Investing in Bitcoin has been a topic of considerable debate and fascination since its inception. The allure of potentially high returns, coupled with the revolutionary technology behind it, has drawn both seasoned investors and curious newcomers alike. However, before diving into the world of Bitcoin investing, it's crucial to understand the intricacies involved and the potential pathways to profitability.

Bitcoin's history is marked by significant volatility. Its price has experienced dramatic surges and equally dramatic crashes. Early adopters who recognized its potential reaped substantial rewards, while others who entered the market at peak prices faced significant losses. This volatility stems from various factors, including market sentiment, regulatory uncertainty, technological advancements, and macroeconomic conditions. Therefore, assessing the profitability of investing in Bitcoin requires careful consideration of these factors and a realistic understanding of the inherent risks.

One of the primary ways individuals profit from Bitcoin is through simply buying and holding, a strategy often referred to as "hodling" (a deliberate misspelling that has become a term of endearment in the crypto community). The underlying premise is that Bitcoin's value will appreciate over time due to its limited supply and increasing adoption. This strategy requires patience and a strong belief in the long-term potential of Bitcoin. However, it's crucial to acknowledge that this approach also carries the risk of significant losses if the price declines and remains low for an extended period. Dollar-cost averaging (DCA) is a common variation of this strategy, where you invest a fixed amount of money at regular intervals, regardless of the price. This helps to mitigate the risk of buying at a price peak and averages out your purchase price over time.

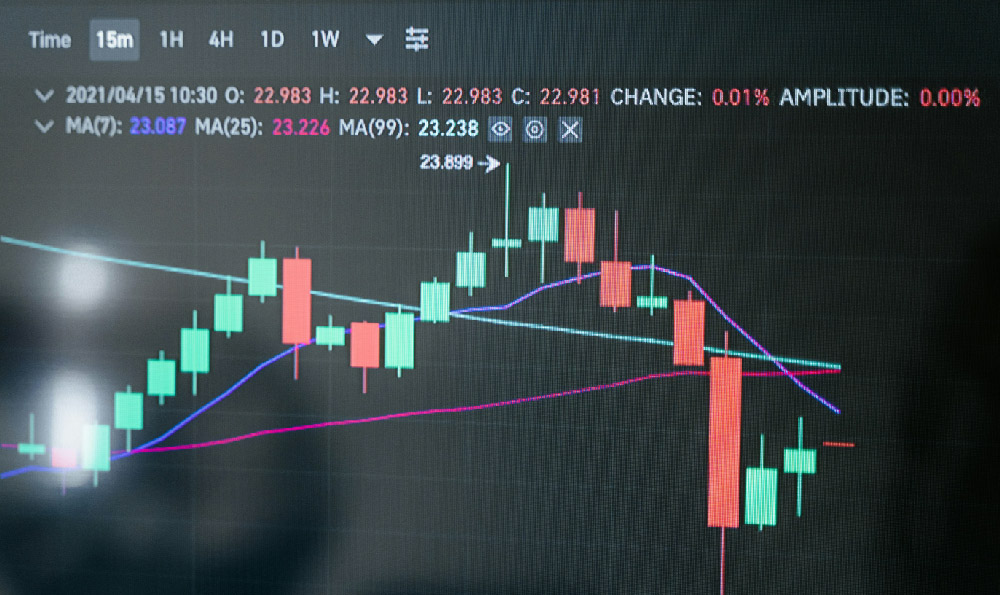

Beyond simply buying and holding, more sophisticated strategies can also be employed to generate income from Bitcoin. Trading, for instance, involves actively buying and selling Bitcoin to capitalize on short-term price fluctuations. This requires a deep understanding of technical analysis, market trends, and risk management. Traders often use various tools and indicators to identify potential entry and exit points, aiming to buy low and sell high. However, trading is a high-risk, high-reward activity that demands significant time, knowledge, and discipline. It's not recommended for beginners and should only be undertaken by those who are willing to dedicate the necessary resources to learn and practice.

Another avenue for generating income from Bitcoin is through staking. While Bitcoin itself doesn't have native staking mechanisms like some other cryptocurrencies, there are platforms and services that allow you to earn rewards for lending or depositing your Bitcoin. These rewards typically come in the form of additional Bitcoin or other cryptocurrencies. However, it's essential to carefully research and vet any platform offering staking services, as there are inherent risks associated with trusting a third party with your Bitcoin.

Cryptocurrency mining is the process of verifying and adding new transactions to the Bitcoin blockchain. Miners use powerful computers to solve complex mathematical problems, and in return, they receive newly minted Bitcoins as a reward. However, Bitcoin mining has become increasingly competitive and resource-intensive. It requires significant upfront investment in specialized hardware and substantial electricity consumption. Unless you have access to cheap electricity and can compete with large-scale mining operations, it's unlikely that mining Bitcoin will be a profitable endeavor for individual investors.

Another, arguably less direct, way to profit from Bitcoin is by investing in companies that are involved in the Bitcoin ecosystem. This could include companies that provide Bitcoin mining equipment, payment processing services, or custody solutions. By investing in these companies, you can gain exposure to the growth of the Bitcoin market without directly holding Bitcoin itself. However, the performance of these companies may also be affected by factors unrelated to Bitcoin, so it's important to conduct thorough research before investing.

Before investing in Bitcoin, it's crucial to assess your own risk tolerance and financial situation. Bitcoin is a volatile asset, and its price can fluctuate significantly in a short period. You should only invest money that you can afford to lose without impacting your financial stability. It's also important to diversify your investment portfolio and not put all your eggs in one basket. Bitcoin should only be a part of a well-rounded investment strategy that includes other asset classes such as stocks, bonds, and real estate.

Furthermore, it's essential to stay informed about the latest developments in the Bitcoin market and the regulatory landscape. The regulatory environment surrounding Bitcoin is constantly evolving, and new regulations can have a significant impact on its price and adoption. Keeping abreast of these developments will help you make more informed investment decisions and mitigate potential risks.

In conclusion, whether investing in Bitcoin is profitable depends on various factors, including your investment strategy, risk tolerance, and the market conditions. While there is the potential for significant gains, there is also the risk of substantial losses. Before investing in Bitcoin, it's crucial to conduct thorough research, understand the risks involved, and develop a well-thought-out investment plan. Diversification and risk management are key to mitigating potential losses and maximizing the chances of success. Remember, investing in Bitcoin is not a get-rich-quick scheme, and it requires patience, discipline, and a long-term perspective. By approaching it with a responsible and informed mindset, you can potentially benefit from the growth of Bitcoin while managing the inherent risks.