Okay, I'm ready to provide an article addressing the prompt "What are the best ways to earn, and which is right for you?". Here's the article:

The pursuit of financial security and independence often leads us to explore diverse avenues for generating income. The "best" approach, however, is a deeply personal matter, contingent on individual skills, risk tolerance, time commitment, and financial goals. There’s no universal magic bullet; the optimal strategy is the one that aligns most seamlessly with your unique circumstances and aspirations.

One of the most traditional and reliable paths to earning is through employment. A stable job provides a predictable income stream, benefits like health insurance and retirement plans, and opportunities for professional growth. However, the ceiling on earnings within a traditional job is often predetermined, and advancement may depend on factors beyond individual performance. The right job, in the right field, can be incredibly rewarding. Careful consideration should be given to skills and interest alignment, as well as growth opportunities within the chosen field. Researching average salaries, required qualifications, and company culture are vital steps in making an informed decision.

Moving beyond the confines of traditional employment, freelancing and contract work offer greater autonomy and flexibility. Platforms like Upwork, Fiverr, and Toptal connect individuals with clients seeking specialized skills, ranging from writing and graphic design to web development and consulting. The earning potential in freelancing is virtually limitless, dependent only on your skills, marketing efforts, and ability to deliver high-quality work. However, it also entails a higher degree of self-discipline and responsibility. Securing clients, managing invoices, and paying self-employment taxes all fall on the individual. Success in freelancing requires a proactive mindset, excellent communication skills, and a strong work ethic. Building a solid portfolio and garnering positive reviews are crucial for establishing credibility and attracting new clients.

For those with a knack for identifying opportunities and a willingness to take on risk, entrepreneurship presents a potentially lucrative, though demanding, path. Starting your own business allows you to create something from scratch, pursue your passions, and potentially generate substantial wealth. However, it also requires significant capital investment, time commitment, and a high tolerance for uncertainty. Thorough market research, a solid business plan, and access to funding are essential for launching a successful venture. Entrepreneurship is not for the faint of heart; it involves long hours, setbacks, and the constant need to adapt to changing market conditions. Despite the challenges, the rewards of building a thriving business can be immense, both financially and personally.

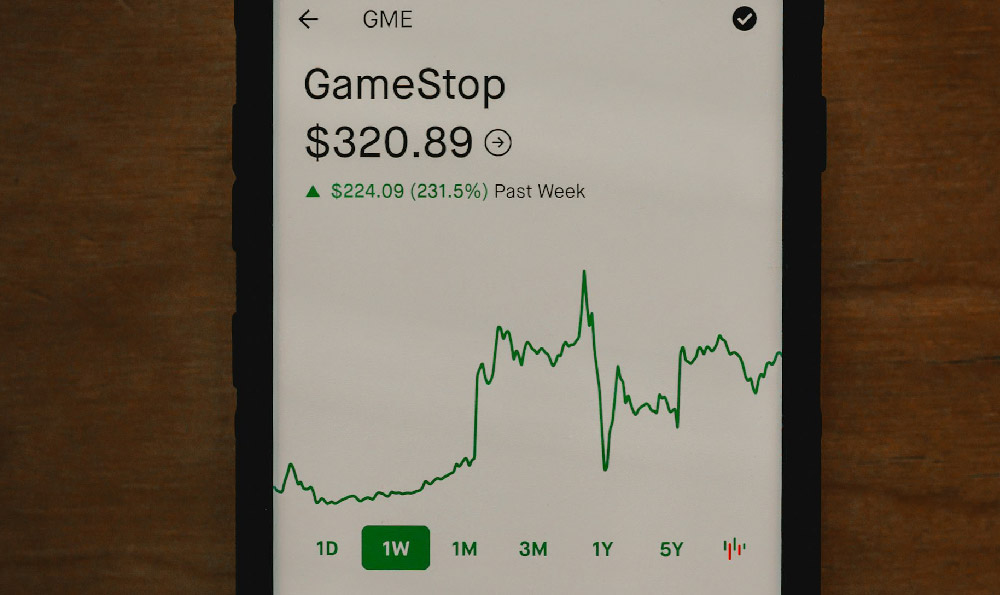

Beyond actively working for income, passive income streams can provide a significant boost to financial well-being. Investing in the stock market, for example, allows you to generate income through dividends and capital appreciation. However, investing carries inherent risks, and it's crucial to conduct thorough research or consult with a financial advisor before committing your capital. Diversifying your portfolio across different asset classes can help mitigate risk. Understanding your risk tolerance and investment goals is paramount. Some people might prefer long-term, low-risk investments, while others might be willing to take on more risk for the potential of higher returns. Options trading is another path, but extremely risky and only appropriate for investors with a full grasp of the potential downside.

Real estate investing is another popular way to generate passive income. Renting out properties can provide a steady stream of cash flow, and the value of real estate can appreciate over time. However, managing rental properties requires time and effort, or the expense of hiring a property manager. Vacancy periods, repairs, and tenant issues can impact profitability. Thorough due diligence and careful financial planning are essential for successful real estate investing.

The rise of the internet has opened up new avenues for earning, such as creating and selling online courses, affiliate marketing, and building a YouTube channel. These methods require minimal upfront investment but demand significant time and effort to build an audience and create compelling content. Affiliate marketing involves promoting other people's products and earning a commission on sales. Building a successful YouTube channel requires consistently creating engaging videos and growing a subscriber base. These online ventures can generate substantial passive income once they gain traction, but it can take months or even years to achieve significant results.

Another potentially lucrative avenue is cryptocurrency and NFTs. While these assets have shown the potential for explosive growth, they are also highly volatile and subject to regulatory uncertainty. Investing in cryptocurrency and NFTs carries significant risk, and it's crucial to do your research and understand the underlying technology before investing any money. Only invest what you can afford to lose, and diversify your portfolio to mitigate risk.

So, how do you determine the best way to earn for you? Start by assessing your skills, interests, and risk tolerance. What are you good at? What do you enjoy doing? How much risk are you willing to take? Then, research different earning opportunities and consider the time commitment, financial investment, and potential rewards. Talk to people who are already successful in the areas that interest you.

Crucially, don't be afraid to experiment and learn from your mistakes. The path to financial success is rarely linear. Be patient, persistent, and willing to adapt to changing circumstances. Building multiple income streams can provide greater financial security and flexibility. Consider combining a traditional job with freelance work or investing in passive income opportunities. Ultimately, the best way to earn is the one that aligns with your values, goals, and lifestyle, and allows you to achieve your full potential. Remember that continuous learning and adaptation are keys to long-term financial success.