take time to find a buyer, which can tie up capital and increase holding costs.

Beyond these, there are numerous other avenues touted as paths to rapid riches, including penny stocks, day trading, and various types of alternative investments. Each of these options carries its own unique set of risks and requires a specialized skillset and knowledge base.

The most crucial aspect of pursuing quick returns is risk management. Diversification is key; don't put all your eggs in one basket. Allocate a small portion of your portfolio to these higher-risk, higher-reward ventures, and ensure that the bulk of your investments are in more stable, long-term assets. Set clear profit targets and stop-loss orders to limit potential losses. Be prepared to cut your losses quickly if an investment is not performing as expected.

It's also important to be wary of scams and fraudulent schemes that promise guaranteed quick returns. If something sounds too good to be true, it probably is. Do your research, check the credentials of anyone offering investment advice, and be skeptical of any investment that is marketed aggressively or promises unusually high returns with little or no risk.

Finally, remember that the pursuit of quick returns should not come at the expense of your long-term financial goals. Building a solid financial foundation requires patience, discipline, and a long-term perspective. While the allure of fast cash is tempting, it's crucial to approach such ventures with caution, a clear understanding of the risks involved, and a well-defined risk management strategy. Success in investing, particularly when seeking rapid returns, requires a blend of knowledge, discipline, and a healthy dose of realism. The siren song of speed can be seductive, but navigating the financial seas requires a steady hand and a clear understanding of the potential dangers that lie beneath the surface. Always remember that past performance is not indicative of future results, and that all investments carry risk.

Disclaimer: This article provides general information and should not be considered financial advice. Investing involves risk, including the potential loss of principal. Consult with a qualified financial advisor before making any investment decisions.