Investing in the stock market can be a daunting, yet potentially rewarding, endeavor. Many individuals are lured by the promise of financial growth but are often unsure where to begin and what knowledge is essential for success. A measured and informed approach is crucial for navigating the complexities of the market and mitigating inherent risks.

Before diving into specific stocks or investment vehicles, a fundamental understanding of the stock market's mechanics is paramount. The stock market, at its core, is a marketplace where buyers and sellers come together to trade shares of publicly held companies. These shares represent a portion of ownership in the company, and their value fluctuates based on various factors, including company performance, economic conditions, and investor sentiment. Familiarizing yourself with key terms such as "market capitalization," "price-to-earnings ratio," "dividend yield," and "volatility" is a crucial first step. These metrics provide insights into a company's financial health and potential investment value.

Next, understanding the different types of securities available for investment is essential. Stocks are the most common, representing ownership in a company. Bonds, on the other hand, represent debt issued by corporations or governments. Exchange-Traded Funds (ETFs) and mutual funds are baskets of stocks or bonds managed by professionals, offering diversification and potentially reducing risk. Each type of security has its own risk-reward profile, and choosing the right mix depends on your individual investment goals, risk tolerance, and time horizon.

One of the most important aspects of successful stock market investing is developing a well-defined investment strategy. This strategy should be based on your personal financial goals, such as saving for retirement, buying a home, or simply growing your wealth. Are you seeking long-term growth, or are you looking for short-term gains? What level of risk are you comfortable taking? Your answers to these questions will guide your investment decisions. A common strategy is dollar-cost averaging, where you invest a fixed amount of money at regular intervals, regardless of the stock price. This can help smooth out the impact of market volatility and potentially lower your average cost per share.

Fundamental analysis is a critical tool for evaluating the intrinsic value of a company. This involves examining a company's financial statements, including its balance sheet, income statement, and cash flow statement, to assess its profitability, debt levels, and growth potential. Understanding how to read and interpret these financial statements can help you identify companies that are undervalued by the market and have the potential for long-term growth. Moreover, staying informed about industry trends, competitive landscapes, and macroeconomic factors is essential for making informed investment decisions.

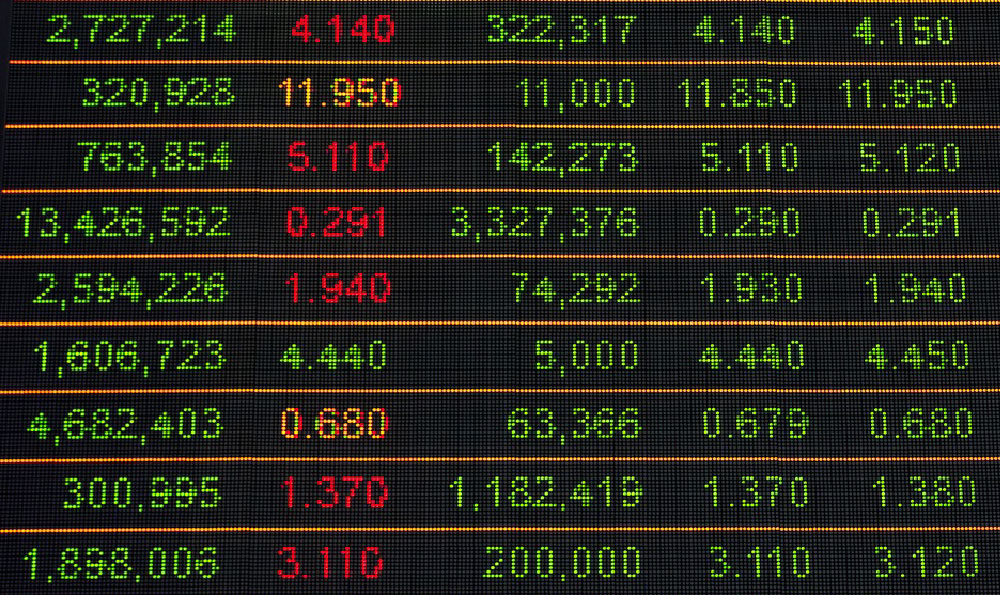

Technical analysis, on the other hand, focuses on studying past market data, such as price charts and trading volume, to identify patterns and predict future price movements. While technical analysis can be a useful tool for short-term trading, it's important to remember that past performance is not necessarily indicative of future results. Relying solely on technical analysis without considering fundamental factors can be risky.

Diversification is a cornerstone of risk management in the stock market. Spreading your investments across different asset classes, industries, and geographic regions can help reduce the impact of any single investment on your overall portfolio. A diversified portfolio is less susceptible to the volatility of individual stocks or sectors and can provide more stable returns over the long term.

Another crucial aspect of risk management is understanding your own risk tolerance. This refers to your willingness and ability to withstand potential losses in your investments. Are you comfortable with the possibility of losing a significant portion of your investment in exchange for potentially higher returns? Or are you more risk-averse and prefer a more conservative approach? Knowing your risk tolerance will help you choose investments that are aligned with your comfort level and avoid making emotional decisions during market downturns.

Avoiding common investment pitfalls is essential for protecting your capital. One common mistake is chasing hot stocks or following the advice of unqualified individuals. It's important to do your own research and make informed decisions based on your own analysis. Another pitfall is letting emotions drive your investment decisions. Fear and greed can lead to impulsive buying and selling, often at the wrong time. Sticking to your investment strategy and avoiding emotional decisions is crucial for long-term success.

Continuous learning is a vital part of being a successful stock market investor. The market is constantly evolving, and it's important to stay updated on the latest trends, regulations, and investment strategies. Read books, articles, and financial news publications to expand your knowledge and stay informed about market developments. Consider taking online courses or attending seminars to deepen your understanding of specific investment topics.

Finally, choosing the right brokerage account is a crucial step in starting your investment journey. Different brokers offer different features, fees, and investment options. Consider factors such as commission fees, account minimums, research tools, and customer service when selecting a broker. Many online brokers offer commission-free trading, making it more accessible and affordable to invest in the stock market.

Investing in the stock market requires a combination of knowledge, discipline, and patience. By understanding the fundamentals of the market, developing a well-defined investment strategy, managing risk effectively, and continuously learning, you can increase your chances of achieving your financial goals and building long-term wealth. Remember that investing involves risk, and there are no guarantees of success. However, with a measured and informed approach, you can navigate the complexities of the market and potentially reap the rewards of long-term investing.